What is the basic difference between a bank and a credit union?

What are 3 differences between a bank and a credit union

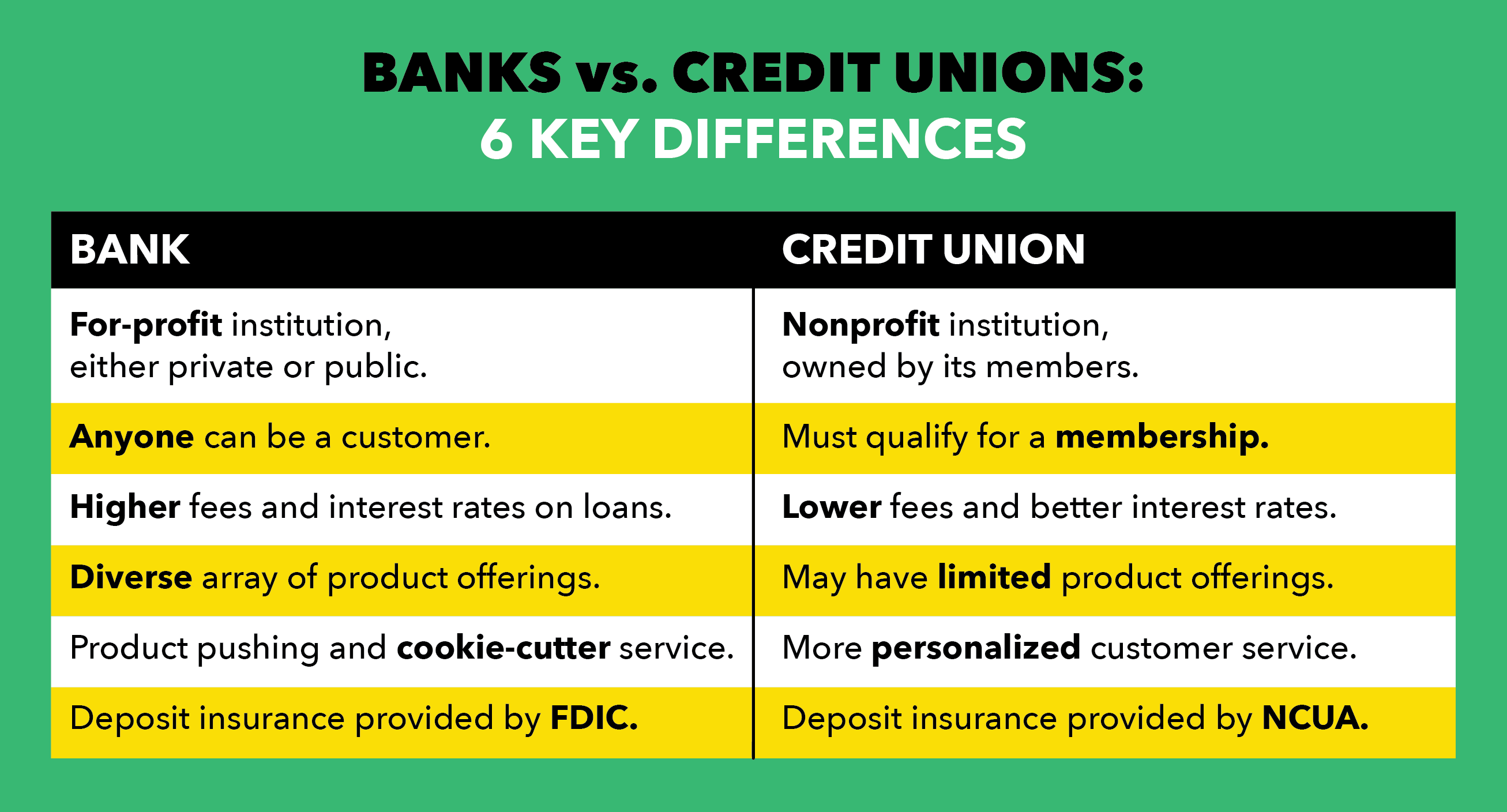

The bottom line is that banks are for-profit institutions, while credit unions are nonprofit. Credit unions typically brag better customer service and lower fees, but have higher interest rates. On the contrary, banks generally have lower interest rates and higher fees.

