What is the difference between an account number and a MICR account number?

Is an MICR number the same as an account number

Your MICR number is the long number located at the bottom of your checks and is used for setting up direct deposits and automatic withdrawals from your accounts. This is not the same as your account number.

Cached

What does MICR account number mean

Magnetic ink character recognition

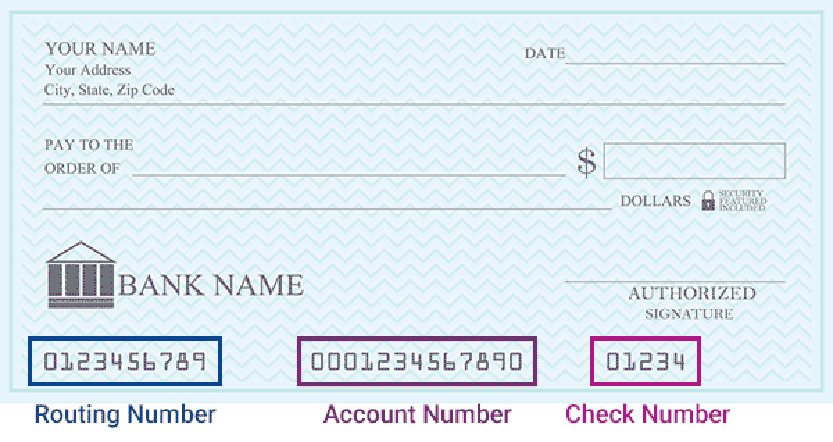

Magnetic ink character recognition is the string of characters at the bottom left of a personal check that includes the account, routing, and check numbers. MICR numbers are designed to be readable by both individuals and sorting equipment. They can't be faked or copied, due to the use of magnetic ink and unique fonts.

Cached

Can I use the MICR account number for direct deposit

The MICR includes additional digits that tell our system specifically which account to deposit to/withdraw. By using the MICR and routing number together for direct deposits and other ACH payments/withdrawals, the system can work as it should and process your transactions automatically.

Cached

Is MICR account number my routing number

The first number in the MICR line is called the routing number. This nine-digit number identifies the bank that's associated with the check. The routing number is sometimes called an ABA number – for the American Bankers Association – or routing transfer number.

Cached

Which account number to use for direct deposit

The first group is your routing number, the second is your account number and the third is your check number. Knowing how to locate these important numbers is useful for setting up automatic payments for monthly bills and filing forms for actions such as direct deposit.

What is an account number

A bank account number is a unique identifier for each account at a bank or other financial institution that you have. Along with the routing number, the bank uses this number to make payments and accept deposits.

Do I use MICR for wire transfer

The following information is needed to send a domestic outgoing wire: Name of the financial institution receiving the wire. Receiving financial institution ABA/routing number for wire transfers. Receiving party's MICR/Account Number.

What number should I use for direct deposit

If you use your bank's direct deposit form, you'll likely need your employer's address. Bank's routing number. This is the nine-digit number, also known as the American Bankers Association — or ABA — number, printed on your bank statement or along the bottom left of your checks. Your account number.

Is an account number enough for direct deposit

Most banking transactions — such as setting up a direct deposit or making a wire or ACH transfer — require your bank's routing number and your account number.

Can you deposit money using account number

You can deposit money using a card, an ATM Deposit Code or using your account details.

What does an account number look like

You'll see three sets of numbers in a computer-readable font at the bottom of the check: The first set of numbers on the left is the nine-digit bank routing number. The middle numbers are your account number. The third number is the number of the check.1.

How many digits is an account number

Bank account numbers typically consist of eight to 12 digits, but some account numbers could even contain up to 17 digits. You can find your account number on your checks or by accessing your account on your financial institution's website or by contacting the bank directly.

Is MICR same as routing

Routing Number: The routing number consists of nine digits printed on the bottom-left corner of your check. The odd font used to print the number is known as magnetic ink character recognition (MICR) and is printed in electronic ink to allow banking institutions to easily process checks.

Do I use MICR or ACH for direct deposit

What is a MICR Number used for MICR numbers are commonly used for setting up Automated Clearing House (ACH) payments or deposits. An ACH payment is an electronic payment you have setup with a company to debit your account for such things as utility bills, gym memberships, loan payments, etc.

Is direct deposit number different from account number

If you hold two accounts at the same bank, the routing numbers will, in most cases, be the same, but your account numbers will be different. Anyone can locate a bank's routing number, but your account number is unique to you, so it is important to guard it, just as you would your Social Security number or PIN code.

How many digits is a bank account number for direct deposit

9 digits

The routing number, account number, and check number are located at the bottom edge of your check. Routing numbers are always 9 digits long. Account numbers may be up to 17 digits long.

What account info do you need for direct deposit

Each employee needs to provide the following information: bank name, account type, account number and routing number. Some states also require employees to sign a consent form before their employer can switch them to direct deposit.

Can I send money with just my routing and account number

To send an ACH transfer, you will only need the routing number and account number of the recipient's account, but your bank may also request the name of the account holder and financial institution for confirmation purposes.

Can you take money with a routing and account number

The Difference Between Routing Number and Account Numbers

With both of these pieces of information, someone can potentially use them to withdraw money, pay their own bills, purchase items online from vendors, or set up a new account using your funds—all from your checking account.

How many digits is an account number example

Bank account numbers typically consist of eight to 12 digits, but some account numbers could even contain up to 17 digits. You can find your account number on your checks or by accessing your account on your financial institution's website or by contacting the bank directly.