What is the average Social Security check at age 62?

How much does a 62 year old get on Social Security

According to the SSA's 2023 Annual Statistical Supplement, the monthly benefit amount for retired workers claiming benefits at age 62 earning the average wage was $1,480 per month for the worker alone. The benefit amount for workers with spouses claiming benefits was $2,170 at age 62.

What is the lowest Social Security payment at age 62

The Social Security special minimum benefit provides a primary insurance amount (PIA) to low-earning workers. The lowest minimum PIA in 2023, with at least 11 years of work, is $49.40 per month.

How much does Social Security go up from 62 to 65

Key takeaways. If you claim Social Security at age 62, rather than wait until your full retirement age (FRA), you can expect a 30% reduction in monthly benefits. For every year you delay claiming Social Security past your FRA up to age 70, you get an 8% increase in your benefit.

What is the highest Social Security check at age 62

In 2023, the average senior on Social Security collects $1,827 a month. But you may be eligible for a lot more money than that. In fact, some seniors this year are looking at a monthly benefit of $4,555, which is the maximum Social Security will pay. Here's how to score a benefit that high.

Can I draw Social Security at 62 and still work full time

You can get Social Security retirement or survivors benefits and work at the same time.

How much Social Security will I get at 62 if I make 100k a year

If your highest 35 years of indexed earnings averaged out to $100,000, your AIME would be roughly $8,333. If you add all three of these numbers together, you would arrive at a PIA of $2,893.11, which equates to about $34,717.32 of Social Security benefits per year at full retirement age.

How do you find out how much Social Security you will receive

Your Social Security Statement (Statement) is available to view online by opening a my Social Security account. It is useful for people of all ages who want to learn about their future Social Security benefits and current earnings history.

Can I retire at 62 and still work full time

Starting with the month you reach full retirement age, there is no limit on how much you can earn and still receive your benefits.

How do I get the $16728 Social Security bonus

To acquire the full amount, you need to maximize your working life and begin collecting your check until age 70. Another way to maximize your check is by asking for a raise every two or three years. Moving companies throughout your career is another way to prove your worth, and generate more money.

How much Social Security will I get if I make $25000 a year

What is the Social Security payment for a salary over 25,000 dollars For people who are earning 25,000 dollars across the year rather than the previously mentioned amount, 1,880 dollars of the benefits would have to be withheld, so the monthly benefit amount is 1,886 dollars.

How much Social Security will I get at 62 if I make 50000 a year

$1,386

Suppose you were born on Jan. 1, 1960, and had an average annual income of $50,000. As of May 2023, you would get a monthly benefit of $1,386 if you filed for Social Security at 62; $1,980 at full retirement age (in this case, 67); or $2,455 at 70.

How much Social Security will I get at 62 if I make 40000 a year

The exact calculation produces a figure of about $1,172 per month.

Can I draw Social Security at 62 and still work part time

You can get Social Security retirement or survivors benefits and work at the same time. But, if you're younger than full retirement age, and earn more than certain amounts, your benefits will be reduced. The amount that your benefits are reduced, however, isn't truly lost.

What is the Social Security bonus trick

Wait as Long as You Can

Claiming “early,” at age 62, will result in the permanent reduction of your Social Security checks by up to 30%. Waiting until age 70, however, has the opposite effect. For every year that you delay claiming past full retirement age, your monthly benefits will get an 8% “bonus.”

Is Social Security based on the last 5 years of work

We base your retirement benefit on your highest 35 years of earnings and the age you start receiving benefits.

How much Social Security will I get if I earn $60000 a year

And older receive Social Security benefits. Making it an essential part of retiring in the u.s.. Benefits are based on your income. The year you were born and the age you decide to start taking money

How do you get the $16 728 Social Security bonus

To acquire the full amount, you need to maximize your working life and begin collecting your check until age 70. Another way to maximize your check is by asking for a raise every two or three years. Moving companies throughout your career is another way to prove your worth, and generate more money.

How can I find out how much Social Security I will get

Your Social Security Statement (Statement) is available to view online by opening a my Social Security account. It is useful for people of all ages who want to learn about their future Social Security benefits and current earnings history.

