What is the dependent care limit for 2023?

What is the limited purpose FSA limit for 2023

How much can I contribute You can contribute a minimum annual amount of $120, up to a maximum annual amount of $2,850 for 2023. To figure out how much you want to contribute, estimate your dental and vision expenses for the plan year (January 1 through December 31) and enroll in a Limited Purpose FSA for that amount.

What is FSA dependent Care 2023

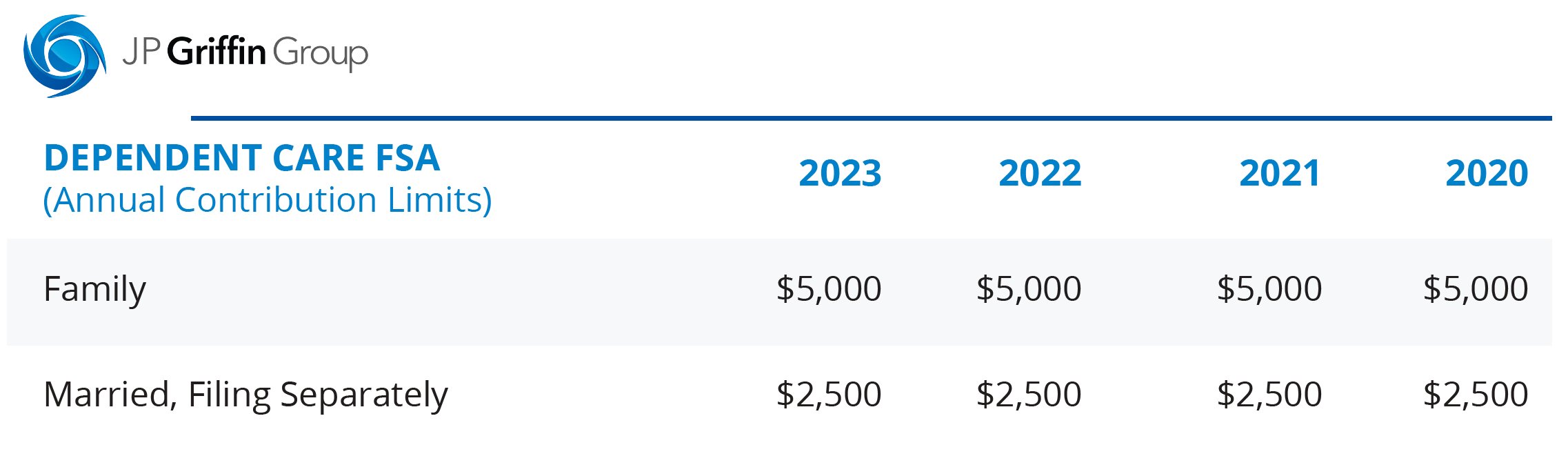

Dependent Care Flexible Spending Account

This account is used to reimburse you for dependent care expenses, such as child day care, elder care, etc. The contribution maximums for 2023 are: $5,000 per year per household. $2,500 for married individuals filing a separate tax return.

Cached

Can you carry over dependent care FSA to 2023

The Internal Revenue Service has upped the contribution limit on flexible spending accounts to $3,050, allowing 20% of that amount, or $610, to carry over from 2023 into 2024.

What is the section 125 limit for 2023

A Section 125 plan Health Flexible Spending Account (FSA) allows employees to use up to $2,850 (2023 plan year) and $3,050 (2023 plan year) in pre-tax dollars to pay for eligible out-of-pocket medical, dental and vision care expenses not covered by other insurance.

What is the FSA carryover limit for 2023 to 2024

$610

If a cafeteria plan permits health FSA carryovers, the maximum amount that a participant can carry over from the 2023 to the 2024 plan year is $610 – a $40 increase.

What are the FSA eligibility requirements for 2023

For taxable years beginning in 2023, to qualify as a qualified small employer health reimbursement arrangement (QSEHRA), the arrangement must provide that the total amount of payments and reimbursements by employers for any year cannot exceed $5,850 for individual coverage or $11,800 for family coverage, Revenue …

What is the dependent care FSA limit for 2024

The adjustment to $610 (20% of the $3,050 limit) for amounts carried into 2024 represents a $40 increase to the $570 carryover limit in effect for amounts carried into 2023.

What is the FSA limit for 2024

Key Takeaways – 2024 HSA Contribution Limits

2024 HSA contribution limits will increase to $4,150 and $8,300 for self-only and family coverage. 2024 HDHP minimum deductible and maximum out-of-pocket limits also are increasing.

What are the commuter benefits limits for 2023

$300

Qualified parking exclusion and commuter transportation benefit. For 2023, the monthly exclusion for qualified parking is $300 and the monthly exclusion for commuter highway vehicle transportation and transit passes is $300.

What is the IRS cafeteria plan for 2023

For 2023, the dollar limit on employee salary reduction contributions to health FSAs will be $3,050 (up from $2,850). If the cafeteria plan permits health FSA carryovers, the maximum amount that can be carried over to the 2024 plan year is $610 (up from $570).

Will FSA limits increase in 2024

Key Takeaways – 2024 HSA Contribution Limits

2024 HSA contribution limits will increase to $4,150 and $8,300 for self-only and family coverage. 2024 HDHP minimum deductible and maximum out-of-pocket limits also are increasing.

What are the NYC commuter benefits for 2023

Commuter Benefits Pre-tax Limit Increased to $300 Per Month

For 2023, the maximum pre-tax commuter benefits payroll deduction amounts have been increased to $300/month for transit and $300/month for parking.

What is the maximum contribution for commuter benefit

IRS contribution limits

$300 per employee per month for transportation expenses. $300 per employee per month for parking expenses.

What is the Fed tax exemption for 2023

For 2023, assuming no changes, Ellen's standard deduction would be $15,700: the usual 2023 standard deduction of $13,850 available to single filers, plus one additional standard deduction of $1,850 for those over 65.

What is the commuter transit limit for 2023

$300

The limit on monthly contributions toward qualified transportation and parking benefits for 2023 is $300.

What is the maximum elective contribution limit

The basic limit on elective deferrals is $22,500 in 2023, $20,500 in 2023, $19,500 in 2023 and 2023, and $19,000 in 2023, or 100% of the employee's compensation, whichever is less.

What are the tax changes for 2023

Standard deduction increase: The standard deduction for 2023 (which'll be useful when you file in 2024) increases to $13,850 for single filers and $27,700 for married couples filing jointly. Tax brackets increase: The income tax brackets will also increase in 2023.

What are the new federal tax rates for 2023

For the 2023 tax year, there are seven tax rates: 10%, 12%, 22%, 24%, 32%, 35% and 37%, the same as in tax year 2023. Tax returns for 2023 are due in April 2024, or October 2024 with an extension.

What is the maximum transit limit

Recently, the Internal Revenue Service (IRS) announced updated annual transit contribution limits for commuter plans. For 2023, the maximum monthly contribution for Parking will be $300, and the maximum monthly contribution for qualified mass transit such as bus, subway, or train fares will be $300.

What is the max pre-tax transit

Contribution limits

For tax years beginning after January 1, 2023, the IRS allows up to $300 a month to be deducted pre-tax for commuter costs, and up to $300 a month pre-tax for parking costs.