What is the difference between ACH and routing number?

Do you need both routing and account number for ACH

It's needed for banks to identify where payments should be taken from and sent to. The routing number is used in conjunction with an account number to send or receive an ACH payment.

Cached

What happens if you use wire routing number instead of ACH

What happens if I accidentally provided a wire transfer routing number for an ACH deposit transaction Unless both the numbers are the same, the transaction will not go through and will be reversed and usually takes 4–6 days.

What is routing vs ACH routing

What's the Difference Between ABA and ACH Routing Numbers Technically speaking, ABA routing numbers apply to paper checks while ACH routing numbers apply to electronic transfers and withdrawals. Most major banks today use the same routing number for both.

Do I use my ACH number for direct deposit

Do I use my ACH number for direct deposit Yes, you need to provide your employer with your ACH number as well as your bank account number to set up direct deposit.

Do all bank accounts accept ACH payments

All banks in the United States can use ACH, as all that's needed to receive an ACH transfer is a valid bank account and routing number. Additionally, payment processors like Square, PayPal, and Stripe also use ACH.

Should I do ACH or wire transfer

ACH transfers are quicker, more convenient, cheaper, and more secure. If the funds need to be sent immediately, go with the wire transfer. If it's something that can potentially wait three days, use the ACH transfer.

What routing number do I use to transfer money

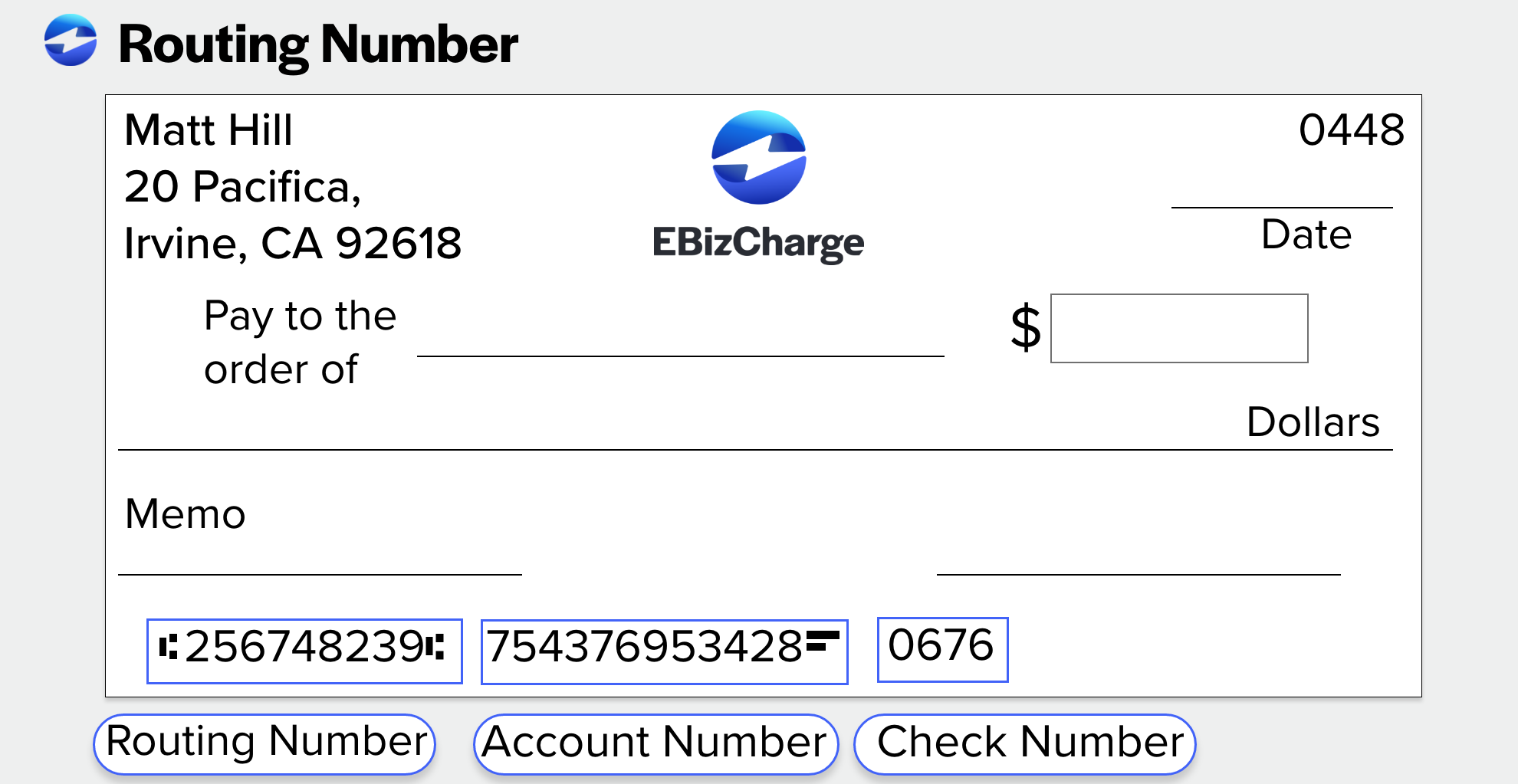

The routing number is the nine-digit, left-most number along the bottom. Your account number is the center number along the bottom of your check. You should also be able to find these numbers through your online banking account.

Which routing number do I use

You can use the third and fourth digits of your account number to determine your routing number. You can find your account number in the top of the right column of a bank statement. In the example, you would use 34 to determine your routing number using the chart below. 34 corresponds to the routing number 074000078.

Is a direct deposit the same as an ACH payment

ACH transfers are electronic, bank-to-bank money transfers processed through the Automated Clearing House Network. Direct deposits are transfers into an account, such as payroll, benefits, and tax refund deposits.

Is ACH and direct deposit the same

Is ACH Direct Deposit Direct deposits are a type of ACH payment – so yes, ACH is a direct deposit, but there are also other types of ACH payments. On the other hand, all direct deposits are ACH transfers.

