What is the difference between allocated and apportioned?

What are two difference between allocation and apportionment

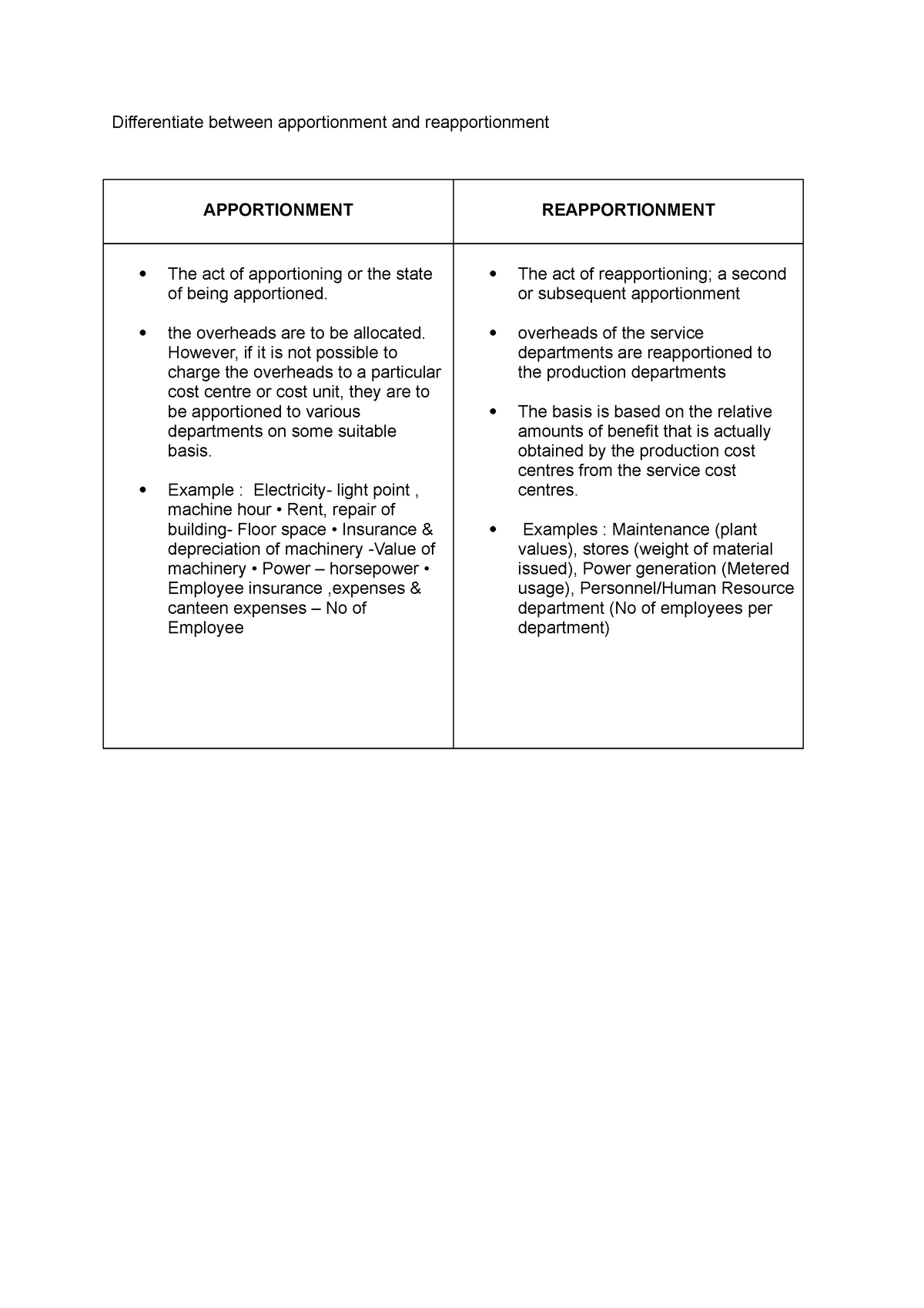

Allocation deals with whole items of costs. Apportionment deals with proportions of items of costs. No base is required for allocation of cost to a department, it is a direct process. An equitable base is required for Apportionment of cost to the production or services department.