How much Social Security will I get if I make $100000 a year

roughly $8,333

If your highest 35 years of indexed earnings averaged out to $100,000, your AIME would be roughly $8,333. If you add all three of these numbers together, you would arrive at a PIA of $2,893.11, which equates to about $34,717.32 of Social Security benefits per year at full retirement age.

Is $1,500 a month enough to retire on

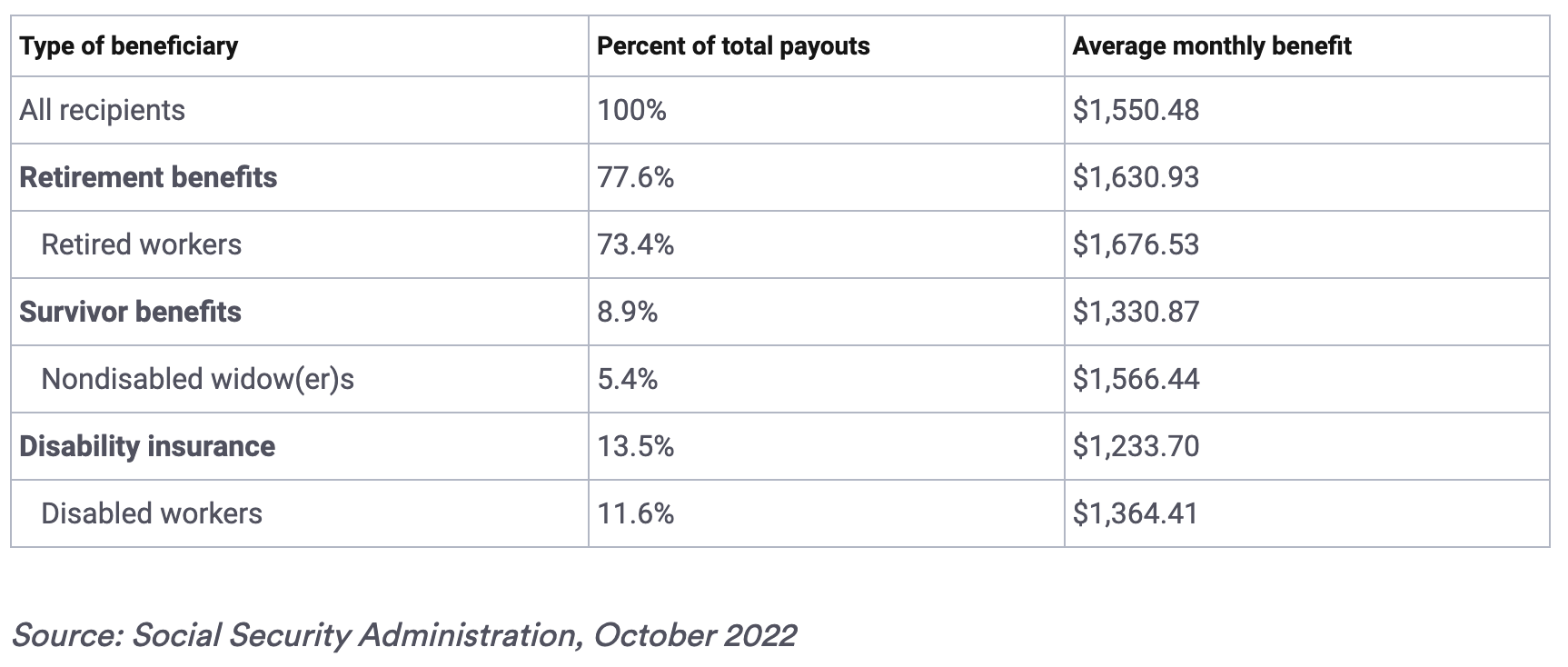

That means that many will need to rely on Social Security payments—which, in 2023, averages $1,544 a month. That's not a lot, but don't worry. There are plenty of places in the United States—and abroad—where you can live comfortably on $1,500 a month or less.