What is the income limit for FAFSA 2023?

Is there an income limit for FAFSA 2023

You may have heard the myth that if your family earns a certain amount of money, then you might not be eligible for student aid. But here's the truth: There's no FAFSA income limit, and it's possible to receive financial aid regardless of your family's income level.

Cached

How much can a student earn before affecting FAFSA 2023

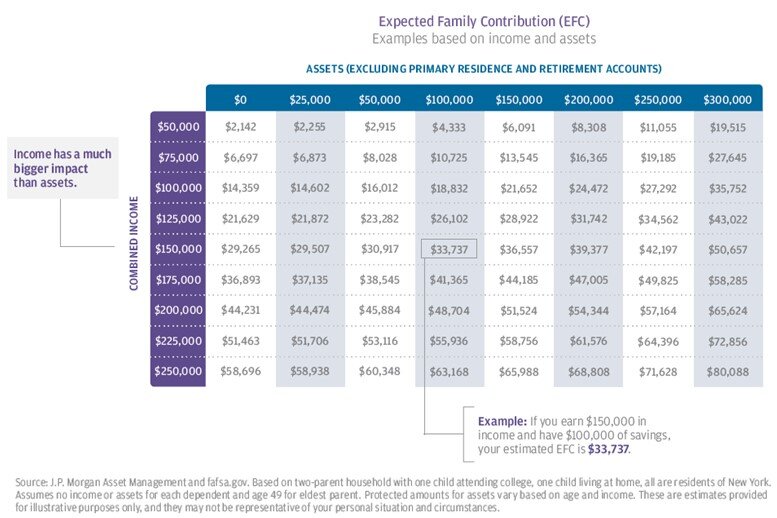

For the 2023-2024 FAFSA, up to $7,600 of a dependent student's income is protected — and thus not considered in the EFC. For parents, the income protection allowance depends on the number of people in the household and the number of students in college.

Cached

What is the maximum income to qualify for FAFSA

There are no income limits to apply, and many state and private colleges use the FAFSA to determine your financial aid eligibility. To qualify for aid, however, you'll also need to submit a FAFSA every year you're in school.

Cached

What are the requirements for 2023 FAFSA

Be a U.S. citizen or eligible noncitizen with a valid Social Security number (with certain exceptions). Have a high school diploma or a GED certificate. Be enrolled or accepted for enrollment in a qualifying degree or certificate program. Maintain satisfactory academic progress while in school.

Cached

Will I get financial aid if my parents make over 100k

There is no set income limit for eligibility to qualify for financial aid through. You'll need to fill out the FAFSA every year to see what you qualify for at your college. It's important to make sure you fill out the FAFSA as quickly as possible once it opens on October 1st for the following school year.

Will I get financial aid if my parents make over 200k

The good news is that the Department of Education doesn't have an official income cutoff to qualify for federal financial aid. So, even if you think your parents' income is too high, it's still worth applying (plus, it's free to apply).

Can you get financial aid if your parents make 100k

Don't worry, this is a common question for many students. The good news is that the Department of Education doesn't have an official income cutoff to qualify for federal financial aid. So, even if you think your parents' income is too high, it's still worth applying (plus, it's free to apply).

At what age does FAFSA go off your own income

24 years of age

You can only qualify as an independent student on the FAFSA if you are at least 24 years of age, married, on active duty in the U.S. Armed Forces, financially supporting dependent children, an orphan (both parents deceased), a ward of the court, or an emancipated minor.

What disqualifies you from FAFSA

For example, if your citizenship status changed because your visa expired or it was revoked, then you would be ineligible. Other reasons for financial aid disqualification include: Not maintaining satisfactory progress at your college or degree program. Not filling out the FAFSA each year you are enrolled in school.

Should I fill out the FAFSA if my parents make a lot of money

One of the biggest myths in the student financial aid world is that you can't submit the FAFSA if your parents have a high income. Everyone, regardless of their parents (or their) income should submit the FAFSA every year. We answer some of these questions in our FAFSA guide.

What are changes for FAFSA 2023 and 2024

Streamlining the FAFSA® Form

The FAFSA Simplification Act also removes questions about Selective Service registration and drug convictions. It also adds questions about applicants' sex, race, and ethnicity, which have no effect on federal student aid eligibility (starting with the 2023–24 award year).

Will I get FAFSA if my parents make a lot

Don't worry, this is a common question for many students. The good news is that the Department of Education doesn't have an official income cutoff to qualify for federal financial aid. So, even if you think your parents' income is too high, it's still worth applying (plus, it's free to apply).

Does FAFSA use parents income

As a dependent student, you're assumed to have parental support, so your parents' information has to be assessed along with yours to get a full picture of your family's financial strength and calculate your Expected Family Contribution.

Does FAFSA check both parents income

If your parents are living and legally married to each other, answer the questions about both of them. If your parents are living together and are not married, answer the questions about both of them. If your parent is widowed or was never married, answer the questions about that parent.

Does FAFSA look at parents income

You may not be required to provide parental information on your Free Application for Federal Student Aid (FAFSA®) form. If you answer NO to ALL of these questions, then you may be considered a dependent student and may be required to provide your parents' financial information when completing the FAFSA form.

Does FAFSA rely on parents income

If you're a dependent student, the FAFSA will attempt to measure your family's financial strength to determine your expected family contribution. Therefore, your family's taxed and untaxed income, assets, and benefits (such as funds collected through unemployment or Social Security) should be entered into the FAFSA.

Does FAFSA actually check income

During verification, the college financial aid administrator will ask the applicant to supply copies of documentation, such as income tax returns, W-2 statements and 1099 forms, to verify the data that was submitted on the Free Application for Federal Student Aid (FAFSA).

What are 3 things that the FAFSA determines your eligibility for

Your eligibility depends on your Expected Family Contribution, your year in school, your enrollment status, and the cost of attendance at the school you will be attending.

At what point does FAFSA stop using parents income

FAFSA considers your parents' income when determining how much aid you can receive up until you are 24, even if you no longer live with them.

Can I get financial aid if my parents make over 200k

The good news is that the Department of Education doesn't have an official income cutoff to qualify for federal financial aid. So, even if you think your parents' income is too high, it's still worth applying (plus, it's free to apply).