What is the credit limit on Discover it card?

What is the average credit limit on a Discover it card

The Discover it® Cash Back credit limit is at least $500 for all cardholders. It has the potential to be higher, too. Discover does not disclose a maximum credit limit, but there are reports of some cardholders receiving credit limits between $2,500 and $9,000.

Cached

How much does discover card give you

Why Discover it® Cash Back rewards credit card Earn 5% cash back on everyday purchases at different places each quarter like Amazon.com,4 grocery stores, restaurants, gas stations, up to the quarterly maximum when you activate. Earn 1% cash back on all other purchases – automatically.

What is the minimum credit score for a Discover it card

The Discover it Secured Credit Card is a no-annual fee secured credit card for people looking to either improve their credit or build their credit history. Therefore, there is no minimum credit score required to qualify for the card.

What is the credit limit for 50000 salary

What will be my credit limit for a salary of ₹50,000 Typically, your credit limit is 2 or 3 times of your current salary. So, if your salary is ₹50,000, you can expect your credit limit to be anywhere between ₹1 lakh and ₹1.5 lakh.

What credit limit can I get with a 750 credit score

The credit limit you can get with a 750 credit score is likely in the $1,000-$15,000 range, but a higher limit is possible. The reason for the big range is that credit limits aren't solely determined by your credit score.

Which credit card usually gives the highest credit limit

Highest “Overall” Credit Limit: $500,000

The winners of the nosebleed award for the highest credit limit among cards for mere mortals are these twins: Chase Sapphire Preferred® Card and Chase Sapphire Reserve®, with annual fees in the mid-triple digits and high-double digits, respectively.

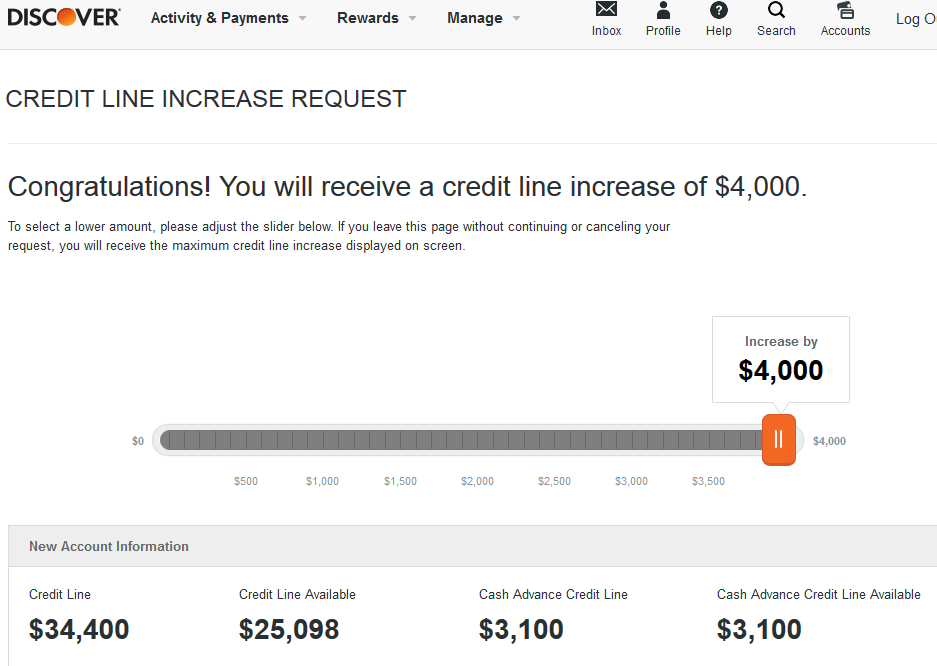

Does Discover raise your credit limit

Discover may automatically increase your credit limit depending on your account history and creditworthiness. If you consistently make on-time payments on your Discover card account, for example, you might be more likely to receive an automatic credit limit increase than someone who regularly misses payments.

Does Discover raise your limit

Credit card companies determine how much you can increase your credit limit based on a variety of factors. If you have a Discover® Card, you can request a credit limit increase online or over the phone.

Can you get a Discover card with a 650 credit score

A 700+ credit score is needed to get most Discover credit cards, but there's no minimum credit score needed for a few Discover cards. You can get the Discover it® Secured Credit Card with a bad credit score (below 640).

Does Discover automatically increase credit limit

Discover may automatically increase your credit limit depending on your account history and creditworthiness. If you consistently make on-time payments on your Discover card account, for example, you might be more likely to receive an automatic credit limit increase than someone who regularly misses payments.

Is a $10,000 credit limit high

Is a $10,000 credit limit good Yes a $10,000 credit limit is good for a credit card. Most credit card offers have much lower minimum credit limits than that, since $10,000 credit limits are generally for people with excellent credit scores and high income.

Can I get a 20k loan with 750 credit score

You should have a 640 or higher credit score in order to qualify for a $20,000 personal loan. If you have bad or fair credit you may not qualify for the lowest rates. However, in order to rebuild your credit you may have to pay higher interest rates and make on-time payments.

How rare is a 750 credit score

Your credit score helps lenders decide if you qualify for products like credit cards and loans, and your interest rate. You are one of the 46% of Americans who had a score of 750 or above in 2023, according to credit scoring company FICO. Here's how your 750 credit score can affect your financial life.

What credit limit can I get with a 700 credit score

What credit score is needed to get a high-limit credit card

| VantageScore 3.0 credit score range | Average credit card limit |

|---|---|

| 300–640 | $3,481.02 |

| 640–700 | $4,735.10 |

| 700–750 | $5,968.01 |

| 750+ | $8,954.33 |

Feb 15, 2023

Why is my Discover credit limit so low

A lack of credit history can lead to a lower limit. This is because the credit card issuer doesn't have enough information to justify giving you access to a large amount of money via a higher limit on a credit card account. Opening a credit card is like starting a new relationship: You have to build trust.

Is Discover it a good credit card to build credit

Paying the security deposit on a secured card might not appeal to everyone at first, but the Discover it® Secured Credit Card could be one of your best options for building or rebuilding your credit. It reports to the three major consumer credit bureaus and offers plenty of useful features, all with no annual fee.

What should my credit limit be

Your credit limit should be at least 3 times higher than your usual monthly spending. That's because your overall credit utilization ratio should stay below 30%. If your spending exceeds that, you risk damaging your credit score.

Which Discover card is easiest to get

If you have a low credit score or limited credit history, a secured card (like the Discover Secured Credit Card) may be a good option for you. The minimum credit score needed for a secured card is lower than the minimum score you need to qualify for an unsecured credit card.

Does the Discover it card do a hard pull

Yes, the Discover it® Secured Credit Card will do a hard pull. You can apply for it with bad credit though. You can prequalify for the Discover it Secured Credit Card on Discover's pre-qualification page, which will not affect your credit score as it will be a soft pull.

What’s a good credit limit

A good credit limit is above $30,000, as that is the average credit card limit, according to Experian. To get a credit limit this high, you typically need an excellent credit score, a high income and little to no existing debt. What qualifies as a good credit limit differs from person to person, though.