What is the cash value of a 25000 life insurance policy?

How do I determine the cash value of my life insurance policy

To calculate the cash surrender value of a life insurance policy, add up the total payments made to the insurance policy. Then, subtract the fees that will be changed by the insurance carrier for surrendering the policy.

Cached

How much does 25k life insurance cost

How Much Is a $250,000 Life Insurance Policy On average, a $250,000 life insurance policy costs $14.75 per month for a 10-year term and $18.09 for a 20-year term. The right term length for you will depend on your financial needs.

Cached

Is 25000 life insurance worth it

Overall, a $25,000 final expense whole life insurance policy can be a good option for those looking for permanent life insurance coverage to cover the costs associated with their final expenses.

Cached

What is the cash value of a $10000 life insurance policy

The $10,000 refers to the face value of the policy, otherwise known as the death benefit, and does not represent the cash value of life insurance policy. A $10,000 term life insurance policy has no cash value.

How much does a $1 million dollar whole life insurance policy cost

The cost of a $1 million life insurance policy for a 10-year term is $32.05 per month on average. If you prefer a 20-year plan, you'll pay an average monthly premium of $46.65.

How much cash is a $100 000 life insurance policy worth

The cash value of your settlement will depend on all the other factors mentioned above. A typical life settlement is worth around 20% of your policy value, but can range from 10-25%. So for a 100,000 dollar policy, you would be looking at anywhere from 10,000 to 25,000 dollars.

What is the average payout for a life insurance policy

This is a difficult question to answer because so many variables are involved, including the type of life insurance policy, the age and health of the insured person, and the death benefit. However, some industry experts estimate that the average payout for a life insurance policy is between $10,000 and $50,000.

When the owner of a $250 000 life insurance policy died the beneficiary decided

If taken as a lump sum, life insurance proceeds to beneficiaries are passed… When the owner of a $250,000 life insurance policy died, the beneficiary decided to leave the proceeds of the policy with the insurance company and selected the interest Settlement Option.

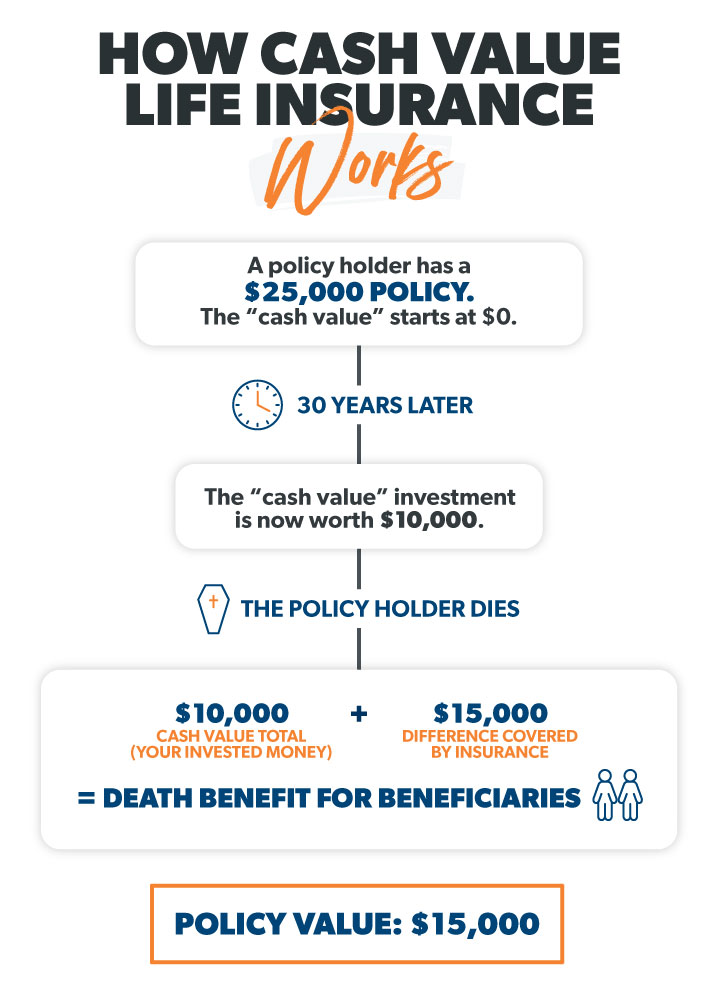

Why is cash value life insurance not a good investment

Why First up, you're going into debt, which is never a good idea. Second, you'll have to pay interest on the loan, and if you don't pay all of it back, your death benefit will decrease. Think about how crazy this is—you're paying interest on a loan made up of your own money.

What is the average amount of life insurance money

This is a difficult question to answer because so many variables are involved, including the type of life insurance policy, the age and health of the insured person, and the death benefit. However, some industry experts estimate that the average payout for a life insurance policy is between $10,000 and $50,000.

What is the cash value of a 250 000 life insurance policy

For example, if you have a $250,000 policy and withdraw $25,000, your beneficiaries will only receive a $225,000 death benefit from your policy.

How much does a $500000 whole life policy cost

The cost of a $500,000 term life insurance policy depends on several factors, such as your age, health profile and policy details. On average, a 40-year-old with excellent health buying a $500,000 life insurance policy will pay $18.44 a month for a 10-year term and $24.82 a month for a 20-year term.

How long does it take to build cash value on life insurance

2 to 5 years

How fast does cash value build in life insurance Most permanent life insurance policies begin to accrue cash value in 2 to 5 years. However, it can take decades to see significant cash value accumulation. Consult a licensed insurance agent to understand the policy's cash value projections before applying.

Do you get the full amount on life insurance payout

A lump sum payout disperses your full portion of the death benefit tax-free via a check or directly into your bank account. If your payout is larger than $250,000, you might consider splitting the deposit between multiple accounts. The FDIC only insures deposits up to $250,000 per depositor, per insured bank.

Is life insurance paid out in a lump sum

There are several ways a beneficiary can receive the death benefit from a life insurance policy. The most common payout type is the lump sum payment. As the name indicates, this is a single payment, usually in the form of a check, that is given to the beneficiary once the amount has been approved by the insurer.

How much money do beneficiaries receive if the insured dies

The death benefit of a life insurance policy represents the face amount that will be paid out on a tax-free basis to the policy beneficiary when the insured person dies. Therefore, if you were to buy a policy with a $1 million dollar death benefit, your beneficiary will receive $1 million upon your death.

Do beneficiaries pay taxes on life insurance proceeds

Answer: Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received.

What is the downside of cash value life insurance

You may have fees associated with your cash value account. You can earn interest on a cash value savings account. Cash value policies are more expensive than term policies.

How to make money with cash value life insurance

One way is to purchase a policy and let the cash value grow over time. Then, when you retire, you can use the cash value to supplement your income. The other way is to purchase a policy and borrow against the cash value. You can use the loan for any purpose, such as buying a new car or taking a vacation.

How much a month is a $500 000 whole life insurance policy

Frequently asked questions. How much does whole life insurance cost A 35-year-old with minimal health conditions can pay about $571 per month for a whole life insurance policy with a $500,000 death benefit coverage amount. Whole life is significantly more expensive than term life insurance on average.