What is the cash advance limit on a Capital One credit card?

How to check my cash advance limit on Capital One credit card

You can find your exact cash advance limit online or on your latest monthly statement, under "Available Credit for Cash Advances". It's also good to keep in mind that ATMs can have their own withdrawal limits, so you may not be able to take out your full cash advance limit at every ATM.

Cached

How much of a cash advance can I get off my credit card

What is the maximum cash advance limit you can withdraw from a credit card Cash advances are typically capped at a percentage of your card's credit limit. For example, if your credit limit is $15,000 and the card caps your cash advance limit at 30%, your maximum cash advance will be $4,500.

Cached

What is the cash advance for Capital One

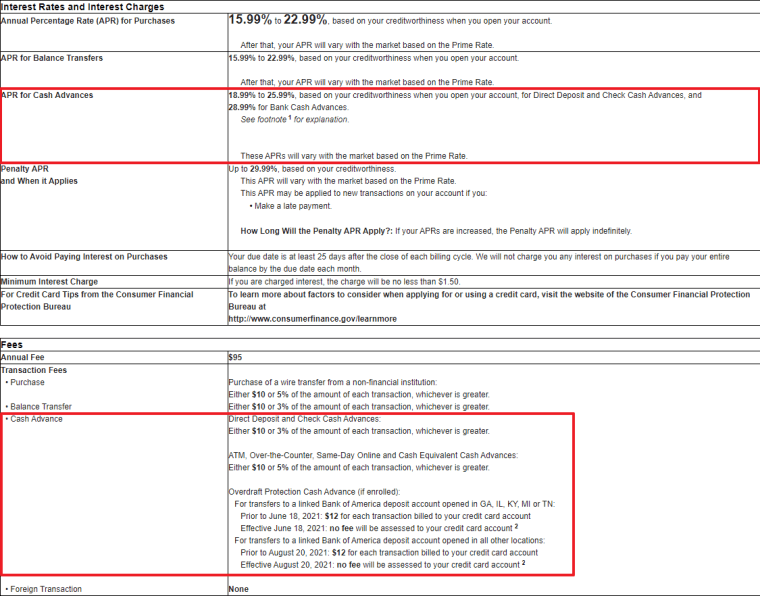

Cash advances come with cash advance fees, so be prepared to pay a little extra for the privilege of withdrawing cash from the ATM. The Capital One cash advance fee is either $10 or 3 percent of the amount of each cash advance, whichever is greater.

Cached

How do I increase my Capital One cash advance limit

You can request a Capital One credit card cash advance limit increase by calling Capital One's customer service department at 800-955-7070 or using the secure chat feature on your online account.

Can I take cash out of my Capital One credit card

Can I use my card to withdraw cash You can withdraw cash on your credit card using your PIN at any cash machine displaying the Mastercard® or Visa symbol. Just remember that every time you make a cash withdrawal we'll charge you a fee.

Does a cash advance hurt your credit

A cash advance won't directly impact your credit scores, but it will use more of your available credit. This affects your credit utilization ratio. And depending on how much you borrow, that could lower your credit scores.

Can I withdraw cash from my Capital One credit card

You can withdraw cash on your credit card using your PIN at any cash machine displaying the Mastercard® or Visa symbol. Just remember that every time you make a cash withdrawal we'll charge you a fee.

How do I know my cash advance limit

Look at your most recent credit card statement and find your Cash Advance Limit. Keep in mind, sometimes ATMs have additional limits. You also must have sufficient total credit line available to take a cash advance.

Can I get a cash advance with a Capital One card

You can take a cash advance inside a bank lobby that displays the Visa or MasterCard credit card logo. You'll just need to provide a government issued photo ID like a driver's license along with your Capital One card.

How do I calculate my cash advance limit

Look at your most recent credit card statement and find your Cash Advance Limit. Keep in mind, sometimes ATMs have additional limits. You also must have sufficient total credit line available to take a cash advance.

Can I use my Capital One credit at an ATM

You'll be able to use your Capital One credit card to get a cash advance at any ATM, though you may have to pay extra fees depending on the ATM you use (see our section on fees below). To avoid additional ATM fees, you can find Capital One ATMs here.

Can I get cash off my Capital One credit card

You can take a cash advance inside a bank lobby that displays the Visa or MasterCard credit card logo. You'll just need to provide a government issued photo ID like a driver's license along with your Capital One card. Forgot your PIN You can request a new one.

Can I use Capital 1 credit card at ATM

You'll be able to use your Capital One credit card to get a cash advance at any ATM, though you may have to pay extra fees depending on the ATM you use (see our section on fees below). To avoid additional ATM fees, you can find Capital One ATMs here.

How much can I withdraw from Capital One ATM

$1,000 per day

Total card purchases and withdrawals are limited to $5,000 per day. This includes ATM withdrawals, cash advances, and signature and PIN-based purchases. Withdrawals from an ATM made using a 360 Checking Card are limited to $1,000 per day. You can lower this limit by calling us at 1-800-655-2265.

How do I withdraw money from my credit one credit card

Insert the credit card into an ATM and enter the PIN. Select the cash advance option on the ATM screen. Enter the amount you'd like to withdraw. Withdraw the cash and remove the credit card from the ATM.

How do I withdraw money from my Credit One credit card

Insert the credit card into an ATM and enter the PIN. Select the cash advance option on the ATM screen. Enter the amount you'd like to withdraw. Withdraw the cash and remove the credit card from the ATM.

Can I transfer money from Capital One credit card to my bank account

Yes. You can do this by using an online bank transfer app like Zelle®, by check, by wire transfer and more. You can also transfer money between your Capital One account and an external bank account. Follow these simple steps to link an external bank account.

Can I use my Capital One credit card at an ATM to get cash

You can get a Capital One cash advance at ATMs or at bank locations displaying a Visa or Mastercard logo, withdrawing the cash in the same way you would with a debit card. But because credit card cash advances are short-term loans from your credit card company, they involve fees and accrue interest.

What is the daily withdrawal limit for Capital One

Total card purchases and withdrawals are limited to $5,000 per day. This includes ATM withdrawals, cash advances, and signature and PIN-based purchases. Withdrawals from an ATM made using a 360 Checking Card are limited to $1,000 per day. You can lower this limit by calling us at 1-800-655-2265.

Can I transfer money from my Capital One credit card to my bank account

Yes. You can do this by using an online bank transfer app like Zelle®, by check, by wire transfer and more. You can also transfer money between your Capital One account and an external bank account. Follow these simple steps to link an external bank account.