What is the downside of ETF?

Are there disadvantages to ETFs

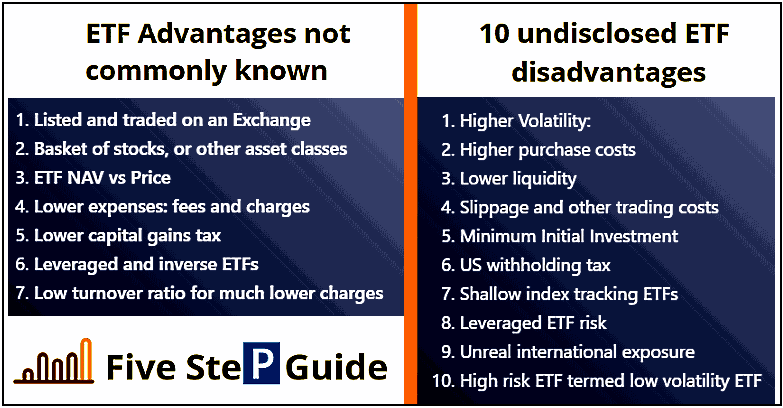

“ETFs are effectively a way to invest and have market exposure,” says John DeYonker, Titan head of investor relations. “And they are incredibly cheap.” However, there are disadvantages of ETFs. They come with fees, can stray from the value of their underlying asset, and (like any investment) come with risks.

Cached

What are the pros and cons of ETFs

In addition, ETFs tend to have much lower expense ratios compared to actively managed funds, can be more tax-efficient, and offer the option to immediately reinvest dividends. Still, unique risks can arise from holding ETFs, as well as tax considerations depending on the type of ETF.

Is ETF safer than stocks

Since ETFs are more diversified, they tend to have a lower risk level than stocks. Similar to stocks, ETFs can be bought and traded at any time and they are also taxed at short-term or long-term capital gains rates.

Cached

How long should you hold an ETF for

Holding period:

If you hold ETF shares for one year or less, then gain is short-term capital gain. If you hold ETF shares for more than one year, then gain is long-term capital gain.

Why is ETF not a good investment

ETFs are subject to market fluctuation and the risks of their underlying investments. ETFs are subject to management fees and other expenses. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund.

Is it smart to just invest in ETFs

If you're looking for an easy solution to investing, ETFs can be an excellent choice. ETFs typically offer a diversified allocation to whatever you're investing in (stocks, bonds or both). You want to beat most investors, even the pros, with little effort.

Are ETFs good for beginners

Are ETFs good for beginners ETFs are great for stock market beginners and experts alike. They're relatively inexpensive, available through robo-advisors as well as traditional brokerages, and tend to be less risky than investing individual stocks.

Is it OK to just invest in ETFs

If you're looking for an easy solution to investing, ETFs can be an excellent choice. ETFs typically offer a diversified allocation to whatever you're investing in (stocks, bonds or both). You want to beat most investors, even the pros, with little effort.

Do you pay taxes on ETFs every year

Just as with individual securities, when you sell shares of a mutual fund or ETF (exchange-traded fund) for a profit, you'll owe taxes on that "realized gain." But you may also owe taxes if the fund realizes a gain by selling a security for more than the original purchase price—even if you haven't sold any shares.

How often should I put money into an ETF

The best time to buy ETFs is at regular intervals throughout your lifetime. ETFs are like savings accounts from back when savings accounts actually paid you interest. Think back to a time when you (or your parents!) used to invest in your future by putting money into a savings account.

What happens if ETF goes bust

You're forced to sell or take liquidation proceeds, which can create a tax burden or lock in investment losses. You may incur a capital gains tax on profits if the ETF's in a taxable account, that is, a non-retirement account. If you owned the fund less than a year, the profit will be taxed at your normal tax rate.

Should beginners invest in ETFs

Are ETFs good for beginners ETFs are great for stock market beginners and experts alike. They're relatively inexpensive, available through robo-advisors as well as traditional brokerages, and tend to be less risky than investing individual stocks.

How much should I invest in an ETF for the first time

There is no minimum amount required to begin investing in ETFs. All you need is enough to cover the price of one share and any associated commissions or fees.

Do I need to pay taxes on ETFs

The IRS taxes dividends and interest payments from ETFs just like income from the underlying stocks or bonds, with the income being reported on your 1099 statement. Profits on ETFs sold at a gain are taxed like the underlying stocks or bonds as well.

What is the tax loophole of an ETF

Key Takeaways. ETFs allow investors to circumvent a tax rule found among mutual fund transactions related to declaring capital gains. When a mutual fund sells assets in its portfolio, fund shareholders are on the hook for those capital gains.

How do I avoid taxes on my ETF

Tax Strategies Using ETFs

One common strategy is to close out positions that have losses before their one-year anniversary. You then keep positions that have gains for more than one year. This way, your gains receive long-term capital gains treatment, lowering your tax liability.

Should long term investors avoid ETFs

ETFs are less volatile than stocks, so they do not give very high returns in a short period and similarly do not fall rigorously like stocks. ETFs are only for those who want slow and steady returns in the long term. For anybody expecting good returns overnight, an ETF is not a good option for you to invest in.

Is it better to hold mutual funds or ETFs

ETFs can be more tax-efficient than actively managed funds due to lower turnover and fewer capital gains. ETFs are bought and sold on an exchange at different prices throughout the day while mutual funds can be bought or sold only once a day at one price.

Can you lose your investment in ETF

An ETF with a low risk rating can still lose money. ETFs do not provide any guarantees of future performance. As with any investment, you might not get back the money you invested. An ETF's risk rating can change over time.

How risky is investing in ETFs

ETFs are for the most part safe from counterparty risk. Although scaremongers like to raise fears about securities-lending activity inside ETFs, it's mostly bunk: Securities-lending programs are usually over-collateralized and extremely safe. The one place where counterparty risk matters a lot is with ETNs.