What is the difference between primary and secondary credit?

What is a primary credit

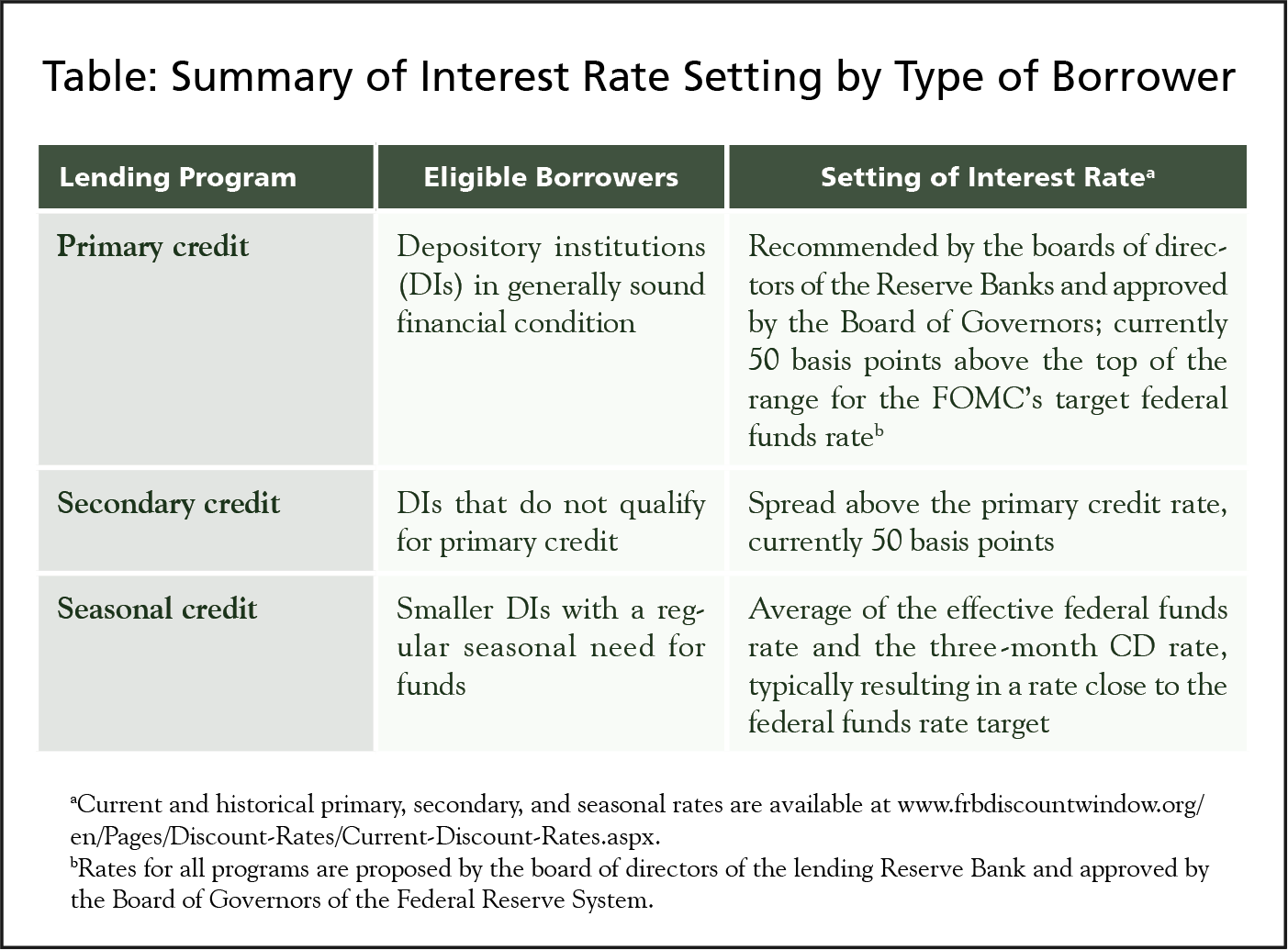

The "Primary Credit" program is the principal safety valve for ensuring adequate liquidity in the banking system. Primary credit is priced relative to the FOMC's target range for the federal funds rate and is normally granted on a “no-questions-asked,” minimally administered basis.

