What is the difference of Cash Card and credit card?

Which is better to use cash or credit cards

Debt Reduction

By paying for purchases with cash, you avoid interest charges on those new purchases. Additionally, if you have triggered a penalty APR on your credit card, it may be wise to pay with cash as new charges could accrue nearly 30% in interest charges.

Cached

Can you use a Cash Card as credit

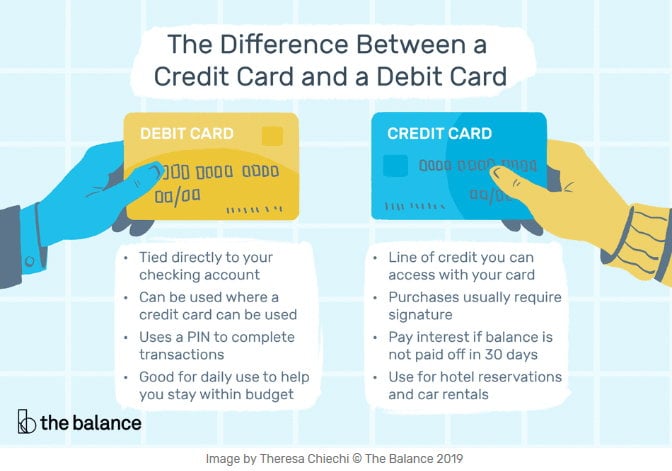

So, although you can choose “credit” when purchasing something with your debit card, you cannot use your debit card the same way you would a credit card. When you select credit, rather than the transaction going through in real time as it does with a debit card, the transaction happens offline.

Why do people use cash instead of credit cards

Cash makes it easier to budget and stick to it. When you pay with the cash you've budgeted for purchases, it's easier to track exactly how you're spending your money. It's also an eye opener and keeps you in reality as to how much cash is going out vs. coming in from week to week or month to month.

Cached

What is the difference between using cash and credit

When you pay with cash, you hand over the money, take your goods and you are done. Which is great, as long as you have the money. When you pay with credit, you borrow money from someone else to pay. Usually this money does not come for free.

Do cash cards affect credit score

If you're in a bind and need cash quickly, you might turn to a cash advance, which is a short-term personal loan against your credit card balance. Because it's so convenient, it comes with higher interest rates and other fees. Cash advances can impact credit scores like any other loan.

What are 3 disadvantages of using cash

The pros and cons of cashPros:No interest charges. There are no additional charges when you pay with cash.Makes it easier to follow a budget. Cash can help you to stick to a budget.Cons:Less Secure. Cash is less secure than a credit card.Less Convenient.Your cash savings may not cover certain expenses.Pros:

Is a Cash Card like a credit card

A cash card is a term for a payment card that stores cash, such as debit, gift, or prepaid debit cards. Credit cards are not considered cash cards. Cash cards are a convenient way for cardholders to make electronic payments. Note that Square's Cash App offers a debit card that's called a Cash Card.

Is Cash Card a credit card

The Cash Card is a Visa debit card which can be used to pay for goods and services from your Cash App balance, both online and in stores.

What is a disadvantage of using cash instead of credit

Cash is less secure than a credit card. Unlike credit cards, if you lose physical money or have it stolen, there's no way to recover your losses. Less Convenient. You can't always use cash as a payment method.

Why do I need a cash card

The Cash Card is a Visa debit card which can be used to pay for goods and services from your Cash App balance, both online and in stores. Your Cash Card can be used as soon as you order it by adding it to Apple Pay and Google Pay, or by using the card details found in the Cash Card tab.

Do most people use cash or credit

General Cash vs Card StatisticsThe average American carries $67 in cash on their person.16% of Americans carry cash with them at all times.The average cash transaction is $22, while the average credit card transaction is $112.Perks and rewards are the main reason 24.78% of US consumers use credit cards.

What are the disadvantages of cash cards

Cash is less secure than a credit card. Unlike credit cards, if you lose physical money or have it stolen, there's no way to recover your losses. Less Convenient. You can't always use cash as a payment method.

Which is safer cash or credit card

Credit cards are often more convenient and secure than carrying cash. As long as you can pay your bill in full each month, using a credit card is typically more advantageous than using cash for in-person purchases.

What are disadvantages of credit card

Credit cards have a few disadvantages, such as high interest charges, overspending by the cardholders, risk of frauds, etc. Additionally, there may also be a few additional expenses such as annual fees, fees of foreign transactions, expenses on cash withdrawal, etc. associated with a credit card.

What is a Cash Card good for

The Cash Card is a Visa debit card which can be used to pay for goods and services from your Cash App balance, both online and in stores. Your Cash Card can be used as soon as you order it by adding it to Apple Pay and Google Pay, or by using the card details found in the Cash Card tab.

What are the benefits of a Cash Card

Signing up for a Cash Card turns your Cash App account into a full-on bank account. You can receive direct deposits, get paid up to two days early, pay with your Cash App balance anywhere Visa is accepted and get unlimited free ATM withdrawals when you have at least $300 deposited each month.

Will a Cash Card affect my credit

If you're in a bind and need cash quickly, you might turn to a cash advance, which is a short-term personal loan against your credit card balance. Because it's so convenient, it comes with higher interest rates and other fees. Cash advances can impact credit scores like any other loan.

Is cash or credit safer

Credit cards are often more convenient and secure than carrying cash. As long as you can pay your bill in full each month, using a credit card is typically more advantageous than using cash for in-person purchases. You need to use a credit card for online transactions as you can't pay in cash.

What are the disadvantages of a cash card

Cons: Less Secure. Cash is less secure than a credit card. Unlike credit cards, if you lose physical money or have it stolen, there's no way to recover your losses.

What are the disadvantages of a Cash Card

Cash is less secure than a credit card. Unlike credit cards, if you lose physical money or have it stolen, there's no way to recover your losses. Less Convenient. You can't always use cash as a payment method.