What is the 72 rule in finance?

What is the Rule of 72 in finance example

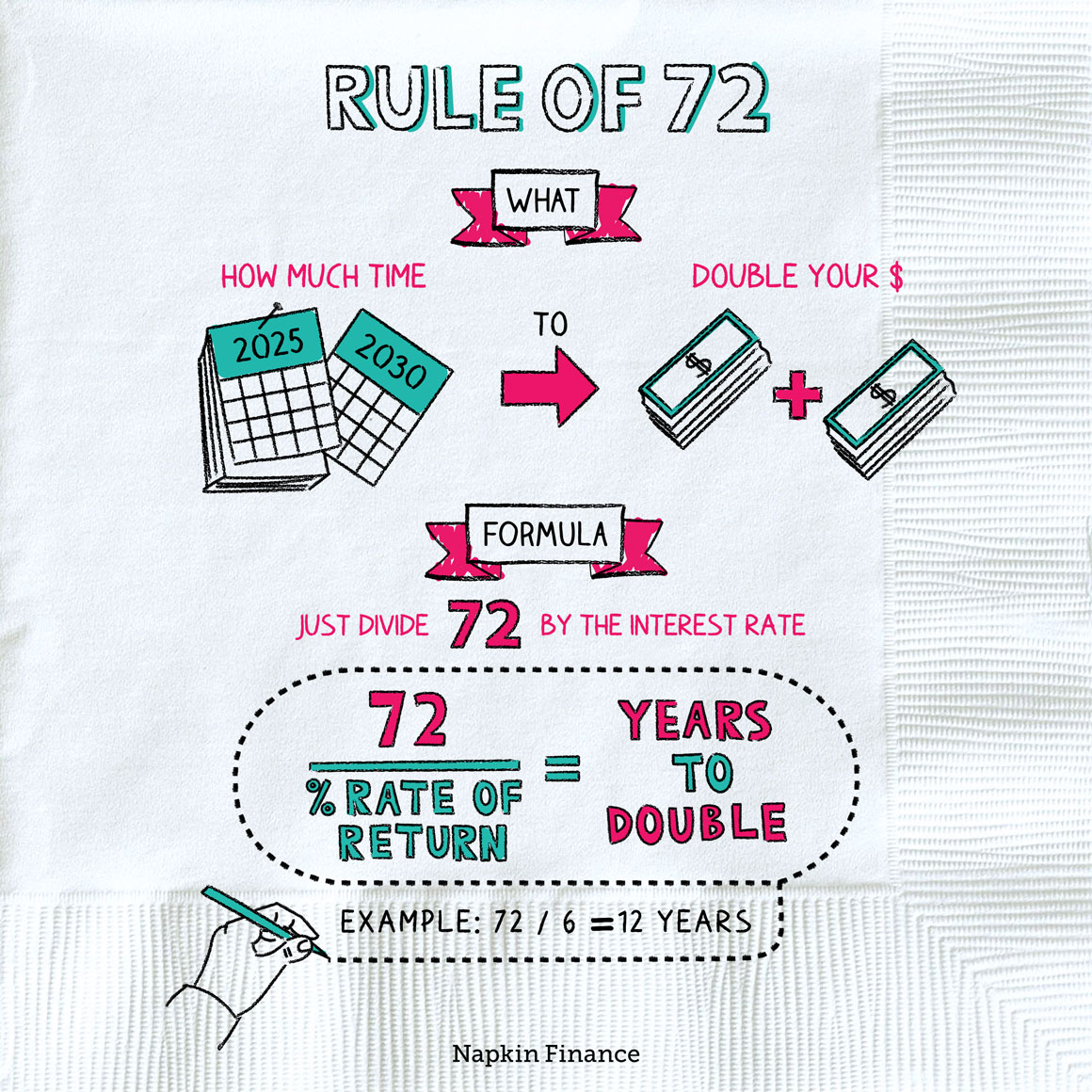

What is the Rule of 72 The Rule of 72 is a calculation that estimates the number of years it takes to double your money at a specified rate of return. If, for example, your account earns 4 percent, divide 72 by 4 to get the number of years it will take for your money to double. In this case, 18 years.

Cached

Does the Rule of 72 really work

The Rule of 72 is reasonably accurate for low rates of return. The chart below compares the numbers given by the Rule of 72 and the actual number of years it takes an investment to double. Notice that although it gives an estimate, the Rule of 72 is less precise as rates of return increase.

