What is the $250 rebate?

Who gets the $250 Georgia refund

Single filers and married individuals who file separately could receive a maximum refund of $250. Head of household filers could receive a maximum refund of $375. Married individuals who file joint returns could receive a maximum refund of $500.

Who gets the $250 rebate in Virginia

individual filers

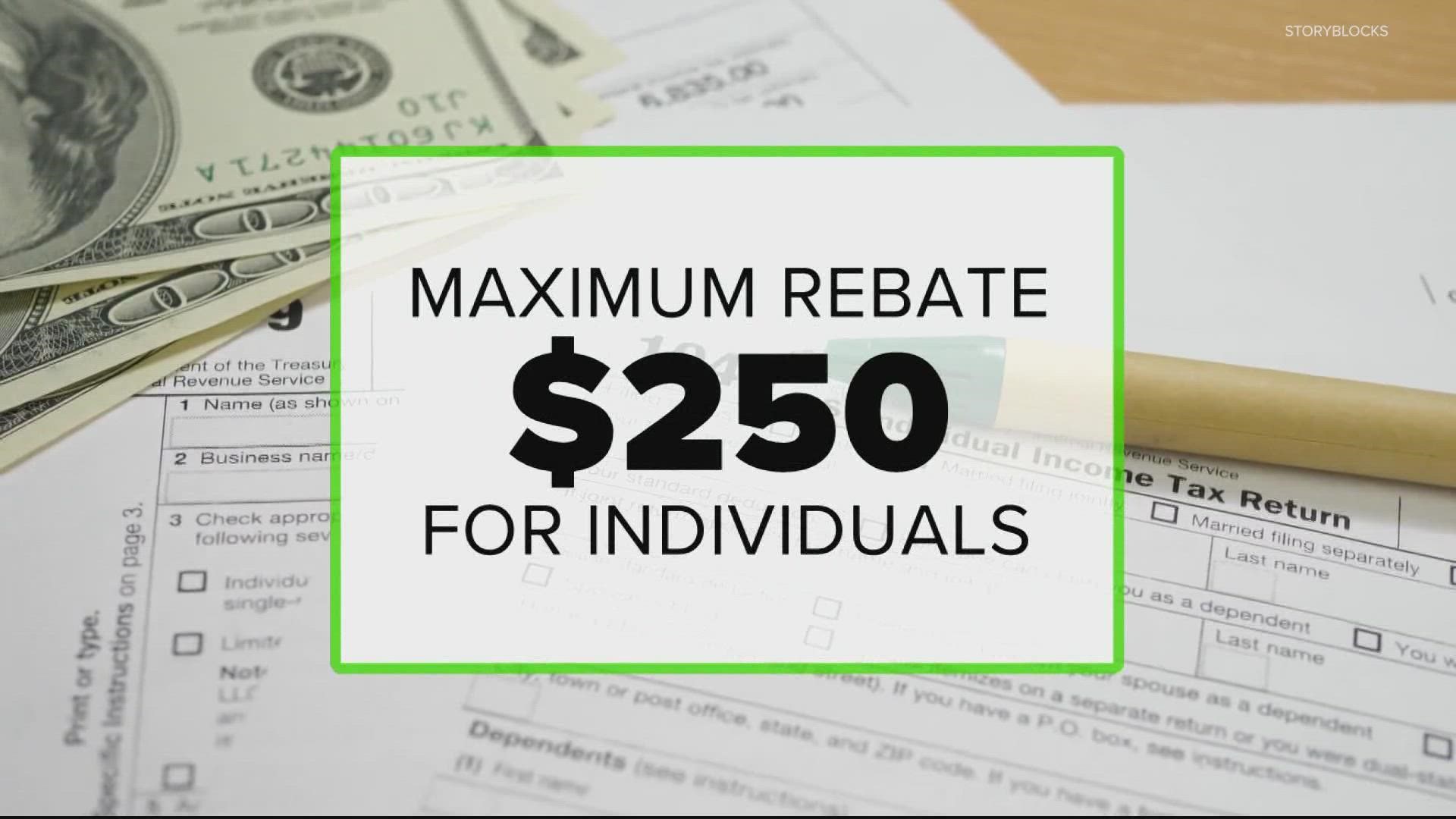

The 2023 Virginia General Assembly passed a law giving taxpayers with a liability a rebate of up to $250 for individual filers and up to $500 for joint filers.

