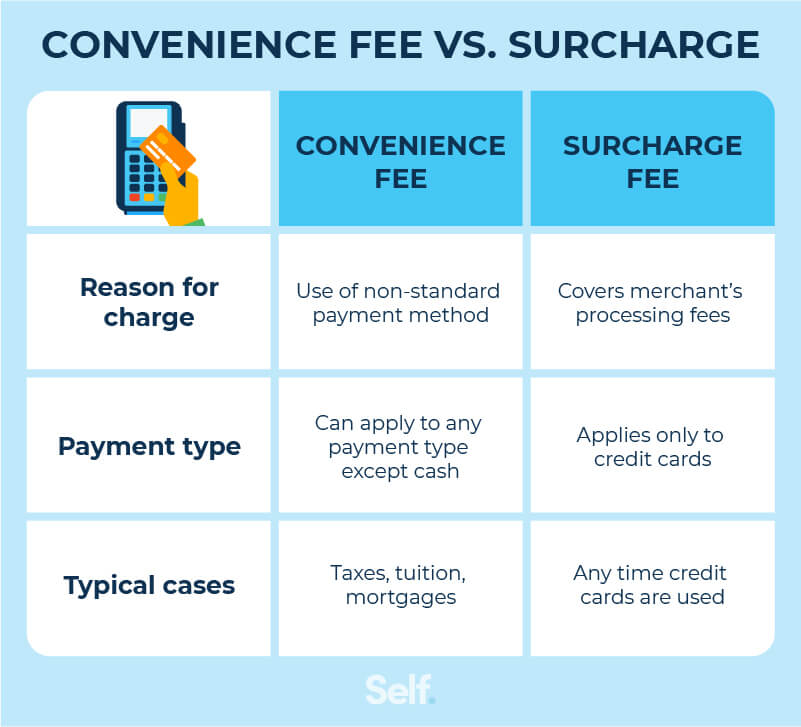

What is the difference between a surcharge and a convenience fee?

Can I charge my customers a convenience fee

Convenience fees are legal in all 50 states but must be clearly communicated at the point of sale. Additionally, a convenience fee can only be imposed if there's another preferred form of payment as an option.

Cached

What is considered a convenience fee

A pay-to-pay fee – also known as a convenience fee – is a fee charged by a company when you make a payment through a particular channel. For example, companies sometimes allow you to make a payment in person or by mail for free but charge you a fee for the convenience of taking your payment over the phone or online.

Cached

What is the difference between a surcharge and a transaction fee

Transaction fees are what a bank charges to an ATM user who is not one of its customers. That's distinct from a surcharge, which is what the owner of the ATM charges for supplying the unit that dispenses the cash.

Is it legal to charge a surcharge for using a debit card

U.S. merchants cannot surcharge debit card or prepaid card purchases.

CachedSimilar

What states is it illegal to charge a convenience fee

To date, only two states and one jurisdiction still outlaw the use of credit card surcharges. They are a result of non-qualified transactions of different communications methods.: Connecticut, Massachusetts, and Puerto Rico.

How much should I charge for a convenience fee

A convenience fee is typically a percentage of the transaction amount (usually 1% to 4%), or a small flat fee, and must be disclosed to the customer.

Why do companies charge convenience fee

Convenience fees are charged by businesses to cover the cost they pay to payment processing companies for when a customer pays by credit card. A convenience fee is different from a surcharge, which is a charge simply for just using a credit card.

What is the purpose of a surcharge

A surcharge is an extra fee beyond the original price of a good or service. Consumers pay surcharges to offset the higher cost of a certain product or fee.

Why is it called surcharge

This is charged in a form of tax, fee or extra charge which is known as surcharge. So basically, a surcharge as its name suggests is an extra charge or tax which is charged for certain goods and services.

Why can’t you surcharge a debit card

There are two sets of rules and regulations that prohibit surcharging when the customer pays by debit card (or a prepaid card). First of all, credit card brands such as Visa and MasterCard do not allow it, so debit card surcharges will violate the contract the merchant has with those companies.

What states don’t allow credit card surcharges

Which states allow credit card surcharges Surcharging is allowed in 48 states in the United States. As of early 2023, only Connecticut, Massachusetts, and Puerto Rico continue to prohibit surcharging. Note that surcharging laws have been overturned by court decisions in several other states but are still on the books.

Can merchants charge a surcharge for credit cards

If you're wondering if it is legal to charge credit card fees, the short answer is yes. The practice of surcharging was outlawed for several decades until 2013 when a class action lawsuit permitted merchants in several U.S. states to implement surcharges in their businesses.

Is there a way to avoid convenience fee

There are only two viable options for dealing with convenience fees: pay them or use an alternative payment method, like ACH or a bank-to-bank network. ACH (Automated Clearing House) is a computer-based network for efficient domestic transaction processing. It can be used for debit and credit payments.

Why do companies charge a convenience fee

Convenience fees are used to cover the merchant's payment processing costs. As payment processing costs businesses money, some business owners choose to pass those costs onto the customer via convenience fees.

Why do stores charge a surcharge

Each time a merchant accepts and processes a credit card transaction, they pay a processing fee to the appropriate financial institution. A credit card surcharge (or cc surcharge) is a fee enforced by the merchant to compensate for some of the cost of payment processing.

How do you explain surcharge fees

A surcharge is an extra fee beyond the original price of a good or service. Consumers pay surcharges to offset the higher cost of a certain product or fee. For example, a farming company may have an extra surcharge on their produce to cover the cost of the labor used to harvest the food.

What is an example of a surcharge

For example, if a tax is imposed at 30 per cent on an income of Rs 100, the total payable tax would be Rs 30. Then, a surcharge of 10 per cent calculated on Rs 30 would amount to Rs 3. So, the effective payability would be Rs 30 + Rs 3 = Rs 33.

How do you explain surcharges to customers

A surcharge is an extra fee beyond the original price of a good or service. Consumers pay surcharges to offset the higher cost of a certain product or fee. For example, a farming company may have an extra surcharge on their produce to cover the cost of the labor used to harvest the food.

How do you explain surcharge

A surcharge is an extra fee or tax added to the customer's final bill for paying through check, credit, or debit card rather than cash. The additional sum reflects the extra services offered by the merchant, increased product costs, or government regulatory costs.

Is it illegal to charge a surcharge on credit cards

In most states, companies can legally add a surcharge to your bill if you pay with a credit card. The fee might be a certain percentage on top of the purchase amount, which the companies can use to cover their credit card processing costs.