What is the deadline for homestead exemption in Florida 2023?

When can I apply for homestead exemption 2023 in Florida

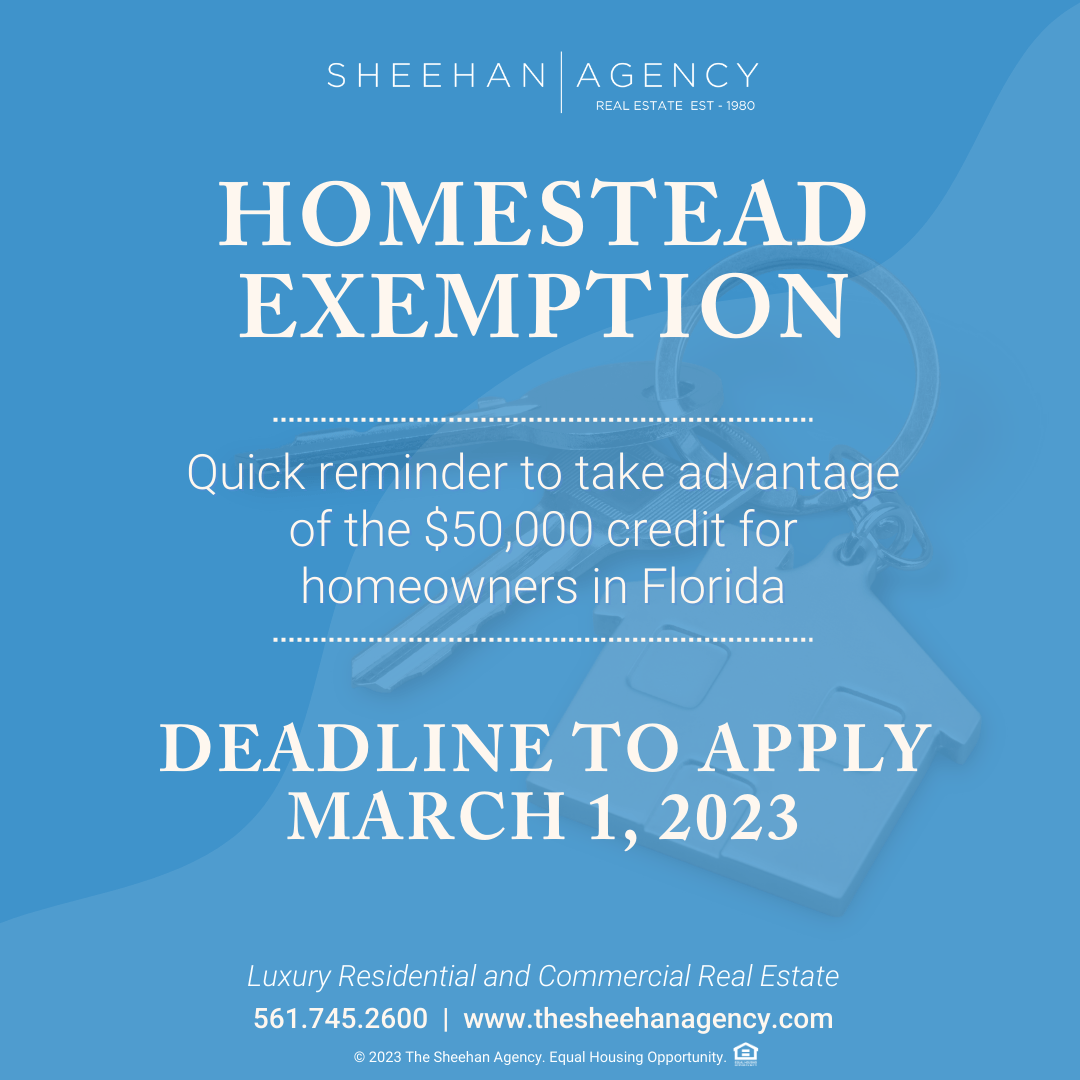

The deadline to timely file for a homestead exemption is March 1, 2023. Late filing is permitted through early September. (The deadline for late filing is set by Florida law and falls on the 25th day following the mailing of the Notices of Proposed Property Taxes which occurs in mid-August.)

