What is the difference between credit and Visa card?

Is A Visa card the same as a credit card

Types of Visa cards include credit cards, debit cards, prepaid cards, and gift cards.

Which is better Visa card or credit card

What is the difference between VISA and Mastercard There aren't major differences between the two companies. VISA is slightly larger and has a higher transaction volume and a slightly higher level of global acceptance. However, MasterCard is accepted in more countries than VISA is.

Can Visa card be used as credit card

Yes, a Visa card can be used as a credit card because Visa is a card network that includes credit cards, along with debit cards, prepaid cards and gift cards. You can also choose to use your Visa debit card as a credit card while shopping by selecting credit on the payment terminal.

Are all credit cards Visa

There are hundreds of credit card issuers in the U.S., but there are only four major payment networks: Visa, Mastercard, Discover and American Express. (Unlike Visa and Mastercard, American Express and Discover are both card issuers and payment networks.)

Cached

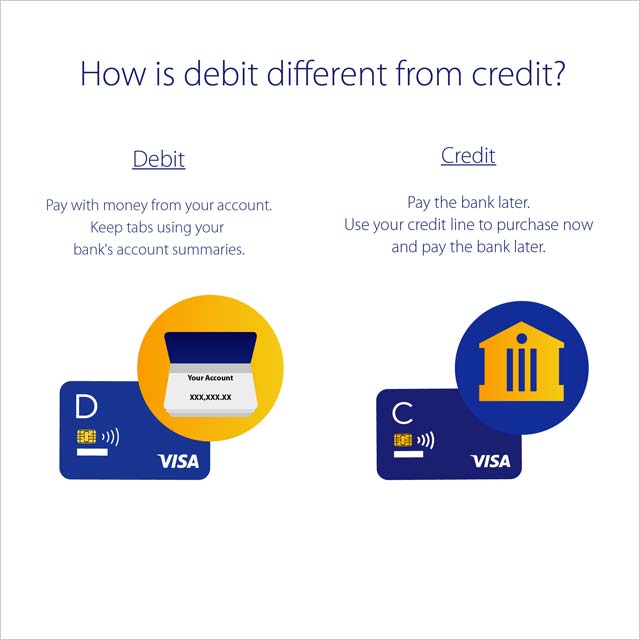

Does Visa mean debit or credit

The definition of a Visa debit card is a card that is branded as a Visa. It contains a card number and a CVV code, but it is not a credit card. Instead, it is linked to a deposit account. When purchases are made with the card, the transactions are subtracted from the funds in the deposit account.

Why are credit cards called visas

The term Visa was conceived by the company's founder, Dee Hock. He believed that the word was instantly recognizable in many languages in many countries and that it also denoted universal acceptance.

What are the disadvantages of Visa card

Here are a few disadvantages of using a Credit Card:Habit of Overspending. Although credit cards provide you with adequate credit for a long time, you must be prudent when spending the money.High Rate of Interest.Deception.Hidden Costs.Restricted Drawings.Minimum Due.

Which credit card is very best

Best Premium Credit Cards in India for 2023Axis Bank Magnus Credit Card. Joining Fee: Rs. 10,000.SBI Elite Credit Card. Joining Fee: Rs. 4,999.HDFC Infinia Credit Card Metal Edition. Joining Fee: Rs. 12,500.HDFC Diners Club Black Credit Card. Joining Fee: Rs. 10,000.Axis Bank Reserve Credit Card. Joining Fee: Rs. 50,000.

What is a Visa card used for

Currently, VISA cards are available in over 190 countries worldwide and are the most commonly used card type. You can use VISA cards to do online shopping and transact at almost everywhere that accepts VISA around the world, including cash withdrawal, bank transfer and savings deposit.

Can I use credit if I have no money

Chip Lupo, Credit Card Writer

No, you cannot get a credit card with no money because the law requires credit card issuers to verify that applicants have the ability to make monthly payments before approving them for an account.

How do you know if a credit card is a visa

A Visa credit card is any card that uses the Visa network. You can tell if your card is a Visa card by looking for the Visa logo. This logo is printed on every Visa card, usually in its bottom or top right-hand corner.

Which card type is best

VISA ATM Cards

It is one of the most popular and widely used cards; hence, is accepted globally. VISA provides several types of ATM cards like Classic, Gold, Platinum, etc.

What is the purpose of a visa

What is the purpose of a visa A visa allows a nonimmigrant to travel to a U.S. port-of-entry (airport, for example) and present themselves to a U.S. Immigration Inspector.

What does Visa card stand for

A VISA card is an international payment card introduced by Visa International Service Association, a payment network based in the US, cooperating with financial institutions to issue different branded VISA cards.

Why do people use Visa cards

Credit cards are safer to carry than cash and offer stronger fraud protections than debit. You can earn significant rewards without changing your spending habits. It's easier to track your spending. Responsible credit card use is one of the easiest and fastest ways to build credit.

What are 3 negatives of a credit card

ConsInterest charges. Perhaps the most obvious drawback of using a credit card is paying interest.Temptation to overspend. Credit cards make it easy to spend money — maybe too easy for some people.Late fees.Potential for credit damage.

Is it good or bad to have a credit card

Credit cards can help you improve your credit score, but only if you use them responsibly. Your payment history and borrowing amount are the two biggest factors in your credit score. Secured credit cards are an option for borrowers with a poor credit history.

What credit card is mostly accepted

Visa and Mastercard are by far the most widely accepted cards, with Discover slightly behind those brands and American Express in a distant fourth place. Any retailer that accepts card payments likely takes Visa and Mastercard.

What are the pros and cons of a visa card

The Pros of using a Visa Debit CardShop online with ease.Accepted Internationally.Helps with Financial Discipline.No Fees or Interest from Visa.Security for Fraudulent Purchases.Spending is limited to the funds available.Overdraft and Bank Fees.It Doesn't Help in Building Credit.

Does it hurt your credit if you don’t use it

Not using your credit card doesn't hurt your score. However, your issuer may eventually close the account due to inactivity, which could affect your score by lowering your overall available credit. For this reason, it's important to not sign up for accounts you don't really need.