What is the best PayPal card to get?

Which card is better for PayPal

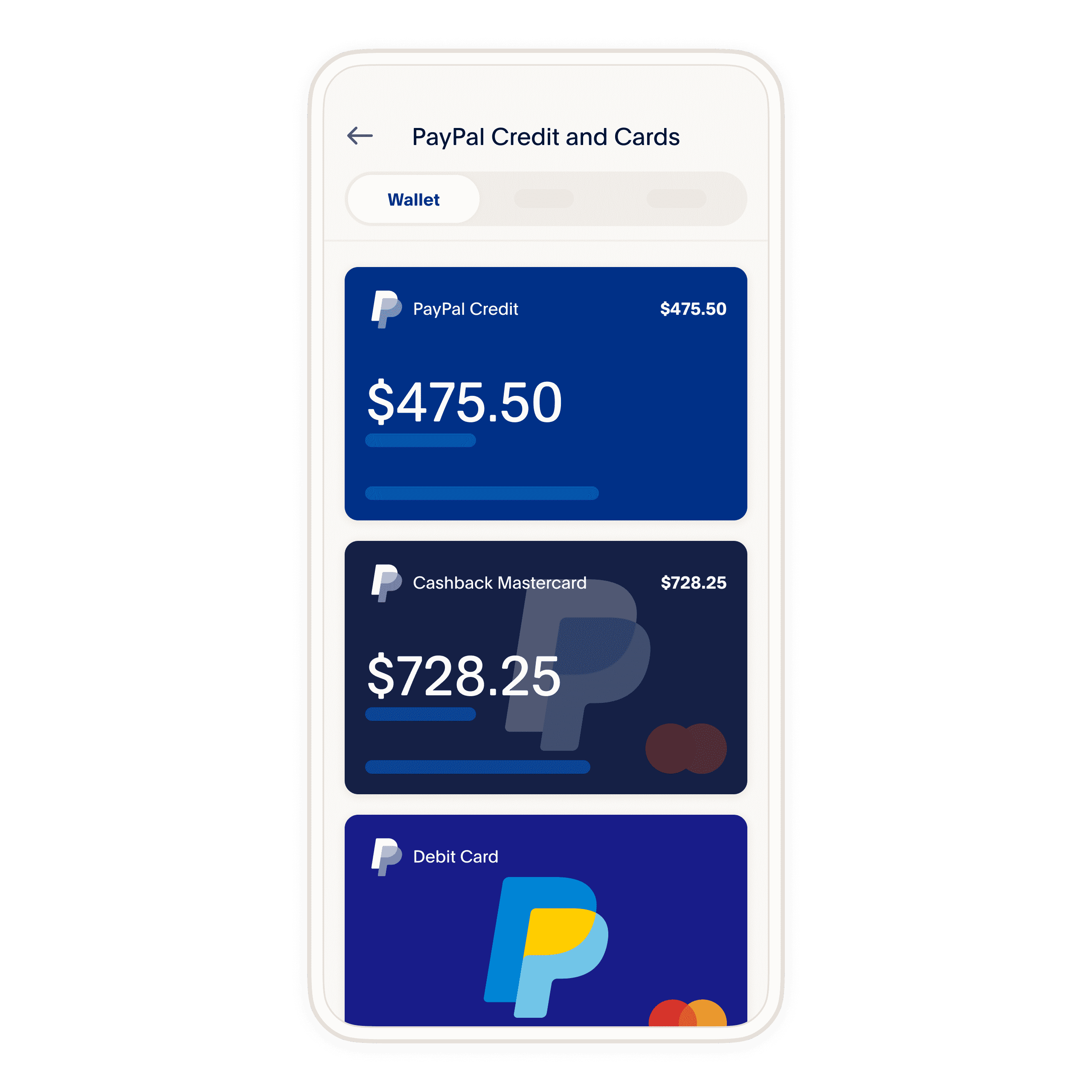

If you're looking for a physical credit card that you can use anywhere, the PayPal Mastercard® is the better option between the two. PayPal Credit is a serviceable choice for online shopping — but it has caveats, which we'll get to in the next question.

Cached

What is the difference between PayPal Credit and PayPal MasterCard

PayPal Credit allows you to take advantage of the interest-free period again and again as long as your transactions are above the $99 threshold. If you are more interested in earning cash back rewards or want more flexibility in using your credit card, the PayPal Cashback Mastercard is the better option.