Cached

What is the Rule of 69 in finance

The Rule of 69 states that when a quantity grows at a constant annual rate, it will roughly double in size after approximately 69 divided by the growth rate.

Does your money double every 7 years

When does money double every seven years To use the Rule of 72 to figure out when your money will double itself, all you need to know is the annual rate of expected return. If this is 10%, then you'll divide 72 by 10 (the expected rate of return) to get 7.2 years.

Cached

How many years are needed to double a $100 investment using the Rule of 72

Answer and Explanation: It will take a bit over 10 years to double your money at 7% APR. So 72 / 7 = 10.29 years to double the investment.

How do you double money using the Rule of 72

The rule says that to find the number of years required to double your money at a given interest rate, you just divide the interest rate into 72. For example, if you want to know how long it will take to double your money at eight percent interest, divide 8 into 72 and get 9 years.

Can you live off interest of one million dollars

Once you have $1 million in assets, you can look seriously at living entirely off the returns of a portfolio. After all, the S&P 500 alone averages 10% returns per year. Setting aside taxes and down-year investment portfolio management, a $1 million index fund could provide $100,000 annually.

How much interest does $10000 earn in a year

Currently, money market funds pay between 4.47% and 4.87% in interest. With that, you can earn between $447 to $487 in interest on $10,000 each year. Certificates of deposit (CDs). CDs are offered by financial institutions for set periods of time.

What is the 10 5 Rule finance

The 10, 5, 3 rule. This is the expected long-term return from equities 10%, bonds 5%, and cash 3%. It hasn't quite worked out like that since 2008, but it's a long term view over 20 years. It can be combined with the rule of 72, so we can see how long it takes for each asset class to approximately double in value.

What is the 42 Rule finance

The so-called Rule of 42 is one example of a philosophy that focuses on a large distribution of holdings, calling for a portfolio to include at least 42 choices while owning only a small amount of most of those choices.

Can I retire on $300000

In most cases $300,000 is simply not enough money on which to retire early. If you retire at age 60, you will have to live on your $15,000 drawdown and nothing more. This is close to the $12,760 poverty line for an individual and translates into a monthly income of about $1,250 per month.

What will 100k be worth in 20 years

How much will $100k be worth in 20 years If you invest $100,000 at an annual interest rate of 6%, at the end of 20 years, your initial investment will amount to a total of $320,714, putting your interest earned over the two decades at $220,714. What is an after-tax rate of return

How long in years will it take a $300 investment to be worth $1000 if it is continuously compounded at 10% per year

Thus, it will take approximately 8.17 years.

What’s the future value of a $1000 investment compounded at 8% semiannually for five years

$1,480.24

An investment of $1,000 made today will be worth $1,480.24 in five years at interest rate of 8% compounded semi-annually.

How long would it take money earning 6% to double based on the rule of 72

So, if the interest rate is 6%, you would divide 72 by 6 to get 12. This means that the investment will take about 12 years to double with a 6% fixed annual interest rate. This calculator flips the 72 rule and shows what interest rate you would need to double your investment in a set number of years.

Can I retire at 55 with $2 million

If you have multiple income streams, a detailed spending plan and keep extra expenses to a minimum, you can retire at 55 on $2 million. However, because each retiree's circumstances are unique, it's essential to define your income and expenses, then run the numbers to ensure retiring at 55 is realistic.

Is $2 million enough to retire at 60

Yes, for some people, $2 million should be more than enough to retire. For others, $2 million may not even scratch the surface. The answer depends on your personal situation and there are lot of challenges you'll face. As of 2023, it seems the number of obstacles to a successful retirement continues to grow.

How much interest does 1 million dollars earn in a year

Bank Savings Accounts

As noted above, the average rate on savings accounts as of February 3rd 2023, is 0.05% APY. A million-dollar deposit with that APY would generate $500 of interest after one year ($1,000,000 X 0.0005 = $500). If left to compound monthly for 10 years, it would generate $5,011.27.

Can I live off the interest of $100000

Interest on $100,000

Even with a well-diversified portfolio and minimal living expenses, this amount is not high enough to provide for most people. Investing this amount in a low-risk investment like a savings account with a rate between 2% to 2.50% of interest each year would return $2,000 to $2,500.

What is the 120 rule finance

The 120-age investment rule states that a healthy investing approach means subtracting your age from 120 and using the result as the percentage of your investment dollars in stocks and other equity investments.