What is the finance charge quizlet?

What is the finance charge

(a) Definition. The finance charge is the cost of consumer credit as a dollar amount. It includes any charge payable directly or indirectly by the consumer and imposed directly or indirectly by the creditor as an incident to or a condition of the extension of credit.

What is a finance charge in math

The total amount it costs to borrow money. Example. A $900 loan that costs $10 to set up and $75 in interest payments has a finance charge of $85.

Where are finance charges

A finance charge is any cost you encounter in the process of obtaining credit, using it, and repaying the debt. 1 Finance charges usually come with any form of credit, whether a credit card, business loan, or mortgage. Any amount you pay beyond the amount you borrowed is a finance charge.

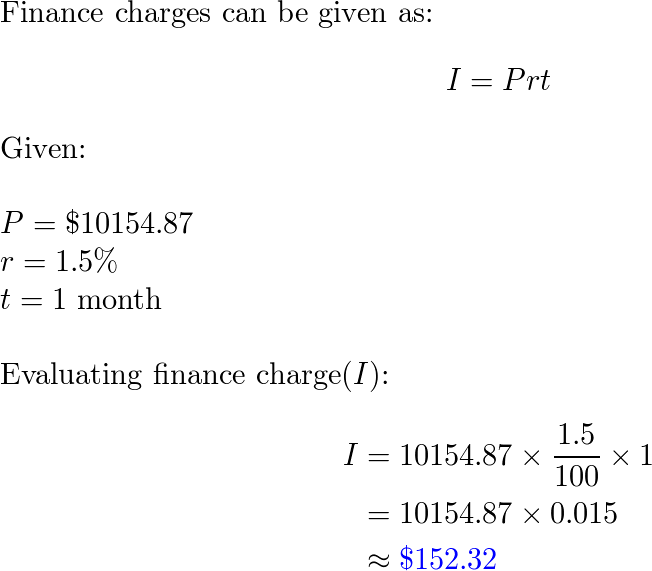

What is finance charge formula

Financial Charge Calculation

Divide your monthly payment by the months you'll be making payments. Subtract the initial principle (the money borrowed to buy the vehicle) from the total. The outcome is your financing charge or the total amount of interest you'll pay.

What is an example of finance charge

A finance charge is the cost of borrowing money and applies to various forms of credit, such as car loans, mortgages, and credit cards. Common examples of finance charges include interest rates and late fees.

Does finance charge mean interest

A finance charge – which can be a flat fee or a percentage – is the amount of money you pay to borrow funds from a lender, credit card issuer or other financial institution. A common misconception is that a finance charge means interest. Finance charges are more than interest.

How do you find the finance charge in a math problem

All right so how do we find a finance charge well the finance charge is found by taking your annual percentage. Rate and dividing by 12. The reason we divide by 12 is because we make these payments

What is a finance charge example on a loan

Mortgages: Finance charges may include the total amount of interest plus any loan charges, including origination fees, discount points, private mortgage insurance, document preparation fees, etc. Auto loans: Finance charges may include interest, credit report fees, filing fees, discount fees, etc.

What are financial charges examples

These types of finance charges include things such as annual fees for credit cards, account maintenance fees, late fees charged for making loan or credit card payments past the due date, and account transaction fees.

Which of the following is always a finance charge

Charges Always Included

Interest is the most obvious example and most common finance charge. Other charges that always qualify include, but are not limited to: Loan origination fees. Mortgage broker fees.

Which of the following are included in the finance charge

Examples of a Finance Charge: 1) interest; 2) service or transaction charges; 3) points, loan fees, finder's fees, and similar charges; 4) appraisal, investigation, and credit report fees; 5) premiums for guarantee or insurance protecting the creditor against the consumer's default; 6) charges imposed on the CU by …

Is finance cost the same as interest

Financing costs are defined as the interest and other costs incurred by the Company while borrowing funds. They are also known as “Finance Costs” or “borrowing costs.” A Company funds its operations using two different sources: Equity Financing.

What is a finance charge and how do you find it on a credit account

Any fee you incur from using your credit card is considered a finance charge. Interest, penalty fees, annual fees, foreign transaction fees, cash advance fees, and balance transfer fees are all finance charges.

How to calculate finance charge using adjusted balance method

The adjusted balance method of calculating your finance charge uses the previous balance from the end of your last billing cycle and subtracts any payments and credits made during the current billing cycle. New charges made during the billing cycle are not factored into the adjusted balance.

What is finance charges when using credit

Any fee you incur from using your credit card is considered a finance charge. Interest, penalty fees, annual fees, foreign transaction fees, cash advance fees, and balance transfer fees are all finance charges.

Are finance charges an expense

Finance charges may not be limited to the interest you pay — look for other charges that you wouldn't have to pay if you were making the same transaction in cash instead of with credit. Finance charges are an additional expense for making a purchase.

What is an example of a finance charge

A finance charge is the total amount of money a consumer pays for borrowing money. This can include credit on a car loan, a credit card, or a mortgage. Common finance charges include interest rates, origination fees, service fees, late fees, and so on.

What is not included as a finance charge

Taxes, license fees, or registration fees paid by both cash and credit customers are generally not finance charges. However, a tax imposed by a state or other governmental body solely on a creditor (not the consumer) that the creditor separately imposes on the consumer is a finance charge.

What is finance charge and finance cost

It may be a flat fee or a percentage of borrowings, with percentage-based finance charges being the most common. A finance charge is often an aggregated cost, including the cost of carrying the debt along with any related transaction fees, account maintenance fees, or late fees charged by the lender.

What is the interest rate and finance charges

According to accounting and finance terminology, the finance charge is the total fees that you pay to borrow the money in question. This means that the finance charge includes the interest and other fees that you pay in addition to paying back the loan.