What is the formula for monthly payment?

What is the formula for calculating monthly installment payments

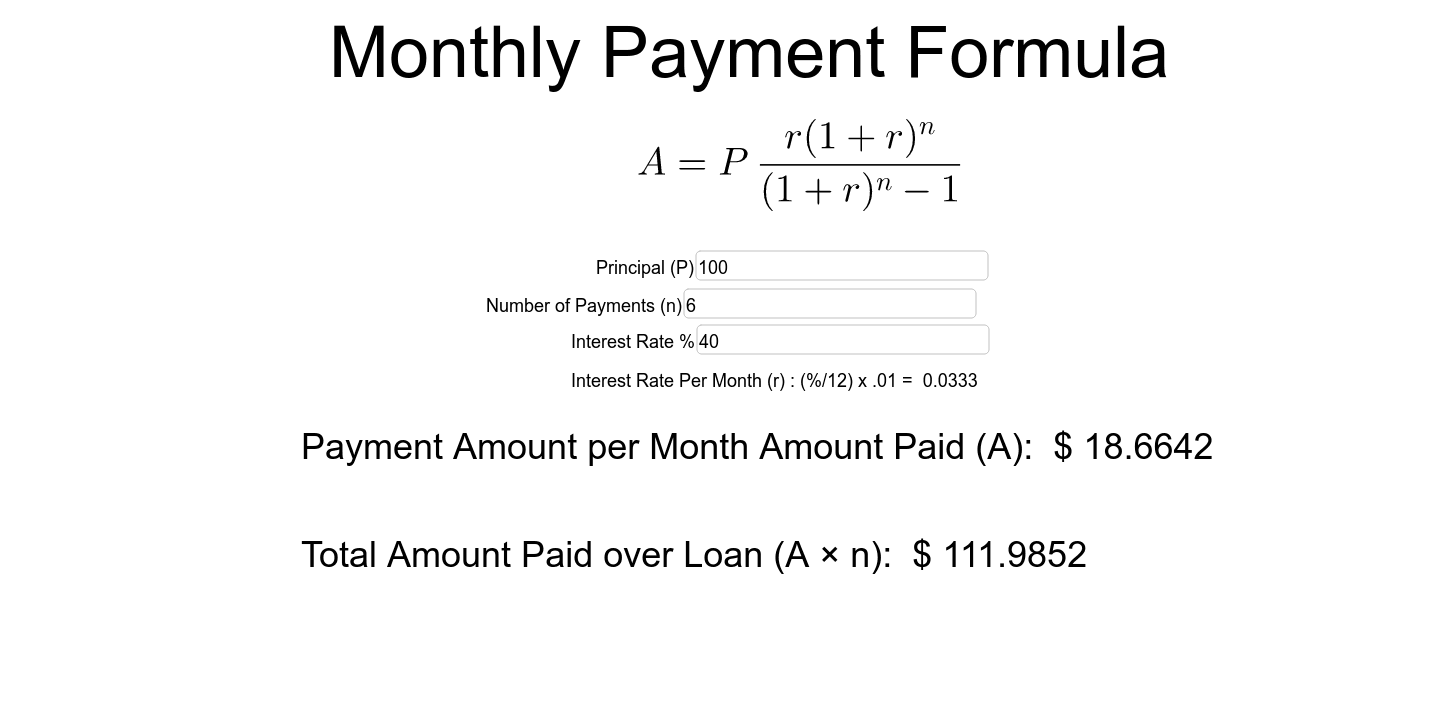

The equation to find the monthly payment for an installment loan is called the Equal Monthly Installment (EMI) formula. It is defined by the equation Monthly Payment = P (r(1+r)^n)/((1+r)^n-1). The other methods listed also use EMI to calculate the monthly payment.

Cached

What is the formula for monthly payments in Excel

Example

| Data | Description |

|---|---|

| Formula | Description |

| =PMT(A2/12,A3,A4) | Monthly payment for a loan with terms specified as arguments in A2:A4. |

| =PMT(A2/12,A3,A4,,1) | Monthly payment for a loan with with terms specified as arguments in A2:A4, except payments are due at the beginning of the period. |

| Data | Description |

Cached

What is an example of a monthly payment

For example, if you borrow $100,000 for 30 years at 4.25%, your monthly payment per $1,000 borrowed would be $4.92. Multiply that factor (4.92) by 100 (100,000/1,000) to estimate your monthly payment of $492.00.

