What is the cheapest s& p 500 index fund?

What is the lowest fee SP 500 index fund

Fidelity has the lowest costs, with a 0.015% expense ratio. Schwab's is only slightly higher at 0.02%, while the Vanguard 500 Index Fund Admiral Shares has a 0.04% expense ratio. Fidelity and Schwab offer their index funds with no minimum investment, making them very accessible to beginning investors.

Cached

What is the best performing S&P 500 index fund

Summary of the Best S&P 500 Index Funds of 2023Fidelity 500 Index Fund (FXAIX)Vanguard 500 Index Fund Admiral Shares (VFIAX)Schwab S&P 500 Index Fund (SWPPX)

Cached

How much does the S&P 500 index fund cost

Schwab S&P 500 Index Fund (SWPPX)

Expense ratio: 0.02 percent. That means every $10,000 invested would cost $2 annually. Who is it good for: Great for investors looking for a broadly diversified index fund at a low cost to serve as a core holding in their portfolio.

Cached

How to invest in S&P 500 with little money

You can't directly invest in the index itself, but you can buy individual stocks of S&P 500 companies, or buy an S&P 500 index fund or ETF. The latter is ideal for beginner investors since they provide broad market exposure and diversification at a low cost.

Cached

Which is better Vanguard or Fidelity

In fact, Fidelity is our overall pick for the best online broker in 2023, so it is very hard to beat. All that said, Vanguard still offers some of the lowest-cost funds in the industry and will appeal to buy-and-hold investors, retirement savers, and investors who want access to professional advice.

Does Fidelity 500 Index Fund have fees

Fidelity® 500 Index Fund has an expense ratio of 0.02 percent.

Where to buy S and P 500 index fund

Popular investing platforms like Fidelity and Robinhood will allow you to buy shares of an S&P 500 fund in a traditional taxable brokerage account or an account for a specific goal, like a retirement account. Choose which type of fund you want to invest in.

Do any mutual funds outperform the S&P 500

From 2010 through 2023, anywhere from 55% to 87% of actively managed funds that invest in S&P 500 stocks couldn't beat that benchmark in any given year. Compared with that, the results for 2023 were cause for celebration: About 51% of large-cap stock funds failed to beat the S&P. 500.

Can I buy 100 dollars of S&P 500

In other words, if you invest $100 in the SPDR S&P 500 ETF Trust (SPY 0.18%), you'll own a tiny portion of all 500-plus companies that are in the S&P 500 Index. You get instant diversification and an investment with a long history of making money for anyone who can hold for a decade or longer. It's also simple to do.

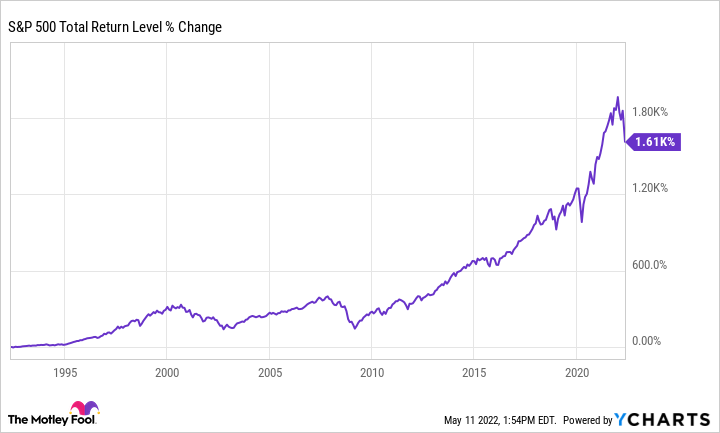

What would $100 invested in S&P 500

The nominal return on investment of $100 is $24,462.29, or 24,462.29%. This means by 2023 you would have $24,562.29 in your pocket. However, it's important to take into account the effect of inflation when considering an investment and especially a long-term investment.

Should I just put my money in S&P 500

Whether you're nervous about market volatility or simply want an investment you can count on to keep your money safe, an S&P 500 ETF or index fund is a fantastic choice. This type of investment tracks the S&P 500 itself, meaning it includes the same stocks as the index and aims to mirror its performance.

How much do you need to invest in S&P 500 to become a millionaire

As you can see from the chart, investing $5,000 annually in the S&P 500 would make you a millionaire in a little over 30 years, assuming average 10.25% annual returns.

Does Fidelity have lower fees than Vanguard

Fidelity: Costs. Vanguard and Fidelity charge $0 commissions for online equity, options, and ETF trades for U.S.-based customers. Fidelity has a $0.65 per contract option fee; it's $1 at Vanguard. Fidelity will set you back more for broker-assisted stock trades ($32.95 versus Vanguard's $25.

What are the cons of Vanguard

ConsRelatively high minimum investment requirements for many fund options.Higher-than-average per-contract options fee.Slow process to open an account.No trading platform for active traders.No fractional shares of stocks or ETFs.

Do Fidelity index funds have fees

Proving what it means to put value first

That's why we introduced zero expense ratio index mutual funds. We also offer zero minimum investment Fidelity Mutual Funds, no minimums to open an account, 3 no account fees for retail brokerage accounts, and 24/7 live customer service — now that's value.

Does Vanguard S&P 500 ETF have fees

A fee that's deducted from your account to cover the cost of maintaining the account. At Vanguard, these annual fees range from $15 to $25 depending on the type of account you own.

Can I just buy S&P 500

The S&P 500 is a stock market index made up of about 500 publicly traded companies. You cannot directly invest in the index itself. You can buy individual stocks of companies in the S&P 500, or buy an S&P 500 index fund or ETF. Index funds typically carry less risk than individual stocks.

Should a financial advisor beat the S&P 500

Putting Your Money in the S&P 500 Will Make You More Money

The answer lies in the high, percentage-based fees that financial advisors and fund managers charge. Overall, a financial advisor may be able to perform better than the S&P 500.

Do target date funds outperform the S&P 500

In bull markets, index funds that track the S&P 500 tend to outperform target-date funds. However, during times of high volatility, equity index funds will generally lose more in value than target-date funds, which are more conservative.

How much would 100$ invested into S&P 500 30 years ago be worth today

If you invested $100 in the S&P 500 at the beginning of 1930, you would have about $566,135.36 at the end of 2023, assuming you reinvested all dividends. This is a return on investment of 566,035.36%, or 9.71% per year.