What is the deadline for non filers to get stimulus check?

How do I get my stimulus check if I’m a non filer

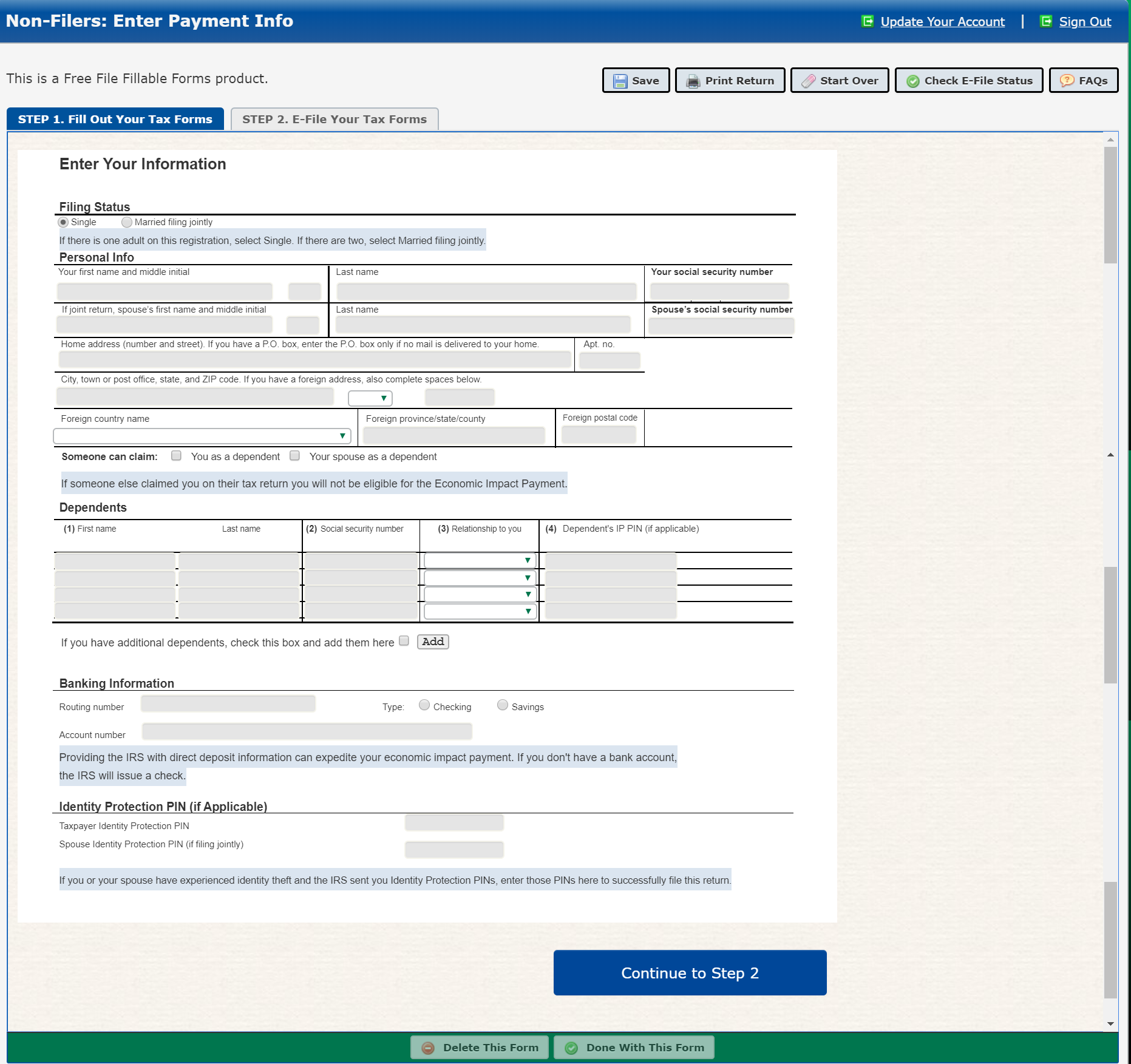

If you cannot use these options, you'll get your payment as a paper check.Step 1: Visit the IRS website to access the Non-filer form.Step 2: Create an account.Step 3: Fill out filing status, claim dependents, and provide banking information.Step 4: Fill out income and personal identification information.

