What is the best U.S. Treasury ETF?

Are Treasury bond ETFs worth it

If you plan to buy and sell frequently, bond ETFs are a good choice. For long-term, buy-and-hold investors, bond mutual funds, and bond ETFs can meet your needs, but it's best to do your research as to the holdings in each fund.

What is the best way to invest in U.S. Treasuries

While you can buy Treasurys like T-bonds directly from the source — the U.S. government — one of the most common ways people add them to their portfolio is by investing in Treasury exchange-traded funds or mutual funds through bank, brokerage or retirement accounts.

What is the biggest Treasury ETF

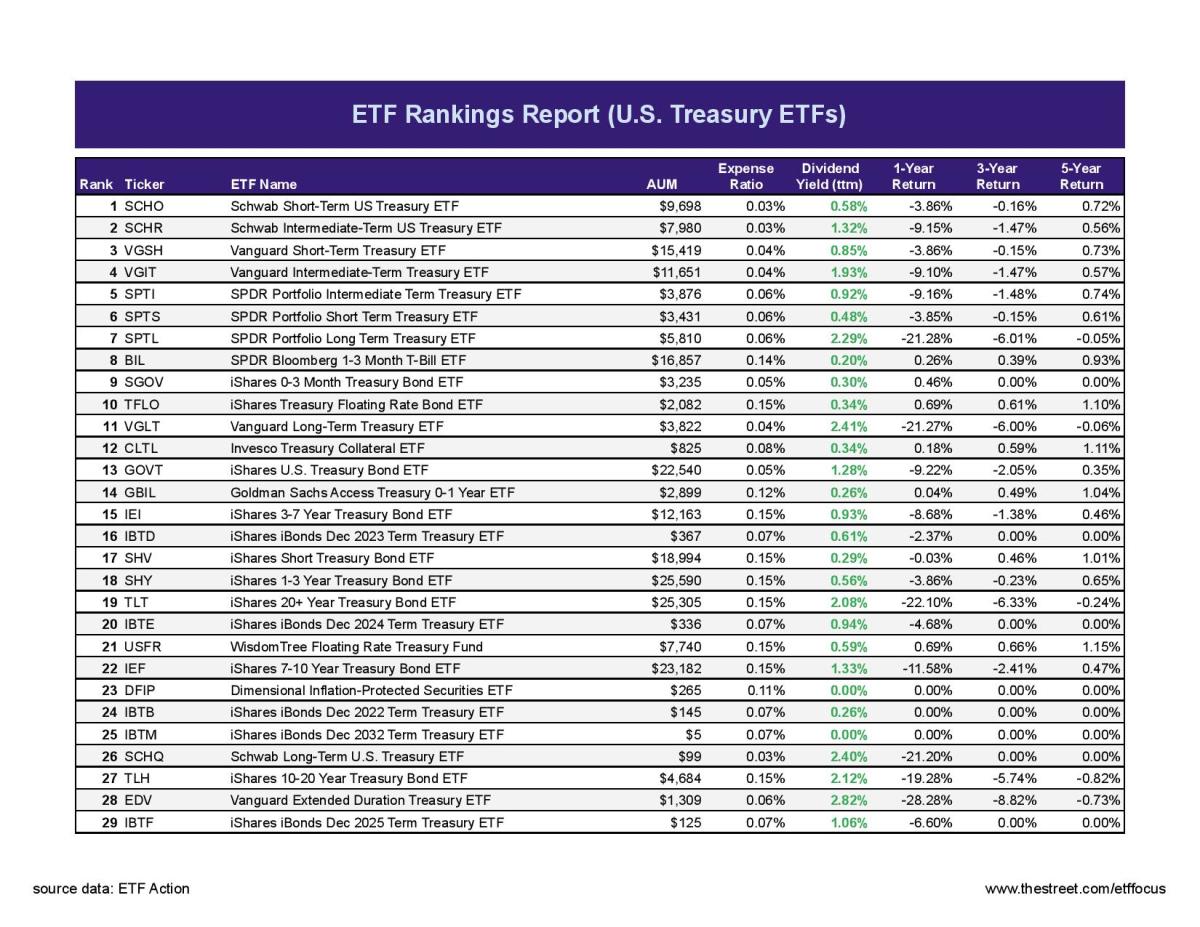

Treasuries ETF List

| Symbol Symbol | ETF Name ETF Name | % In Top 10 % In Top 10 |

|---|---|---|

| TLT | iShares 20+ Year Treasury Bond ETF | 61.19% |

| BIL | SPDR Bloomberg 1-3 Month T-Bill ETF | 72.79% |

| IEF | iShares 7-10 Year Treasury Bond ETF | 97.65% |

| SHY | iShares 1-3 Year Treasury Bond ETF | 42.41% |

Cached

What is the best T bond to buy

iShares iBonds Dec 2024 Term Treasury ETF (IBTE)Vanguard Short-Term Treasury ETF (VGSH)iShares U.S. Treasury Bond ETF (GOVT)iShares 25+ Year Treasury STRIPS Bond ETF (GOVZ)Vanguard Short-Term Inflation-Protected Securities ETF (VTIP)The US Treasury 3 Month Bill ETF (TBIL)SPDR Bloomberg 1-3 Month T-Bill ETF (BIL)

