What is the CARES Act retention credit?

Do you have to pay back employee retention credit

No. The Employee Retention Credit is a fully refundable tax credit that eligible employers claim against certain employment taxes. It is not a loan and does not have to be paid back.

How will I receive my employee retention credit refund

The ERC is a refundable tax credit that was designed to encourage employers to keep their employees on payroll during the pandemic. ERC refunds are claimed via an amended payroll tax return, Form 941-X, for each applicable qualifying quarter in 2023 and 2023.

Who qualifies for the ERTC tax credit

Businesses and non-profits of any size that closed or limited operations during the COVID-19 pandemic may be eligible. If your business lost money compared to before the pandemic, you may also be eligible.

Can I still claim the employee retention credit

They can file this form up to three years after the original payroll taxes were due. This means that employers can claim the 2023 ERTC until April 15, 2024, and the 2023 ERTC until April 15, 2025. Here's what you need to know about the ERTC and how to take advantage of it.

Cached

Who qualifies for employee retention credit

Who Is Eligible. An employer is eligible for the ERC if it: Sustained a full or partial suspension of operations limiting commerce, travel or group meetings due to COVID-19 and orders from an appropriate governmental authority or.

Who is not eligible for ERC

Do Owner Wages Qualify for the ERC In general, wages paid to majority owners with greater than 50 percent direct or indirect ownership of the business do not qualify for the ERC.

Has anyone received ERC refund 2023

You could receive your refund 21 days after filing your 2023 taxes in 2023. This means you could receive your refund three weeks after the IRS receives your return. It may take several days for your bank to have these funds available to you.

Which employees do not qualify for ERC credit

Do Owner Wages Qualify for the ERC In general, wages paid to majority owners with greater than 50 percent direct or indirect ownership of the business do not qualify for the ERC.

What disqualifies you from ERC

Only recovery businesses are eligible to claim this tax credit in the fourth quarter of 2023. Another restriction is that, regardless of your eligibility, you cannot claim the ERC on wages that were reported as payroll costs in obtaining PPP loan forgiveness or that were used to claim certain other tax credits.

How do I get a $10000 tax refund 2023

How to Get the Biggest Tax Refund in 2023Select the right filing status.Don't overlook dependent care expenses.Itemize deductions when possible.Contribute to a traditional IRA.Max out contributions to a health savings account.Claim a credit for energy-efficient home improvements.Consult with a new accountant.

Can I still apply for the employee retention credit in 2023

You can file for the employee retention tax credit in 2023 if you haven't already. This is known as filing for the ERC “retroactively.” You can do this by submitting an Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund, Form 941-X. This is an amendment to your original payroll tax return, Form 941.

What are 2 ways to qualify for ERC

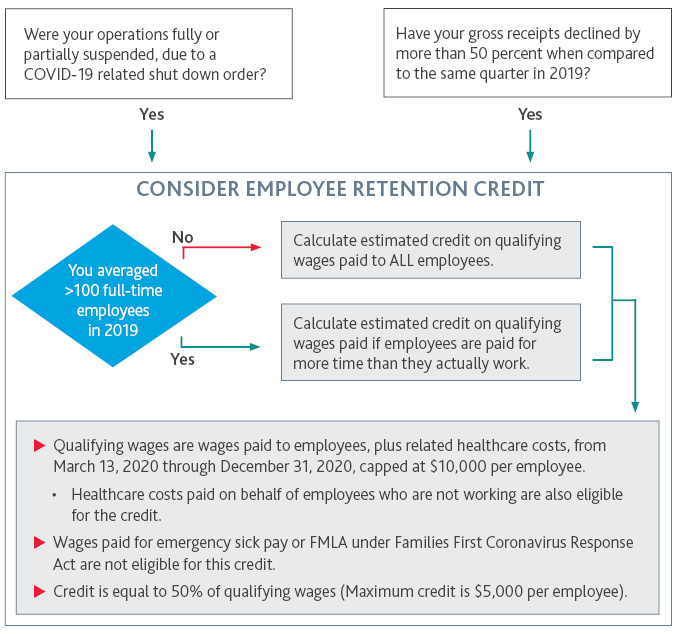

First, if your business was affected by a mandated full or partial suspension of business then you automatically qualify for the ERC. The second way to qualify, is based on a significant reduction in gross receipts.

Who is eligible for employee retention credit 2023

To be eligible for the ERC credit, employers must have either experienced a disruption in business operations or a decrease in gross receipts. Additionally, employers must maintain their workforce at pre-pandemic levels.

Who qualifies for ERC 2023

In order to be eligible for the ERC, a company must have been wholly or partially impacted by COVID-19 and demonstrate at least a 50% drop in gross receipts when compared to similar quarters.

How to get $10,000 tax refund

CAEITCBe 18 or older or have a qualifying child.Have earned income of at least $1.00 and not more than $30,000.Have a valid Social Security Number or Individual Taxpayer Identification Number (ITIN) for yourself, your spouse, and any qualifying children.Living in California for more than half of the tax year.

How to get the biggest tax refund in 2023

Follow these six tips to potentially get a bigger tax refund this year:Try itemizing your deductions.Double check your filing status.Make a retirement contribution.Claim tax credits.Contribute to your health savings account.Work with a tax professional.

What is the deadline for the ERC credit in 2023

Better Business Advice, a leading business tax advice website, has published comprehensive guidance on the latest deadlines for filing Employee Retention Credit (ERC) claims. As of June 2023, businesses can still file ERC claims for 2023 and 2023.

Do I qualify for retention credit

Who Is Eligible. An employer is eligible for the ERC if it: Sustained a full or partial suspension of operations limiting commerce, travel or group meetings due to COVID-19 and orders from an appropriate governmental authority or.

How do I get the biggest tax refund this year

6 Ways to Get a Bigger Tax RefundTry itemizing your deductions.Double check your filing status.Make a retirement contribution.Claim tax credits.Contribute to your health savings account.Work with a tax professional.

When to expect refund 2023

Most people with no issues on their tax return should receive their refund within 21 days of filing electronically if they choose direct deposit.