What is the APR on a Balance Credit loan?

What is the APR for balance credit

Balance Credit offers a fixed APR personal loan product that ranges from 99% APR up to 720% APR.

Cached

What is a normal APR for a loan

6% to 36%

Typically, personal loan APRs are from 6% to 36%. Use our personal loan calculator to see your monthly payment and total interest based on your credit score and desired loan terms.

Is APR monthly or yearly

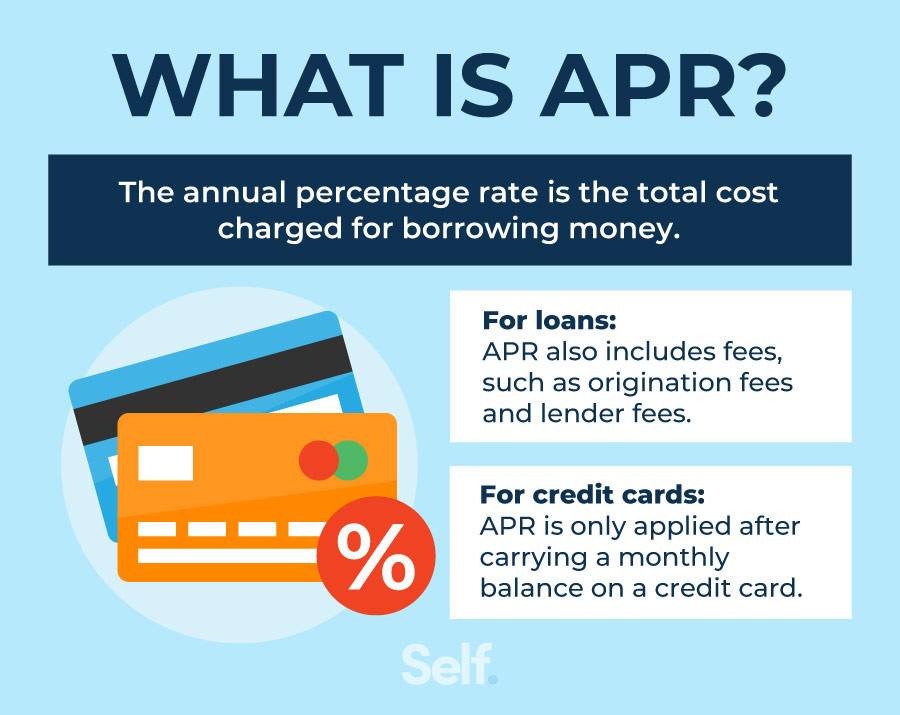

The Annual Percentage Rate (APR) is the cost you pay each year to borrow money, including fees, expressed as a percentage.

Is balance credit legit

Is Balance Credit legit Yes, Balance Credit is a legitimate company that can help you get quick funds if you're in a pinch. While the company has limited availability and higher APRs than traditional lenders, Balance Credit is worth researching if you need a quick alternative to a payday loan.

Cached

Can I pay off my balance credit loan early

Some lenders may charge a prepayment penalty of up to 2% of the loan's outstanding balance if you decide to pay off your loan ahead of schedule. Additionally, paying off your loan early will strip you of some of the credit benefits that come with making on-time monthly payments.

What kind of loan is balance credit

Balance Credit Loan Terms, Rates, and Other Important Details. Balance Credit offers only unsecured loans, meaning no collateral is required. However, loan terms vary based on the applicant's credit history and income. The amount of interest you'll pay on a Balance Credit personal loan vary by state.

Is 24% APR good or bad

Yes, a 24% APR is high for a credit card. While many credit cards offer a range of interest rates, you'll qualify for lower rates with a higher credit score. Improving your credit score is a simple path to getting lower rates on your credit card.

Is 20% APR too high

A good APR is around 20%, which is the current average for credit cards. People with bad credit may only have options for higher APR credit cards around 30%. Some people with good credit may find cards with APR as low as 12%.

Is 29.99 APR bad

It takes time and all too often it feels like you just don't have that time. I know it is tempting for you to take this offer since you are in the process of building your credit. However, you are correct in your statement that 29.99 percent is too high — it's way too high.

What does a 26.99 APR mean

Is a 26.99% APR good for a credit card No, a 26.99% APR is a high interest rate. Credit card interest rates are often based on your creditworthiness. If you're paying 26.99%, you should work on improving your credit score to qualify for a lower interest rate.

Does balance credit affect credit score

Your credit card balances directly impact your credit score and, ultimately, whether you're able to get approved for a new credit card or a loan. As the credit card balance reported to the credit bureaus fluctuates, so too will your credit score.

What credit score do you need for balance credit

Issuers of balance transfer cards typically require a good or excellent credit score to qualify, which is 670 or higher on the 850-point FICO credit scoring scale.

Why did my credit score drop 40 points after paying off debt

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.

What happens if I pay off a personal credit loan quickly instead of over time

On the one hand, you save money on accruing interest when you pay off a debt early, and your debt-to-income ratio will go down. However, some lenders charge a prepayment penalty for early payments, and using your spare income to pay off your loan early means it won't be available for other expenses.

Is 30% APR too much

A 30% APR is not good for credit cards, mortgages, student loans, or auto loans, as it's far higher than what most borrowers should expect to pay and what most lenders will even offer. A 30% APR is high for personal loans, too, but it's still fair for people with bad credit.

Is 25% APR too high

This is one example of “bad APR,” as carrying a balance at a 25% APR can easily create a cycle of consumer debt if things go wrong and leave the cardholder worse off than when they started.

Is 30% APR bad

A 30% APR is not good for credit cards, mortgages, student loans, or auto loans, as it's far higher than what most borrowers should expect to pay and what most lenders will even offer. A 30% APR is high for personal loans, too, but it's still fair for people with bad credit.

Is a 24% APR bad

Yes, a 24% APR is high for a credit card. While many credit cards offer a range of interest rates, you'll qualify for lower rates with a higher credit score. Improving your credit score is a simple path to getting lower rates on your credit card.

Is 24.9% APR high

A 24.99% APR is reasonable but not ideal for credit cards. The average APR on a credit card is 22.15%. A 24.99% APR is decent for personal loans. It's far from the lowest rate you can get, though.

What is considered a high APR rate

Average credit card interest rates by credit score

| Credit Score | Average APR |

|---|---|

| Subprime (Credit score of 580 to 619) | 20.5% |

| Near Prime (Credit score of 620 to 659) | 19% |

| Prime (Credit score of 660 to 719) | 16.5% |

| Super Prime (Credit score of 720+) | 13.5% |