What is the entry to record the setting up of a petty cash fund quizlet?

What is the entry to record the setting up of a petty cash fund

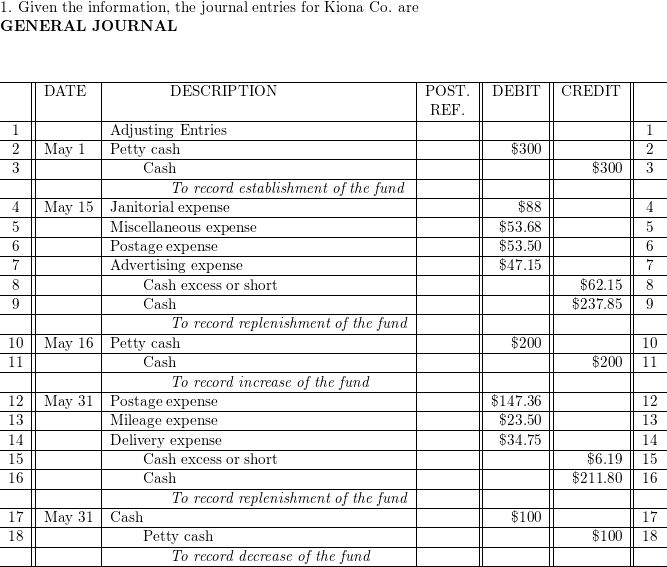

The Petty Cash System

The initial petty cash journal entry is a debit to the petty cash account and a credit to the cash account. The petty cash custodian then disburses petty cash from the fund in exchange for receipts related to whatever the expenditure may be.

What is the journal entry to establish a petty cash fund for $200

Answer and Explanation: The entry establishing a $200 petty cash fund would include d) a debit to Petty Cash for $200. This entry is balanced by a credit to Cash for $200.

What is the purpose of setting up a petty cash fund quizlet

The petty cash fund is a special fund set up to pay for minor expenses with cash instead of paying by cheque (e.g. tea and coffee, fares, stamps). It is always replenished to the imprest amount.

What would be included in the journal entry to record the reimbursement to the petty cash fund

Correct answer: Option a) a debit to Postage Expense. Explanation: Since the expense is paid out of the petty cash fund, we will debit it.

How do you set up a petty cash system

How to Set Up a Petty Cash Management SystemAppoint a Custodian. The first step in the imprest system is to appoint a petty cash custodian.Fund the Account. Also under the imprest system, a balance is predetermined for the petty cash fund.Secure the Funds.Establish Policies.Record Disbursements.

Where is petty cash fund recorded

Petty cash appears within the current assets section of the balance sheet. This is because line items in the balance sheet are sorted in their order of liquidity. Since petty cash is highly liquid, it appears near the top of the balance sheet.

What is the journal entry to establish a petty cash fund for $200 quizlet

Debit to Petty Cash for $200 and credit to Cash for $200.

What is the entry to establish a $100 petty cash fund

More videos on YouTube

| Debit | Credit | |

|---|---|---|

| Petty Cash | 100 | |

| Cash | 100 | |

| To establish a petty cash fund. |

What is the purpose of setting up a petty cash fund

The purpose of a petty cash fund is to provide business units with sufficient cash to cover minor expenditures. The intent is to simplify the reimbursement of staff members and visitors for small expenses that generally do not Exceed $25.00, such as taxi fares, postage, office supplies, etc.

What are three reasons for setting up a petty cash fund

A petty cash fund is generally kept so that employees of a business can make small purchases without having to requisition money, use a company credit or debit card, or have a check cut. These types of transactions require more time and paperwork to complete.

How do you journal petty cash reimbursement

The logical first step is to document the reimbursement, for example by writing out a receipt. The next step is to enter both an expense and an asset account on your books under "petty cash". If you are reimbursed $20 for postage expenses, debit postage expense $20 and credit cash $20.

Which of the following is the correct journal entry to establish a petty cash fund of $500

Expert Answer. Petty Cash A/c Dr. Working note: At the time of replenishment of a petty cash fund of $500, for the month, the journalize entry will be debited from the petty cash fund account from $500 and credited to the cash account from $500.

What are the 7 steps in setting up your petty cash fund

How to set up and use petty cash in your businessSet account limits. Before you start a petty cash fund, you'll need to decide how much you want the fund to be.Determine who will manage petty cash.Create a log.Reconcile and record petty cash expenses.Reassess the petty cash fund periodically.

How do I set up a petty cash fund in Quickbooks online

How to set up a petty cash accountGo to Settings ⚙ and select Chart of accounts.Select New.From the Account Type dropdown▼, select Cash at bank and in hand.From the Detail Type dropdown▼, select Cash on hand.Enter Petty Cash in the Name field.

How is petty cash recorded

A check for cash is prepared in an amount to bring the fund back up to the original level. The check is cashed and the proceeds are placed in the petty cash box. At the same time, receipts are removed from the petty cash box and formally recorded as expenses.

How a petty cash book is recorded

A simple petty cash book is just like the main cash book. Cash received by the petty cashier is recorded on the debit side, and all payments for petty expenses are recorded on the credit side in one column.

What is the journal entry to set up a petty cash fund for 500

The journal entry to set up a Petty Cash Fund for $500 to pay incoming delivery expenses would be: Debit to Petty Cash for $500 and credit Cash for $500.

What would be the journal entry to set up a petty cash fund for $500 to pay incoming delivery expenses

The journal entry to set up a Petty Cash Fund for $500 to pay incoming delivery expenses would be: Debit to Petty Cash for $500 and credit Cash for $500.

How do you set up petty cash

How do I set up a proper petty cash systemStep 1: Get a lockbox or cash register.Step 2: Choose a petty cash custodian.Step 3: Set an initial amount, a replenishment threshold, and a withdrawal limit.Step 4: Go to an ATM, or write a check to petty cash.Step 5: Create a petty cash log.

How do you record a petty cash book

A simple petty cash book is just like the main cash book. Cash received by the petty cashier is recorded on the debit side, and all payments for petty expenses are recorded on the credit side in one column.