Cached

Can I still file for my stimulus check in 2023

Internal Revenue Service declared in Nov 2023 that many people are eligible to receive the benefit of Stimulus Check 2023. According to information released by the Federal Revenue Service late in 2023 on its official portal irs.gov, it is possible to get benefits in 2023.

How can I get my tax refund if I have no income

Credits may earn you a tax refund

If you qualify for tax credits, such as the Earned Income Tax Credit or Additional Child Tax Credit, you can receive a refund even if your tax is $0. To claim the credits, you have to file your 1040 and other tax forms.

Is it too late to claim stimulus money

It's not too late to claim any stimulus checks you might have missed! You will need to file a 2023 tax return to get the first and second stimulus checks and a 2023 tax return to get the third one.

Can I still get stimulus if I didn’t file taxes

First and Second Stimulus Check

You will need to file a tax return for Tax Year 2023 (which you file in 2023). The deadline to file your taxes was last October 15, 2023. If you missed the October 2023 filing deadline, you can still file your tax return to get your first and second stimulus checks.

Can you still file for stimulus money

If you missed the October 2023 filing deadline, you can still file your tax return to get your first and second stimulus checks. If you don't owe taxes, there is no penalty for filing late. To learn more about your options, read the IRS page Filing Past Due Tax Returns.

Do you file taxes if you have no income but have a child

If you have no income but have a child/dependent, you can still file your taxes. This may allow you to get a refund if the tax credits you're eligible for are more than your income.

Can I get a tax refund if my only income is Social Security

You would not be required to file a tax return. But you might want to file a return, because even though you are not required to pay taxes on your Social Security, you may be able to get a refund of any money withheld from your paycheck for taxes.

Is there a time limit to claim stimulus check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2023. After this date, you can still claim the third stimulus check in 2023 by filing your taxes for Tax Year 2023. If you're not required to file taxes, the deadline to use GetCTC.org is November 15, 2023.

What if you still haven t received last stimulus

If you still haven't received your payment, or got less than you were eligible for, you can claim the money on your 2023 tax return by using the Recovery Rebate Credit.

Can I still file for my stimulus check

If you haven't yet filed your tax return, you still have time to file to get your missed 2023 stimulus payments. Visit ChildTaxCredit.gov for details.

Will SSI get a 4th stimulus check

SSI and veterans will get this payment in the same way they got their first stimulus check.

Can I claim my kids on taxes if I didn’t work

You do not need income to be eligible for the Child Tax Credit if your main home is in the United States for more than half the year. If you do not have income, and do not meet the main home requirement, you will not be able to benefit from the Child Tax Credit because the credit will not be refundable.

Can you get earned income if you don’t have dependents

If you don't have a qualifying child, you may be able to claim the EITC if you: Earn income below a certain threshold. Live in the United States for more than half the tax year. Meet the age requirements.

Will SSI recipients receive a fourth stimulus check

SSI and veterans will get this payment in the same way they got their first stimulus check.

What changes are coming for Social Security in 2023

Social Security recipients will get an 8.7% raise for 2023, compared with the 5.9% increase that beneficiaries received in 2023. Maximum earnings subject to the Social Security tax also went up, from $147,000 to $160,200.

What if you’re still waiting for your stimulus check

How can you request an IRS trace for missing stimulus money To request a payment trace, call the IRS at 800-919-9835 or mail or fax a completed Form 3911, Taxpayer Statement Regarding Refund (PDF).

How do I claim an expired stimulus check

What you need to do. Call us at 800-829-0115 to request a replacement check.

Can I still get my stimulus money

If you missed the October 2023 filing deadline, you can still file your tax return to get your first and second stimulus checks. If you don't owe taxes, there is no penalty for filing late. To learn more about your options, read the IRS page Filing Past Due Tax Returns.

Are people on SSI getting a stimulus check in 2023

Although the federal government has not authorized stimulus payments, if you receive an SSI check 2023, you may be entitled to money from the state where you live.