Cached

What is the difference between allocated overheads and apportioned overheads

Key differences between Cost Allocation and Cost Apportionment. Purpose: Cost Allocation is used to determine the cost of a specific department or activity, while Cost Apportionment is used to distribute the cost of a shared resource to multiple departments or activities.

What is the difference between allocation absorption and apportionment

Allocation: It is used for determining, managing and controlling cost. Apportionment: When a product cannot be identified clearly for any category or department, it goes to the Apportionment. Absorption: Every product and every department gets its own amount of overhead with the help of Absorption.

What does apportioned mean in accounts

An apportionment is the separation of sales, expenditures, or income that are then distributed to different accounts, divisions, or subsidiaries. The term is used in particular for allocating profits to a company's specific geographic areas, which affects the taxable income reported to various governments.

Why is allocation and apportionment important

Cost allocation and cost apportionment are two methods of assigning costs to different units, products, or activities in an organization. They are essential for management control, as they help managers measure performance, plan budgets, and make decisions.

What is apportionment explanation

apportionment. / (əˈpɔːʃənmənt) / noun. the act of apportioning. US government the proportional distribution of the seats in a legislative body, esp the House of Representatives, on the basis of population.

What is allocation and apportionment of overhead

Overhead allocation is the apportionment of indirect costs to produced goods. It is required under the rules of various accounting frameworks. In many businesses, the amount of overhead to be allocated is substantially greater than the direct cost of goods, so the overhead allocation method can be of some importance.

How do you apportion and allocate overheads

In order to apportion the cost of electricity to one specific department, you simply multiply the amount of the overhead by the number of employees in that department, then divide that by your total number of employees.

What is an example of allocation and apportionment of overheads

Overheads are directly allocated to various departments on the basis of expenses for each department respectively. Examples are: overtime premium of workers engaged in a particular department, power (when separate meters are available), jobbing repairs etc.

What is apportioned in simple terms

: to divide and share out according to a plan. especially : to make a proportionate division or distribution of. Representatives are apportioned among the states. apportionable.

What are examples of apportioned

The verb apportion means "allocate" or "divvy up," and it's often used to talk about the way money is distributed. For example, your parents might evenly apportion an allowance to each of their children, or apportion slightly less money to your youngest sibling.

What is an example of apportionment

For example, three insurers that each cover $60,000 on a $120,000 property are apportioned 50% of the claim if the property is destroyed. Apportionment can also apply to real estate, workers' compensation, or the distribution of financial benefits.

What is the meaning of apportioned value of a loan

Apportioned Loan Amount means the outstanding amount of the Loan apportioned on each Property, as indicated in the Schedule D (Apportioned Loan Amount Table) of the Loan Agreement, as amended from time to time by the Agent.

What is allocation and apportionment

Cost allocation is about when we determine which particular costs relate to which particular project. Cost apportionment is when we share our organisational running costs across our projects in a way that is fair and reasonable.

What does it mean to allocate overhead costs

To allocate overhead costs, an overhead rate is applied to the direct costs tied to production by spreading or allocating the overhead costs based on specific measures. For example, overhead costs may be applied at a set rate based on the number of machine hours or labor hours required for the product.

What is an example of allocated overhead

Examples include office rent and utilities, administrative salaries, advertising, general liability insurance, and a lot more. G&A supports your ability to take on and bill jobs — but in one sense, they're relatively stable, despite fluctuation in your job progress and labor.

What are allocated and apportioned overhead costs

Allocation of cost means a process in which the entire amount of overhead is charged to a specific cost center. On the contrary, Apportionment of cost can be understood as the distribution of proportions of cost items to the cost unit, i.e. product or service or the cost center.

What does allocated overhead mean

Overhead allocation is the practice of distributing your indirect costs to revenue-producing projects . Overhead is the sum of indirect labor and expenses. It can represent 25% to 50% of all expenses incurred by your enterprise.

What does it mean to be allocated

allocated; allocating. : to divide and distribute for a special reason or to particular persons or things. allocate funds among charities. : to set apart for a particular purpose.

What is the legal definition of apportionment

The legal term apportionment (French: apportionement; Mediaeval Latin: apportionamentum, derived from Latin: portio, share), also called delimitation, is in general the distribution or allotment of proper shares, though may have different meanings in different contexts.