What is the D&B score?

What is a good D&B score

80 to 100

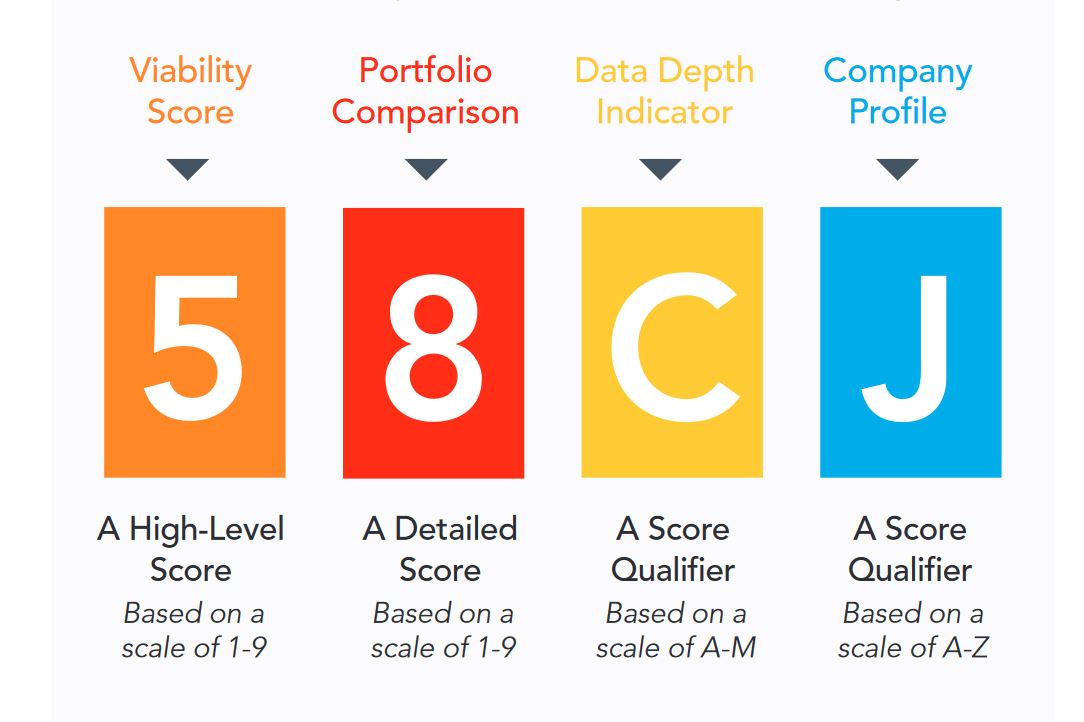

Types of D&B ratings

To be eligible for loans and decent credit ratings, this particular score should fall within the 80 to 100 range. Anything lower than that may indicate difficulty with making payments. Businesses within the 0 to 49 range are considered high risk and would dissuade investors or lenders.

Cached

What does D&B credit score mean

A D&B Rating measures your company's size and creditworthiness. Lenders and suppliers may use this rating to decide whether to do business with your company.

Cached

How is D&B score calculated

How Is the D&B Failure Score Calculated Dun & Bradstreet aggregates company information from a variety of sources. These include public records, financial statements, and past payment experiences. The Failure Score also weighs a company's demographics against those of similar firms in the same industry.

What does a D&B report show

A D&B Report, also known as Dun & Bradstreet Business Credit Report, is a business credit report issued by the business credit reporting agency Dun & Bradstreet. The Dun & Bradstreet Business Credit Report measures the creditworthiness of a company.

Cached

What does a Dun & Bradstreet score of 76 mean

Dun & Bradstreet

A score of 1–49 indicates a high risk of late payment, 50–79 indicates moderate risk, and 80–100 represents low risk.

How do I increase my DUNS score

On the Dun & Bradstreet PAYDEX score, paying on time can get you a score of 80, but paying early could get you to 100. Whatever you do, avoid paying late or allowing your accounts to become delinquent at all costs. Late payments could indicate that your business has financial problems and therefore damage your score.

What is B vs BBB credit rating

'BBB' National Ratings denote a moderate level of default risk relative to other issuers or obligations in the same country or monetary union. 'BB' National Ratings denote an elevated default risk relative to other issuers or obligations in the same country or monetary union.

What is average high credit D&B

What is a good D&B PAYDEX score A PAYDEX score of 80 or higher is widely considered to be in the “very good” range. A score of 80 indicates that, on average, a business pays its debts on the exact day they are due. Scores higher than 80 indicate early repayment.

How do you read a D&B rating

Dun & Bradstreet assigns scores on a scale of 1 to 100, with 100 being the best possible PAYDEX Score. Scores are divided into three Risk Categories, with 0 to 49 indicating a high risk of late payment, 50 to 79 indicating a moderate risk, and 80 to 100 indicating a low risk.

What is a good credit score for business

Businesses are ranked on a scale between 101 to 992, with a lower score correlating to a higher risk of delinquency. A good Business Credit Risk Score is around 700 or higher.

What is the highest DUNS score

Dun & Bradstreet assigns scores on a scale of 1 to 100, with 100 being the best possible PAYDEX Score. Scores are divided into three Risk Categories, with 0 to 49 indicating a high risk of late payment, 50 to 79 indicating a moderate risk, and 80 to 100 indicating a low risk.

Is Dun and Bradstreet score of 80 good

Developed by data and analytics company Dun and Bradstreet, Paydex scores are business credit scores that range from 1-100. A good Paydex score starts at 80, with early payments earning a company higher scores. Paydex scores are dollar-weighted, which means paying off higher debts have a bigger impact on your score.

What is the highest DUNS number

The Basics: 1 to 100

Dun & Bradstreet assigns scores on a scale of 1 to 100, with 100 being the best possible PAYDEX Score. Scores are divided into three Risk Categories, with 0 to 49 indicating a high risk of late payment, 50 to 79 indicating a moderate risk, and 80 to 100 indicating a low risk.

Is 76 a good DUNS number

Dun & Bradstreet

A score of 1–49 indicates a high risk of late payment, 50–79 indicates moderate risk, and 80–100 represents low risk.

What does B mean for business credit

The credit rating given to a company or government can impact on its ability to borrow money. Those with highly speculative ratings, like B, are deemed riskier for investors compared to investment-grade companies.

Is B a good credit rating

Grade B. If have a credit score between 680 and 719 you have good credit. There is nothing wrong with having a score in this range. Sure, you should definitely strive to improve your credit score—higher is always better—but by no means should you be freaking out about your score.

What does a Bradstreet score of 76 mean

low risk

Dun & Bradstreet

A score of 1–49 indicates a high risk of late payment, 50–79 indicates moderate risk, and 80–100 represents low risk.

What does B mean in rating

'B' ratings indicate that material default risk is present, but a limited margin of safety remains. Financial commitments are currently being met; however, capacity for continued payment is vulnerable to deterioration in the business and economic environment.

What credit score does an LLC start with

You're aiming for a score of at least 75 in order to start getting favorable terms and taking advantage of having a strong business credit rating. The basic steps to start the process of establishing credit for your LLC are as follows: Get an EIN from the IRS. Register for a D-U-N-S number.

How good is a Dun and Bradstreet score of 76

Dun & Bradstreet

A score of 1–49 indicates a high risk of late payment, 50–79 indicates moderate risk, and 80–100 represents low risk.