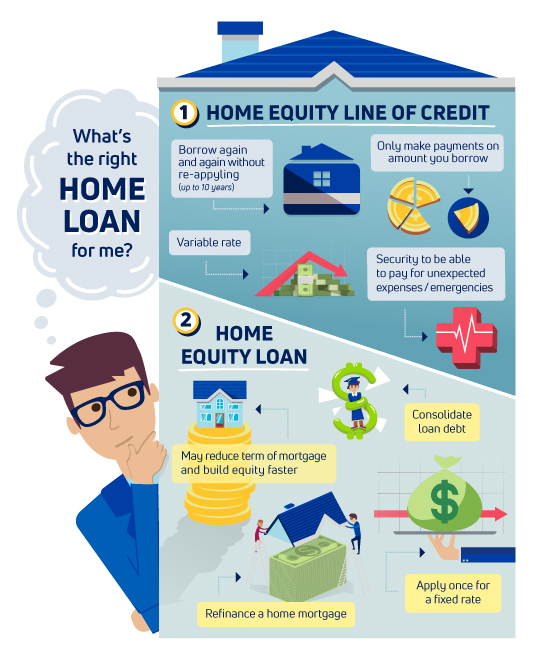

What is the difference between a home equity line and a home equity loan?

Which is better home equity line or loan

Typically, HELOCs will have lower interest rates and greater payment flexibility, but if you need all the money at once, a home equity loan is better. If you are trying to decide, think about the purpose of the financing.

Cached

What is the major disadvantage of a home equity loan

The possibility of losing your house: “If you fail to pay your home equity loan, your financial institution could foreclose on your home,” says Sterling. The potential to owe more than it's worth: A home equity loan takes into account your property value today.

What is the monthly payment on a $50000 HELOC

Loan payment example: on a $50,000 loan for 120 months at 7.50% interest rate, monthly payments would be $593.51. Payment example does not include amounts for taxes and insurance premiums.

Is it wise to get a home equity line of credit

A HELOC can be a worthwhile investment when you use it to improve your home's value. But it can become a bad debt when you use it to pay for things that you can't afford with your current income and savings. You may make an exception if you have a true financial emergency that can't be covered any other way.

Can I take equity out of my house without refinancing

Sale-Leaseback Agreement. One of the best ways to get equity out of your home without refinancing is through what is known as a sale-leaseback agreement. In a sale-leaseback transaction, homeowners sell their home to another party in exchange for 100% of the equity they have accrued.

What is the best option to use home equity

The most popular ways to access your home equity without selling the home are: Cash-out refinance, a HELOC or a home equity loan. All three work in different ways and have a different time period for when you receive the funding.

What is not a good use of a home equity loan

A home equity loan risks your home and erodes your net worth. Don't take out a home equity loan to consolidate debt without addressing the behavior that created the debt. Don't use home equity to fund a lifestyle your income doesn't support. Don't take out a home equity loan to pay for college or buy a car.

Can you pull equity out of your home without refinancing

Home equity loans and HELOCs are two of the most common ways homeowners tap into their equity without refinancing. Both allow you to borrow against your home equity, just in slightly different ways. With a home equity loan, you get a lump-sum payment and then repay the loan monthly over time.

What is the current interest rate on a home equity loan

What are current home equity interest rates

| LOAN TYPE | AVERAGE RATE | AVERAGE RATE RANGE |

|---|---|---|

| Home equity loan | 8.32% | 7.48% – 9.81% |

| 10-year fixed home equity loan | 8.37% | 7.01% – 9.62% |

| 15-year fixed home equity loan | 8.30% | 7.25% – 10.43% |

| HELOC | 8.48% | 7.59% – 9.78% |

What is a good amount for a HELOC

Lender guidelines vary, but the average HELOC limit offered by most lenders is 80%-85%. That means your HELOC amount and your current mortgage balance, when combined, can't exceed 80%-85% of the home's appraised value.

What is the average credit score needed for a home equity line of credit

A credit score of 680 or higher will most likely qualify you for a loan as long as you also meet equity requirements, but a credit score of at least 700 is preferred by most lenders. In some cases, homeowners with credit scores of 620 to 679 may also be approved.

Are home equity lines hard to get

For you to qualify for a home equity line of credit, lenders will usually want you to have a credit score over 620, a debt-to-income ratio below 40% and equity of at least 15%. Most HELOC lenders will let you borrow up to 85% of the value of your home (minus what you owe), though some have higher or lower limits.

What is the cheapest way to get equity out of your house

HELOCs are generally the cheapest type of loan because you pay interest only on what you actually borrow. There are also no closing costs. You just have to be sure that you can repay the entire balance by the time that the repayment period expires.

What is the best way to get equity out of your home

Homeowners can access their equity in multiple ways, from traditional refinancing to a cash-out refinance and, for older Americans, a reverse mortgage. They can also directly access their equity via a home equity line of credit (HELOC) or home equity loan.

What is the best option to take equity out of your home

A cash-out refinance can be a good idea if your home has gone up in value. It is often the best option if you need cash right away and you also qualify to get a better interest rate than on your first mortgage.

What is the best way to get equity out of your house

Homeowners can access their equity in multiple ways, from traditional refinancing to a cash-out refinance and, for older Americans, a reverse mortgage. They can also directly access their equity via a home equity line of credit (HELOC) or home equity loan.

How hard is it to get a HELOC

While qualifying for a HELOC depends more on your home equity than your credit score, good or excellent credit can simplify the process and make it a lot easier to qualify for a HELOC. A good average to shoot for is 645 or higher. Plus, the better your credit score, the better your interest rate.

How hard is it to get an equity loan

Qualification requirements for home equity loans will vary by lender, but here's an idea of what you'll likely need to get approved: Home equity of at least 15% to 20%. A credit score of 620 or higher. Debt-to-income ratio of 43% or lower.

Why are banks no longer offering home equity loans

During the early stages of the 2023 financial crisis, several big banks stopped offering HELOCs, citing unpredictable market conditions as the reason.

Can I pull equity out of my house without refinancing

Sale-Leaseback Agreement. One of the best ways to get equity out of your home without refinancing is through what is known as a sale-leaseback agreement. In a sale-leaseback transaction, homeowners sell their home to another party in exchange for 100% of the equity they have accrued.