What is the effect on the balance sheet when a sale is made on credit?

How do credit sales affect balance sheet

You can find a company's credit sales on the "short-term assets" section of a balance sheet. Because companies don't receive payments from credit sales for many weeks or even months, credit sales appear as accounts receivables, a component of short-term assets on the balance sheet.

Cached

What happens when a sale is made on credit

Credit sales refer to a sale in which the amount owed will be paid at a later date. In other words, credit sales are purchases made by customers who do not render payment in full, in cash, at the time of purchase.

Cached

What is credit sales on a balance sheet

Credit sales are payments that are not made until several days or weeks after a product has been delivered. Short-term credit arrangements appear on a firm's balance sheet as accounts receivable and differ from payments made immediately in cash.

Cached

What are the impacts to 3 financial statements when a sale is made on credit

On the income statement, increases are reported in sales revenues, cost of goods sold, and (possibly) expenses. On the balance sheet, an increase is reported in accounts receivable, a decrease is reported in inventory, and a change is reported in stockholders' equity for the amount of the net income earned on the sale.

Cached

Do credit sales affect equity

A credit increases the balance of a liability, equity, gain or revenue account and decreases the balance of an asset, loss or expense account. Credits are recorded on the right side of a journal entry. Increase asset, expense and loss accounts. Increase liability, equity, revenue and gain accounts.

Does credit sales increase equity

Sales are recorded as a credit because the offsetting side of the journal entry is a debit – usually to either the cash or accounts receivable account. In essence, the debit increases one of the asset accounts, while the credit increases shareholders' equity.

How do you account for sale on credit

During sales on credit, accounts receivable accounts are debited and shown in the company's balance sheet as an asset until the amount is received against such sales and the sales account is credited. It is displayed as revenue in the company's income statement.

How do you record credit sales in accounting

And credit sales in this video we are going to look at credit sales. Because this type is becoming more popular with the developing global economy a credit sale is where goods or services were sold to

How do you record sales on credit

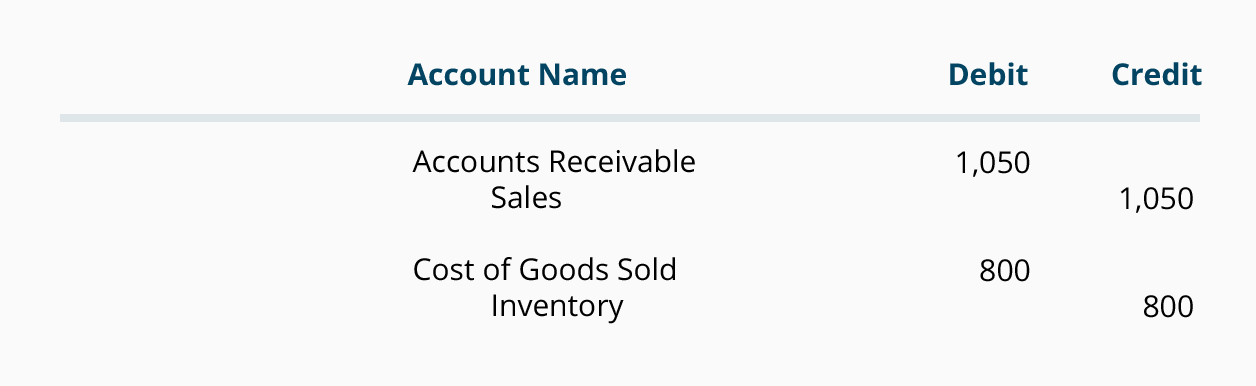

A credit sales journal entry is a type of accounting entry that is used to record the sale of merchandise on credit. The entry is made by debiting the Accounts Receivable and crediting the Sales account. The amount of the sale is typically recorded in the journal as well.

Where do credit sales appear in the balance sheet quizlet

When recording a credit sale, we debit accounts receivable. Accounts receivable are reported as assets in the balance sheet.

What account increases when a credit sale is made

Credits increase liability, equity, and revenue accounts. Credits decrease asset and expense accounts.

Which accounts will be affected when making a sale on credit

At the time of sales on credit, accounts receivable accounts will be debited, which will be shown in the balance sheet of the company as an asset unless the amount is received against such sales, and the sales account will be credited, which will be shown as revenue in the income statement of the company.

What is the accounting entry for a credit sale

A credit sales journal entry is a type of accounting entry that is used to record the sale of merchandise on credit. The entry is made by debiting the Accounts Receivable and crediting the Sales account. The amount of the sale is typically recorded in the journal as well.

What does sold on credit mean in accounting

A sale on credit is revenue earned by a company when it sells goods and allows the buyer to pay at a later date. This is also referred to as a sale on account.

What accounts are affected when goods are sold on credit

When goods are sold on credit, debtors which is an asset account is debited as money is receivable from the customers and sales which is a revenue account is credited.

How do you manage credit sales

Create a clear credit control process.Research your customers' credit management.Maintain a positive working relationship.Invoice quickly and accurately.Encourage early payment.Compile a watch list and take action.Forecast your cash flow and keep it up to date.Trust your business instinct.

Why are sales recorded on the credit side

Sales are recorded as a credit because the offsetting side of the journal entry is a debit – usually to either the cash or accounts receivable account. In essence, the debit increases one of the asset accounts, while the credit increases shareholders' equity.

How are credit sales recorded in accounting

The credit sale is recorded on the balance sheet as an increment in Accounts Receivable, with a decrease in inventory.

What is another name for credit sales on balance sheet

Accounts Receivable

Accounts Receivable – Credit Sales of a Business on the Balance Sheet.

Does a sales account increase with a credit

To record revenue from the sale from goods or services, you would credit the revenue account. A credit to revenue increases the account, while a debit would decrease the account.