What is required for an ACH payment

To receive an ACH payment, you need to provide your bank's routing number and the account number for the checking or savings account you want the money deposited into. With some companies, you may also need to sign an ACH authorization form; your client should provide that if it's required.

Is an ACH considered a direct deposit

Is ACH Direct Deposit Direct deposits are a type of ACH payment – so yes, ACH is a direct deposit, but there are also other types of ACH payments. On the other hand, all direct deposits are ACH transfers.

Can ACH and wire be the same

Both ACH and wire transfers work in a similar way, but with different timelines and rules. Wire transfers are direct, generally immediate transfers between two financial institutions. ACH transfers, meanwhile, pass through the Automated Clearing House, and can take up to a few business days.

Do all banks allow ACH transfers

All banks in the United States can use ACH, as all that's needed to receive an ACH transfer is a valid bank account and routing number. Additionally, payment processors like Square, PayPal, and Stripe also use ACH.

Why do I have two routing numbers

A bank or credit union may have more than one routing number. This is often the case with big banks like Bank of America and Chase Bank, which have two routing numbers in some states.

Should I use direct deposit routing number or wire transfer

Direct deposit is best for just about any payment between U.S. banks, credit unions, or other financial institutions. It's much cheaper, it's marginally more secure, and, in some cases, it can be just as fast as wire transfers.

What happens if you use the wrong routing number

Writing the wrong routing or account number can cause your transaction to be delayed, denied or even posted to a wrong account. If you made a mistake with your routing or account number, the bank may catch the problem and reject the transaction.

What are the two types of ACH payments

There are two types of ACH transactions: direct deposit and direct payment.

Can ACH be used for direct deposit

A “direct deposit” is a type of payment made via the ACH network. It's an informal name for common ACH deposits where individuals receive payments directly into their bank accounts. The ACH-based payouts popularly referred to as direct deposits include: Salary and wages.

Can I make an ACH payment from my checking account

There are two ways to make ACH payments. One option is to set up ACH Debit by providing your bank account details and authorization to the organization taking the payment. Alternatively, you can make an ACH Credit payment electronically from your bank account, using the banking details of the recipient of the funds.