Cached

Is it better to use a credit union or bank

Credit unions typically offer lower fees, higher savings rates, and a more personalized approach to customer service for their members. In addition, credit unions may offer lower interest rates on loans. It may also be easier to obtain a loan with a credit union than a larger bank.

Cached

What are disadvantages of banking with credit unions

Cons of credit unionsMembership required. Credit unions require their customers to be members.Not the best rates.Limited accessibility.May offer fewer products and services.

What is safer a bank or credit union

Why are credit unions safer than banks Like banks, which are federally insured by the FDIC, credit unions are insured by the NCUA, making them just as safe as banks. The National Credit Union Administration is a US government agency that regulates and supervises credit unions.

Why do people use banks instead of credit unions

Advantages of Banks Over Credit Unions

More financial products and services: Banks offer a variety of products and services, while credit unions tend to stick with a few core offerings, such as deposit accounts, credit cards and loans.

What are the advantages and disadvantages of credit unions

The Pros And Cons Of Credit UnionsBetter interest rates on loans. Credit unions typically offer higher saving rates and lower loan rates compared to traditional banks.High-level customer service.Lower fees.A variety of services.Cross-collateralization.Fewer branches, ATMs and services.The biggest negative.

Should I switch from bank to credit union

You'll save more money.

Instead of paying shareholders a portion of the profit generated, credit unions return their profits to their member-owners in the form of better dividends on savingsOpens in a new window, lower interest rates on loans, interest-earning checking and fewer fees.

Why should I use a bank instead of a credit union

More financial products and services: Banks offer a variety of products and services, while credit unions tend to stick with a few core offerings, such as deposit accounts, credit cards and loans. Many banks provide investment accounts and financial advisory services in addition to standard banking products.

What is a weakness of a credit union

Weaknesses of Credit Unions

The membership of a credit union is restricted to a specific community, most often a religion, profession, or geographic location. For a member to be eligible to join a credit union, they must belong to a group listed in the credit union's charter.

Should I move my banking to a credit union

You'll save more money.

Instead of paying shareholders a portion of the profit generated, credit unions return their profits to their member-owners in the form of better dividends on savingsOpens in a new window, lower interest rates on loans, interest-earning checking and fewer fees.

What is the biggest drawback of a credit union

5 Drawbacks of Banking With a Credit UnionMobile Banking Might Be Limited or Unavailable.Fees Might Not Be as Low as You Think.Credit Card Rewards Might Be Limited.ATMs and Branches Might Not Be Convenient.There Might Be Fewer Services.The Bottom Line.

Why do most people choose banks instead of credit unions

More financial products and services: Banks offer a variety of products and services, while credit unions tend to stick with a few core offerings, such as deposit accounts, credit cards and loans. Many banks provide investment accounts and financial advisory services in addition to standard banking products.

Where is the safest place to keep your money

What are the safest types of investments U.S. Treasury securities, money market mutual funds and high-yield savings accounts are considered by most experts to be the safest types of investments available.

Has a credit union ever failed

Credit unions do fail from time to time, too, and have seen a few more failures in recent years than banks.

What are the 2 main benefits of a credit union

Lower fees and higher interest rates on savings are just a few of the typical advantages of working with a credit union.

Why do people choose banks over credit unions

Advantages of Banks Over Credit Unions

More financial products and services: Banks offer a variety of products and services, while credit unions tend to stick with a few core offerings, such as deposit accounts, credit cards and loans.

Can I transfer money from bank to credit union

Money transfers, Direct Debits

In many credit unions, you can register for online banking to transfer funds between internal accounts, to or from external bank accounts, set up direct debits to pay bills, as well as your check account balance.

Do you have to keep a minimum balance at a credit union

Many banks and credit unions require that you keep a minimum amount of money in a checking or savings account. This is generally known as a minimum balance requirement. In some cases, maintaining a minimum balance may let you reduce or eliminate fees or earn a higher APY.

Do poor people use credit unions

Many credit unions provide valuable access to financial services for people of all income levels, including those underserved or unserved by traditional financial institutions.

Why would a bank be better than a credit union

Advantages of Banks Over Credit Unions

More financial products and services: Banks offer a variety of products and services, while credit unions tend to stick with a few core offerings, such as deposit accounts, credit cards and loans.