Cached

What I must do before claiming Florida homestead exemption

Required Documentation for Homestead Exemption ApplicationYour recorded deed or tax bill.Florida Drivers License or Identification Card. Will need to provide ID# and issue date.Vehicle Registration. Will need to provide tag # and issue date.Permanent Resident Alien Card. Will need to provide ID# and issue date.

Do I have to file for Florida homestead exemption every year

All homestead exemption applications must be submitted by March 1. Do I need to reapply for a homestead exemption every year No. We will renew your homestead exemption annually as long as you continue to qualify for the exemption.

Cached

How long do you have to file for homestead in Florida

Florida Homestead Tax Exemptions for each year must be filed by March 1 unless that day falls on a Sunday.

Cached

How soon can I apply for homestead exemption in Florida

When should you claim the homestead tax exemption You should file your regular residential homestead exemption application between January 1 and March 1. If you miss the March 1st cutoff, you may pre-file for the following year from March 2 through December 31.

What is the cutoff for homestead exemption in Florida

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. The first $25,000 applies to all property taxes.

How long does it take for homestead exemption to take effect in Florida

This takes effect on January 1 after you purchase the property. will not take effect until the following year. For example, you bought your home in September last year. The previous owner owned the home for 12 years and had the homestead exemption.

At what age do seniors stop paying property taxes in Florida

65 years old

Senior Exemption Information

The property must qualify for a homestead exemption. At least one homeowner must be 65 years old as of January 1.

What is the cutoff date for homestead exemption in Florida

March 1, 2023, is the deadline for Florida homestead exemption applications for qualifying residences owned and occupied on the January 1 tax day. Florida property appraisers generally enable applications to be made online.

What are the requirements to claim homestead in Florida

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. The first $25,000 applies to all property taxes.

How to get $50,000 homestead exemption in Florida

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. The first $25,000 applies to all property taxes.

How much does the homestead exemption save you in Florida

You could claim up to a $50,000 homestead exemption on your primary residence. The first $25,000 of the exemption applies to all taxing authorities. You can get an additional $25,000 exemption that excludes school taxes if your assessed value is more than $50,000.

Are property taxes frozen at age 65 in Florida

Certain property tax benefits are available to persons 65 or older in Florida. Eligibility for property tax exemptions depends on certain requirements. Information is available from the property appraiser's office in the county where the applicant owns a homestead or other property.

Is there an income limit for Florida homestead exemption

It is made available by the Florida Department of Revenue annually and subject to change each year. The adjusted income limitation for the 2023 exemptions is $35,167. (prior year income) Proof of age and proof of all income to the household is required.

How do I get a 50000 homestead exemption in Florida

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. The first $25,000 applies to all property taxes.

How do I get a full homestead exemption in Florida

Homestead Property Tax Exemption

The application for homestead exemption (Form DR- 501) and other exemption forms are on the Department's forms page and on most property appraisers' websites. Submit your homestead application to your county property apprsaiser.

How does the 5000$ property tax exemption work in Florida

A $5,000 exemption is available on property owned by an honorably discharged veteran with a service connected disability of 10% or greater. This is in addition to the $50,000 homestead exemption. The applicant is required to be a permanent and legal resident of Florida.

Is there a senior discount on property taxes in Florida

There is an additional $50,000 homestead exemption (FLORIDA STATUTE 196.075) for person 65 and older. The adjusted gross income requirement for 2023 cannot exceed $35,167 for all members of the household. An application DR 501SC must be submitted along proof of income.

What is the tax rate for seniors in Florida

The good news is that because there is no state income tax in Florida, retirement income is tax exempt. Here is other great information on Florida taxes for retirees: Florida has no state income tax. No state taxes on pension income & income from an IRA or 401K.

What is the property tax discount for seniors in Florida

There is an additional $50,000 homestead exemption (FLORIDA STATUTE 196.075) for person 65 and older. The adjusted gross income requirement for 2023 cannot exceed $35,167 for all members of the household. An application DR 501SC must be submitted along proof of income.