What is the difference between accrued and accrual?

What is an example of an accrual

Common examples of accruals: Unpaid invoices – where a sale has taken place but the cash is yet to change hands. Sales taxes – where tax has been collected but not yet submitted to the government. Salary and wages – where pay has been earned but payday hasn't come around yet.

What does it mean if something is accrued

to accumulate over time

What Is Accrue To accrue means to accumulate over time—most commonly used when referring to the interest, income, or expenses of an individual or business. Interest in a savings account, for example, accrues over time, such that the total amount in that account grows.

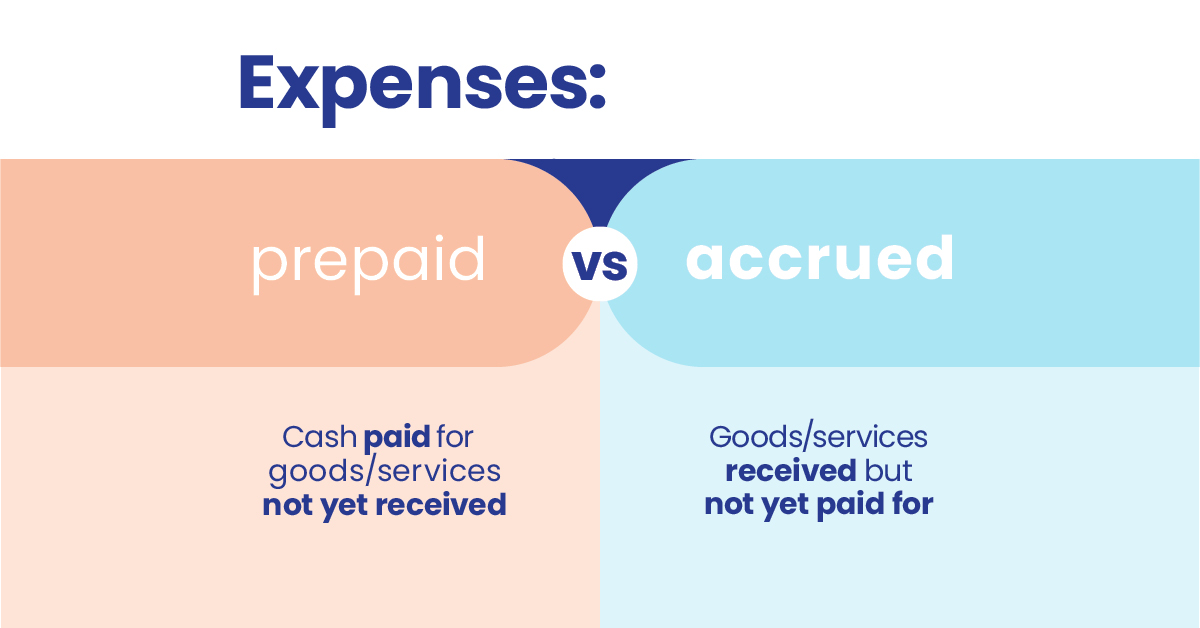

What are the two types of accruals

There are many types of accruals, but most fall under one of the two main types: revenue accruals and expense accruals.

Cached

What is the difference between accrued and incurred

"Incurred" refers to the point at which an expense or liability arises due to a specific event or transaction. In contrast, "accrued" refers to the process of accumulating financial items, such as expenses or revenues, over time, even if the cash payment or receipt has not yet occurred.

What is another word for accrual

synonyms for accrual

On this page you'll find 15 synonyms, antonyms, and words related to accrual, such as: accumulation, buildup, increase, amassing, and amassment.

How do you record accruals

Accrued expenses are recognized by debiting the appropriate expense account and crediting an accrued liability account. A second journal entry must then be prepared in the following period to reverse the entry. For example, a company wants to accrue a $10,000 utility invoice to have the expense hit in June.

What is another word for accrued in accounting

On this page you'll find 15 synonyms, antonyms, and words related to accrual, such as: accumulation, buildup, increase, amassing, and amassment.

Does accrued mean earned

Accrued income is revenue that's been earned, but has yet to be received. Both individuals and companies can receive accrued income. Although it is not yet in hand, accrued income is recorded on the books when it is earned, in accordance with the accrual accounting method.

What is the journal entry for accruals

Journal Entry For Accrued Expenses. An accrued expense journal entry is passed on recording the expenses incurred over one accounting period by the company but not paid actually in that accounting period. The expenditure account is debited here, and the accrued liabilities account is credited.

What does accrued mean in accounting

Accruals are amounts of money that have been earned or spent, but not yet paid. Businesses use accruals to keep tabs on what's owed. It may be money that's going to come in, such as payment from a customer. Or an amount that's going to go out, such as money owed to a supplier, employee, or the tax office.

What expenses are accrued

Salaries, rent, and interest are common accrued expenses that companies owe. Accounts payable, on the other hand, are owed to creditors, including suppliers for goods and services purchased on credit. Occurrence: Accrued expenses tend to be regular occurrences, such as rent and interest payments on loans.

What is the short meaning of accrual

: relating to or being a method of accounting that recognizes income when earned and expenses when incurred regardless of when cash is received or disbursed (see disburse sense 1a) compare cash entry 2.

What is the meaning of accrued in accounting

Accrual refers to an entry made in the books of accounts related to the recording of revenue or expense paid without any exchange of cash.

Where do accruals go on the balance sheet

Accrued expenses tend to be short-term, so they are recorded within the current liabilities section of the balance sheet.

What is accrued also known as

An accrued expense—also called accrued liability—is an expense recognized as incurred but not yet paid. In most cases, an accrued expense is a debit to an expense account. This increases your expenses.

Why is it called accrued expenses

The term accrued means to increase or accumulate so when a company accrues expenses, this means that its unpaid bills are increasing. Expenses are recognized under the accrual method of accounting when they are incurred—not necessarily when they are paid.

How does accrued work

Accrual accounting is an accounting method in which payments and expenses are credited and debited when earned or incurred. Accrual accounting differs from cash basis accounting, where expenses are recorded when payment is made and revenues recorded when cash is received.

Are accruals debited or credited

Is an accrued expense a debit or credit An accrued expense—also called accrued liability—is an expense recognized as incurred but not yet paid. In most cases, an accrued expense is a debit to an expense account. This increases your expenses.

How do you account for accrued expenses

Journal Entry For Accrued Expenses. An accrued expense journal entry is passed on recording the expenses incurred over one accounting period by the company but not paid actually in that accounting period. The expenditure account is debited here, and the accrued liabilities account is credited.

What does accrual mean in accounting

Accruals are amounts of money that have been earned or spent, but not yet paid. Businesses use accruals to keep tabs on what's owed. It may be money that's going to come in, such as payment from a customer. Or an amount that's going to go out, such as money owed to a supplier, employee, or the tax office.