What is the difference between ACH routing number and wire routing number?

Are wire and ACH routing numbers the same

Not necessarily. Both transactions require a 9-digit number, but you will have to verify with the financial institution where you are sending the funds, if the ABA number for ACH or wires are the same, or which routing number should be used for a wire transfer and for the ACH.

Cached

Is ACH and wire the same

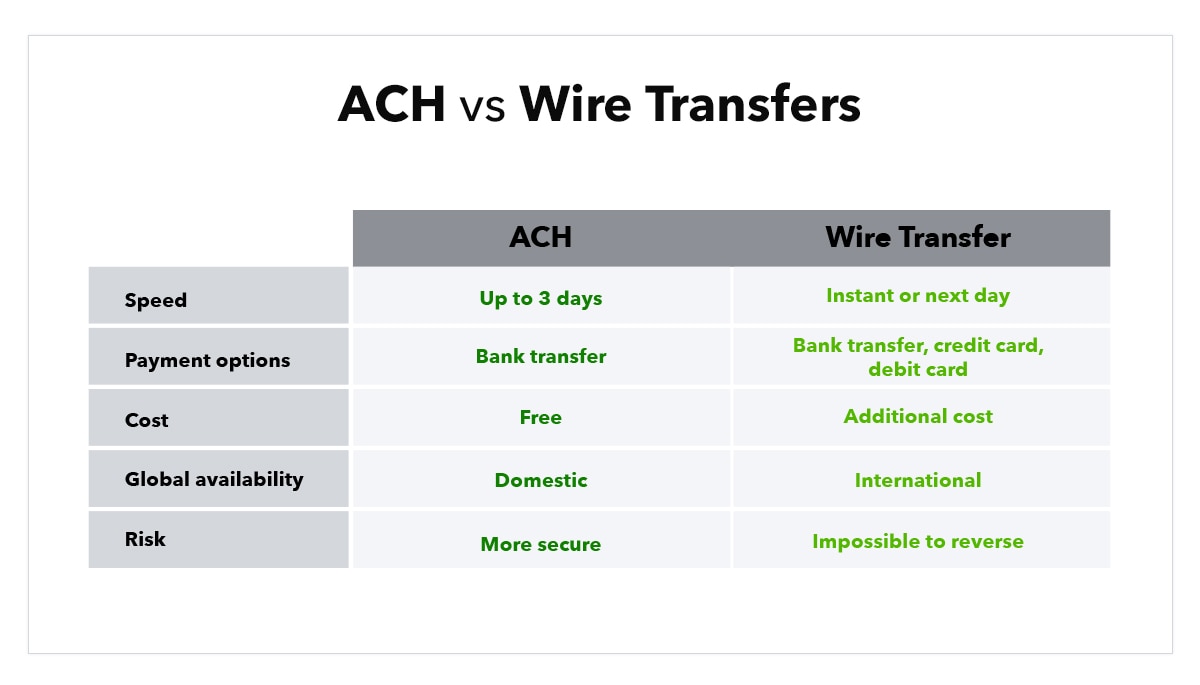

An ACH transfer goes through an interbank system for verification before it's completed. A wire transfer goes directly and electronically from one bank account to another without an intermediary system. ACH transfers typically have lower fees than wire transfers have.

Cached

What happens if you use wire routing number instead of ACH

What happens if I accidentally provided a wire transfer routing number for an ACH deposit transaction Unless both the numbers are the same, the transaction will not go through and will be reversed and usually takes 4–6 days.

Why do I have two routing numbers

A bank or credit union may have more than one routing number. This is often the case with big banks like Bank of America and Chase Bank, which have two routing numbers in some states.

Which routing number do I use for wire transfer

Instead, a wire transfer uses the recipient's bank account number and ABA routing number. This is a unique 9-digit number that identifies each banking institution. If you don't know your bank's routing number, you can find it using a quick internet search.

Why are there 3 routing numbers

Your Bank might have More than One Number

While no banks will ever have the same routing numbers, one bank might have multiple numbers. Banks often have separate routing numbers per type of transaction. Make sure you use the right routing number if you are transferring via wire, sending checks online, etc.

Can you use ACH for wire transfer

Availability: ACH transfers only work for domestic transactions. If you want to send funds abroad through the ACH network, you must do so using an international wire transfer.

Which routing number do I use

You can use the third and fourth digits of your account number to determine your routing number. You can find your account number in the top of the right column of a bank statement. In the example, you would use 34 to determine your routing number using the chart below. 34 corresponds to the routing number 074000078.

Can routing number 021000021 be used for ACH

The ACH routing number for Chase is also 021000021. The domestic and international wire transfer routing number for Chase is 21000021. If you're sending an international transfer to Chase, you'll also need a SWIFT code. Click here to see routing number for Chase in other states.

What are the 2 types of routing number

ABA routing numbers are used for paper or check transfers. ACH routing numbers are used for electronic transfers. Transactions using ACH routing numbers “clear” faster (same or next day) than funds transferred on paper checks using ABA numbers.

Do you need a different routing number for wire transfers

You will need both routing numbers and bank account numbers for domestic wire transfers within the United States. The ABA routing transit number (ABA RTN) is a nine-digit code printed on the bottom of checks which identifies the financial institution from which the funds are sent.

What are the three types of routing

There are three types of Routing:Static Routing.Default Routing.Dynamic Routing.

Do I use wire or electronic routing number

If you're looking for a fast, one-off transaction and are comfortable paying a higher fee, a wire transfer may be your choice. For recurring or regular payments and credits where you want to avoid fees, and transactions don't necessarily need to be completed same-day, ACH may be preferable.

What happens if you use the wrong routing number

Writing the wrong routing or account number can cause your transaction to be delayed, denied or even posted to a wrong account. If you made a mistake with your routing or account number, the bank may catch the problem and reject the transaction.

Is 021000021 a wire or ACH number

The routing number for Chase in New York is 021000021 for checking and savings account. The ACH routing number for Chase is also 021000021. The domestic and international wire transfer routing number for Chase is 21000021. If you're sending an international transfer to Chase, you'll also need a SWIFT code.

Is 021000021 a wire routing number

021000021 is a routing number provided by Chase for domestic and international wire transfers only.

Which routing number do I use electronic or wire

ABA routing numbers are used for paper or check transfers. ACH routing numbers are used for electronic transfers.

Can a bank have 2 different routing numbers

While no banks will ever have the same routing numbers, one bank might have multiple numbers. Banks often have separate routing numbers per type of transaction.

What are the 2 ways of routing

Static routing uses preconfigured routes to send traffic to its destination, while dynamic routing uses algorithms to determine the best path.

What are the 2 types of routing

Types of RoutingStatic Routing.Default Routing.Dynamic Routing.