Cached

What is the highest limit for a PayPal MasterCard

FAQs. What is the credit limit for the PayPal Cashback Mastercard® The credit limit for the PayPal Cashback Mastercard® usually ranges from $300 to $10,000, although some cardholders have reported receiving higher limits.

What kind of cards does PayPal offer

PayPal supports a large number of credit cards, including Visa, Mastercard®, American Express, Discover, JCB, Diners Club, and EnRoute. Depending on your processor, Payflow Pro also supports level 2 and level 3 Purchasing Cards (P-Cards).

Is it a good idea to get a PayPal card

Bottom Line: Is the PayPal Credit Card Worth It Yes. The PayPal Credit Card is worth it because it has a $0 annual fee and good rewards. It will not be worth it if you do not pay the bill in full every month, however, due to the card's high interest rate.

Does PayPal card build credit

As mentioned above, PayPal Credit does not help you build credit, since a hard check will actually make your credit score go down.

Why do people use PayPal instead of credit card

First, PayPal lets you connect your preferred payment method to your account, whether you want to pay with a credit card, a debit card, a bank account or a rewards balance. PayPal also encrypts your bank or credit card information, which helps keep that information safe.

What are the benefits of PayPal Mastercard

Earn 3% cash back on PayPal purchases and 2% on all other purchases.No restrictions. No rotating categories. No annual fee.Cash in on unlimited 3% cash back. Maximize your cash back every time you shop with PayPal.Enjoy unlimited 2% cash back. Get rewarded when you shop everywhere else Mastercard® is accepted.

What credit score do you need for PayPal Mastercard

To get approved for PayPal, credit borrowers generally need a credit score of 670 or higher. Applicants with a credit score of 700 or higher have the best odds of getting approval for lending from PayPal. However, approval with PayPal is not solely based on the credit score of the applicant.

How often does PayPal Credit increase limit

We review your credit limit monthly and may invite you to increase your limit once you've been a PayPal Credit customer for at least 6 months. You can always request a credit limit decrease or opt out of receiving offers to increase your credit limit.

Are PayPal cards free

There is no fee to set up your account and get a card. We don't charge a monthly fee and no minimum balance is required. We don't charge for inactivity or limited use of the card. A fee of up to $3.95 will apply when loading cash to your PayPal balance at supported stores.

How do I get a PayPal card

To get a PayPal debit card, also called the PayPal Cash Card, go to the PayPal Cash Card page and click Get card. Log in to your PayPal account and complete the form. Once PayPal approves the card, you will get it in five to seven business days.

What are the downsides to PayPal cash card

PayPal Prepaid Mastercard ConsNo network that offers free ATM withdrawals, and a $2.50 fee per withdrawal over the counter at a bank.Fee of up to $3.95 per cash load at a NetSpend Reload Network location.PayPal transfers limited to $300 per day.No way to access online services without linking card to PayPal account.

Do PayPal cards have a monthly fee

We don't charge a monthly fee and no minimum balance is required. We don't charge for inactivity or limited use of the card. A fee of up to $3.95 will apply when loading cash to your PayPal balance at supported stores.

What is the limit on PayPal Credit

Is there a limit to how much money you can spend with PayPal Credit Like other lines of credit, how much you can qualify for depends on your individual credit and circumstances. Lines of credit can be anywhere from $250 up to $20,000, says Schmidt.

What are the disadvantages of PayPal

Drawbacks to using PayPalHigh chargeback fees.Higher fees than a typical merchant (credit card processing) account.Account suspension for terms and conditions (T&C) violations that can freeze your funds for months.May take 2 business days to get your money.Customer service can be hard to reach.

Should I use bank or card for PayPal

You don't need a credit card to use PayPal. As long as you have a bank account, you can set up a PayPal account without a credit card or debit card. It's helpful to understand how PayPal works and what your options are for sending and receiving money through their app.

Is there a monthly fee for the PayPal prepaid Mastercard

The PayPal Prepaid Mastercard® comes with a variety of fees. For starters, you'll pay a plan fee of $4.95 per month, and the first month's fee will be deducted from your account within 36 hours from the first time you load the card. The fee to get cash from an ATM is $1.95, plus any bank or ATM operator fees.

How much does PayPal Mastercard give you

Earn 3% cash back on PayPal purchases and 2% on all other purchases. With the new PayPal Cashback Mastercard®, earn unlimited cash back1 at millions of merchants. No restrictions.

Can I get a PayPal Credit card with 650 credit score

You will need a credit score of at least 700 to get it.