Cached

Who qualifies for Georgia surplus refund

To qualify for the latest round of checks you have to have paid taxes to the state of Georgia on any income you earned in 2023. Retirees might have to pay federal taxes on Social Security, but according to the Georgia Department of Revenue that income is exempt from state taxes.

When can I expect my Georgia surplus refund 2023

6-8 weeks

Please allow 6-8 weeks for Surplus Tax Refunds to be issued (if you filed by the April 18, 2023 deadline)

Cached

When can I expect my Kemp tax refund

The Department anticipates all refunds for those who filed by the April 18 deadline to be issued within the next 8 weeks. Refunds will not be issued until 2023 tax returns have been processed. Individuals who received a filing extension will not receive their refunds until their returns have been filed.

How do I check my Kemp refund

Call the DOR automated telephone line at 877-423-6711 to check the status of your tax refund.

How do I know if I get the Virginia tax rebate

You can check the status of your Virginia refund 24 hours a day, 7 days a week using our “Where's My Refund” tool or by calling our automated phone line at 804.367. 2486. Tax Tips – Where Is My Virginia Refund

How do I get my $250 or $500 Virginia tax rebate

To be eligible, taxpayers must file by November 1, 2023 and have had a 2023 tax liability. Starting September 19, taxpayers can go to tax.virginia.gov/rebate and check their eligibility for this one-time tax rebate.

Why have I not received my Georgia surplus refund

What are some common reasons I might not have received an HB 162 refund You did not file both a 2023 and 2023 Georgia income tax return prior to the deadline for the 2023 return in calendar year 2023. You did not file by the due date or timely request an extension of October 16th, 2023.

Who is getting the surplus money in Georgia

The extra money is an additional refund of income taxes from 2023 stemming from the state's revenue surplus. To receive the funds, filers must have paid and filed taxes for the past two tax years. Below is the structure of the payments: $500 for married couples filing jointly.

What is the Kemp refund for 2023

Single filers and married individuals who file separately could receive a maximum refund of $250. Head of household filers could receive a maximum refund of $375. Married individuals who file joint returns could receive a maximum refund of $500.

How do I track my Georgia surplus check

To check the status of your Georgia state refund online, go to https://dor.georgia.gov/wheres-my-refund.

Who gets the $350 payment in GA

You must have been enrolled and actively receiving Medicaid, PeachCare for Kids®, SNAP, and/or TANF benefits on July 31, 2023, to be eligible. If you're not sure if you're eligible, you can visit gateway.ga.gov and navigate to the “Check My Benefits – Case Selection” page.

Why did I get a rebate check from Virginia

If you owed money on your Virginia tax return in 2023, you were in luck in 2023. That's because the Virginia General Assembly passed a law giving some Virginia taxpayers a 2023 tax "stimulus" rebate of up to $250 for individual filers, and up to $500 for joint filers.

Is Virginia giving out stimulus money

Who's Eligible: To qualify for Virginia's one-time stimulus tax rebate, you must have filed a 2023 Virginia income tax return by November 1, 2023, and have a 2023 Virginia net tax liability (you can still get a rebate if you received a refund after filing your 2023 state return).

How do I check my Virginia rebate

Check your refund status

Use our Where's my Refund tool or call 804.367.2486 for our automated refund system.

Where is my GA rebate check

Call the DOR automated telephone line at 877-423-6711 to check the status of your tax refund.

Can you track your Georgia surplus refund

Check the status of your refund online. After submitting your return, please allow at least 2-3 weeks of processing time before checking your refund status. Looking for information on the Surplus Tax Refund

How do I check my GA surplus check

Ways to check your statusCheck your refund online (does not require a login)Sign up for Georgia Tax Center (GTC) account. GTC provides online access and can send notifications such as when a refund has been issued.Use the automated telephone service at 877-423-6711.

Why did i get a Georgia gas tax refund 2023

The 2023 Georgia tax rebates have come thanks to legislation known as House Bill 162. The bill provides a one-time tax credit (i.e., surplus tax refund) for individual Georgia taxpayers who filed state income tax returns for the 2023 and 2023 tax years.