Cached

What are primary and secondary bank loans

The relationship between the two markets is symbiotic. Primary mortgage markets give borrowers access to the funds needed to purchase a home. The secondary mortgage market replenishes those funds by allowing lenders to sell those mortgages to Ginnie Mae, Fannie Mac, Freddie Mae, and other private investors.

What is the difference between the primary credit rate and the federal funds rate

The prime rate is the interest rate that banks charge their corporate customers that have the best credit profile. The federal funds rate is the starting point at which the prime rate is determined and the prime rate is the starting point for which other interest rates are set, such as the rates on mortgages.

Is the primary credit rate the same as the discount rate

The discount rate on secondary credit is higher than the rate on primary credit. The rate for seasonal credit is an average of selected market rates. Rates are established by each Reserve Bank's board of directors, subject to the review and determination of the Board of Governors of the Federal Reserve System.

What is secondary credit

Secondary credit is a lending program that is available to depository institutions that are not eligible for primary credit. It is extended on a very short-term basis, typically overnight, at a higher rate than the primary credit rate.

What are the three 3 types of credit

The different types of credit

There are three types of credit accounts: revolving, installment and open. One of the most common types of credit accounts, revolving credit is a line of credit that you can borrow from freely but that has a cap, known as a credit limit, on how much can be used at any given time.

What is the difference between primary and secondary account

With most financial accounts, the primary account holder has the option to give authorized users access to the account. Those are known as secondary account holders and, in the case of credit cards, also called additional cardholders.

What is the difference between primary and secondary bank account

The primary bank account is used for both depositing and withdrawing funds to and from the trading account. A secondary bank account is an additional bank account that can be added to a Zerodha account. The bank account mapped as a secondary bank account can only be used to deposit funds to the trading account.

How much higher is prime rate than fed funds rate

about 3 percent higher

Generally, the prime rate is about 3 percent higher than the federal funds rate. That means that when the Fed raises interest rates, the prime rate also goes up. The prime rate is the rate at which individual banks and credit unions lend to their customers, including large corporations.

Is a higher or lower federal funds rate better

In effect, if the federal funds rate is raised, money becomes less available, and short-term interest rates go up, which helps combat inflation. If it's decreased, money becomes more readily available, and short-term interest rates sink, which helps stimulate economic activity.

What is the secondary discount rate

The secondary discount rate is an even higher discount window rate of interest for Fed loans made to banks that are struggling with liquidity.

What is the current primary credit rate

Basic Info. Primary Credit Rate is at 5.25%, compared to 5.25% the previous market day and 1.00% last year. This is higher than the long term average of 1.98%.

What are the 2 types of credit

Revolving credit refers to credit that is automatically renewed as you pay off your debts — it is a type of open credit.Installment credit is a fixed amount of money that you borrow with an agreement to pay it off in predetermined increments until the loan is paid off.

What are the 2 classification of credit

Trade Credit, Consumer Credit, Bank Credit, Revolving Credit, Open Credit, Installment Credit, Mutual Credit, and Service Credit are the types of Credit.

What is the meaning of secondary account

Secondary Account means any current and/or savings account that the Cardholder has linked to his account.

Can a secondary account holder withdraw money

Either person can withdraw or spend the money at will — even if they weren't the one to deposit the funds. The bank makes no distinction between money deposited by one person or the other, making a joint account useful for handling shared expenses.

What is primary vs secondary direct deposit

A Primary account must be set up first. Additional Secondary accounts then can be set up. Secondary accounts are established to receive either a percentage of your net amount or a flat amount of the net payment. All deposits are made to the secondary accounts first.

What is a secondary account in banking

A Secondary Savings Account is a way for you to save for multiple goals. Easily manage your finances by organizing your funds into separate secondary savings accounts for specific purposes.

How high will prime rate go in 2023

So far in 2023, the Fed raised rates 0.25 percentage points twice. If they hike rates at the May meeting, it is likely to be another 0.25% jump, meaning interest rates will have increased by 0.75% in 2023, up to 5.25%.

What happens when the Fed raises the prime rate

Bottom line. As a result of the Fed changing the federal funds rate, the prime rate also changes and your credit card APR will fluctuate accordingly — meaning an increase in the federal funds rate and prime rate results in an increase in your card's APR.