What is the monthly payment

The monthly payment is the amount paid per month to pay off the loan in the time period of the loan. When a loan is taken out it isn't only the principal amount, or the original amount loaned out, that needs to be repaid, but also the interest that accumulates.

How do I create a monthly payment schedule in Excel

How to create an amortization schedule in ExcelCreate column A labels.Enter loan information in column B.Calculate payments in cell B4.Create column headers inside row seven.Fill in the "Period" column.Fill in cells B8 to H8.Fill in cells B9 to H9.Fill out the rest of the schedule using the crosshairs.

How do you calculate PMT on a calculator

So I have to make sure that I also put that in so I press the number of years which is 20 when I press 2nd function and then I press n. Okay. And what that does is that it takes the number of years

How do you calculate monthly payment per 1000

For example, if you borrow $100,000 for 30 years at 4.25%, your monthly payment per $1,000 borrowed would be $4.92. Multiply that factor (4.92) by 100 (100,000/1,000) to estimate your monthly payment of $492.00.

How do you calculate monthly interest

It's easy. Simply divide your APY by 12 (for each month of the year) to find the percent interest your account earns per month. For example: A 12% APY would give you a 1% monthly interest rate (12 divided by 12 is 1).

How do I calculate scheduled payments in Excel

How to create an amortization schedule in ExcelCreate column A labels.Enter loan information in column B.Calculate payments in cell B4.Create column headers inside row seven.Fill in the "Period" column.Fill in cells B8 to H8.Fill in cells B9 to H9.Fill out the rest of the schedule using the crosshairs.

How do you manually calculate PMT

Which is payment formula equals the principal multiplied by APR interest rate divided by n. The number of payments per year all divided by one minus parenthesis 1 plus again the interest rate divided

How do you calculate monthly payments on a TI 84

Interest is compounded monthly n is equal to four times 12 or 48.. So we enter 48 enter the interest rate is four percent so we enter four enter the present value of the loan would be twenty eight

What is PMT in math

So a PMT is the amount you're contributing each period. So if it's at the end of each year or at the end of each month. But the PMT is amount deposited essentially so it could be five thousand it

How much is a monthly payment for 500 000

Monthly payments on a $500,000 mortgage by interest rate

At a 7.00% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total $3,327 a month, while a 15-year might cost $4,494 a month.

What is the formula for simple monthly interest

How do I Calculate Simple Interest Monthly To calculate simple interest monthly, we have to divide the yearly interest calculated by 12. So, the formula for calculating monthly simple interest becomes (P × R × T) / (100 × 12).

What is the formula annual interest rate to monthly

To convert annual rate to monthly rate, when using APR, simply divide the annual percent rate by 12.

How do you calculate payment schedule

Starting in month one, take the total amount of the loan and multiply it by the interest rate on the loan. Then for a loan with monthly repayments, divide the result by 12 to get your monthly interest. Subtract the interest from the total monthly payment, and the remaining amount is what goes toward principal.

How do I use PMT for monthly payment in Excel

In cell C6, the PMT function calculates the monthly payment, based on the annual rate, which is divided by 12 to get the monthly rate, the number of payments (periods) and the loan amount (present value): =PMT(C2/12,C3,C4)

What is the formula for the PMT function

The mathematical equivalent for the PMT Excel Formula =PMT() is:PMT = (r * PV) / [1 – (1 + r)^(-n)]Where: PV is the p.

How do you calculate total payments

Total amount paid with interest is calculated by multiplying the monthly payment by total months. Total interest paid is calculated by subtracting the loan amount from the total amount paid.

How much is 75k monthly payment

The monthly payment on a $75,000 loan ranges from $1,025 to $7,535, depending on the APR and how long the loan lasts. For example, if you take out a $75,000 loan for one year with an APR of 36%, your monthly payment will be $7,535.