Cached

What is the downside of Treasury bonds

Bonds and interest rates have an opposite relationship: bonds tend to lose value when interest rates rise. The risk with buying a Treasury bond of longer duration is that interest rates will increase during the bond's life, and your bond will be worth less on the market than new bonds being issued.

Is it better to buy bonds directly or bond ETFs

Bond ETFs offer many advantages over single bonds: Diversification. With an ETF, you can own hundreds, even thousands, of bonds in an index at a purchase price significantly less than what it would be to invest in each issue individually. It's institutional-style diversification at retail prices.

What is the downside to US Treasuries

Just as prices can rise in an economy, so too can interest rates. As a result, Treasury bonds are exposed to interest rate risk. If interest rates are rising in an economy, the existing T-bond and its fixed interest rate may underperform newly issued bonds, which would pay a higher interest rate.

Is investing in US Treasuries a good idea

Treasury bills are good investments for individuals looking to make a large purchase in a short timeline, as the money will only be tied-up for at most a year. Although T-bills don't typically earn as much as other securities, or in some cases CDs, they still offer higher returns than traditional savings accounts.

Does Vanguard have a Treasury ETF

Vanguard Short-Term Treasury ETF seeks to track the performance of a market-weighted Treasury bond index with a short-term dollar-weighted average maturity.

What is 1 to 3 year US Treasury ETF

Returns

| 1y | 3y | |

|---|---|---|

| Total Return (%) | 0.13 | -0.97 |

| Market Price (%) | 0.18 | -0.94 |

| Benchmark (%) | 0.23 | -0.87 |

| After Tax Pre-Liq. (%) | -0.53 | -1.31 |

What is the 2 year rate for T-bonds

2 Year Treasury Rate is at 4.59%, compared to 4.52% the previous market day and 2.83% last year.

Which Treasury bond has the highest yield

I bonds are paying a 9.62% annual rate through October 2023, the highest yield since being introduced in 1998, the U.S. Department of the Treasury announced Monday.

What is the safest Treasury bond

T-Bills Are a Safe Investment

The federal government has never defaulted on an obligation, and it's universally believed it never will. Investors who hold T-bills can rest assured that they will not lose their investment. T-Bills are considered a zero-risk investment thanks also to Treasury market liquidity.

Are Treasury bonds safe during a market crash

The short answer is bonds tend to be less volatile than stocks and often perform better during recessions than other financial assets. However, they also come with their own set of risks, including default risk and interest rate risk.

What is the downside of bond ETF

Some of the disadvantages are mentioned below: The investment manager fees associated with the bond ETFs are too high if compared to the low return; it erodes the central part of the return. IT majorly invests in fixed interest securities; therefore, they provide a low rate of return.

Do Treasury bond ETFs pay dividends

Bond ETF income will come primarily in the form of dividends, but advisors should be aware that bond ETFs can also generate capital gains. Most bond ETFs seek to maintain a specific maturity over time.

Are U.S. Treasuries a good buy now

Right now, the 3-month Treasury bill rate is 5.08% while the 30-year Treasury rate is 3.84%. So, if you're looking for a risk-free way to earn interest on your cash over a short period of time, investing in a T-bill could be a good choice.

Can you lose money buying U.S. Treasuries

The federal government has never defaulted on an obligation, and it's universally believed it never will. Investors who hold T-bills can rest assured that they will not lose their investment. T-Bills are considered a zero-risk investment thanks also to Treasury market liquidity.

What is the downside of buying Treasuries

The risk with buying a Treasury bond of longer duration is that interest rates will increase during the bond's life, and your bond will be worth less on the market than new bonds being issued.

How to buy 2 year Treasuries through Vanguard

How do I buy a bondWithin the My Accounts tab, navigate to Buy & Sell.If you have more than one account, you'll need to select the account you want to use for your purchase.Select the type of bond, maturity, and credit quality by selecting the appropriate yield from the Bonds section of the Quick search tab.