What is the income limit for other dependent credit?

Is there an income limit for other dependent credit

The credit begins to phase out when the taxpayer's income is more than $200,000. This phaseout begins for married couples filing a joint tax return at $400,000. A taxpayer can claim this credit if: They claim the person as a dependent on the taxpayer's return.

Cached

How much income can an other dependent have

Your relative can't have a gross income of more than $4,400 in 2023 and be claimed by you as a dependent. Do you financially support them You must provide more than half of your relative's total support each year.

Cached

What is the income tax filing threshold for dependents

Gross income is the total of your unearned and earned income. If your gross income was $4,400 or more, you usually can't be claimed as a dependent unless you are a qualifying child. For details, see Dependents. Single dependents—Were you either age 65 or older or blind

What is the dependent credit limit

For 2023, the credit for child and dependent care expenses is nonrefundable and you may claim the credit on qualifying employment-related expenses of up to $3,000 if you had one qualifying person, or $6,000 if you had two or more qualifying persons. The maximum credit is 35% of your employment-related expenses.

Can I claim my 25 year old son as a dependent

To meet the qualifying child test, your child must be younger than you and either younger than 19 years old or be a "student" younger than 24 years old as of the end of the calendar year. There's no age limit if your child is "permanently and totally disabled" or meets the qualifying relative test.

What are the IRS rules for qualifying dependent

Tests To Be a Qualifying Relative

The child must be your son, daughter, stepchild, foster child, brother, sister, half brother, half sister, stepbrother, stepsister, or a descendant of any of them. An adopted child is always treated as your own child.

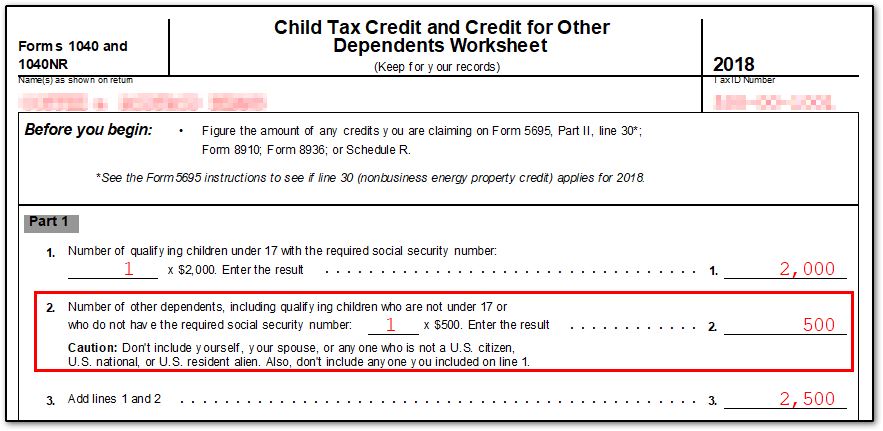

What are the requirements for other dependent credit

A taxpayer can claim this credit if:They claim the person as a dependent on the taxpayer's return.They cannot use the dependent to claim the child tax credit or additional child tax credit.The dependent is a U.S. citizen, national or resident alien.

Can you make too much money to claim a dependent

The person must have gross income less than $4,300. Tax-exempt income, like certain Social Security benefits, isn't included in gross income. You must provide more than half of the person's support for the year. The person must not file a joint return for the year, unless it's only to claim a refund of taxes withheld.

What are the requirements for claiming a dependent

The child must be: (a) under age 19 at the end of the year and younger than you (or your spouse, if filing jointly), (b) under age 24 at the end of the year, a full- time student, and younger than you (or your spouse, if filing jointly), or (c) any age if permanently and totally disabled.

Can I still claim my child as a dependent if they work

Share: You can usually claim your children as dependents even if they are dependents with income and no matter how much dependent income they may have or where it comes from.

What are the qualifications for dependent credit

A child qualifies if they meet all of the following:Relationship — must be your:Age: Are under 13 years old.Residency: Lived with you for more than 1/2 the year.Support: Did not provide more than 1/2 of his/her own support.Joint Return: Did not file a joint federal or state income tax return.

How do you qualify for dependent tax credit

Your family can claim this credit if you: Paid for care in 2023 for a qualifying child under age 13 claimed as a dependent*, or a spouse or dependent not able to care for themselves, who lived with your family for more than half of the year. AND. Needed the child or dependent care to work or look for work.

Can I claim my 30 year old unemployed son as a dependent

It's possible, but once you're over age 24, you can no longer be claimed as a qualifying child. The only exception to this is if you're permanently and totally disabled. However, you can be claimed as a qualifying relative if you meet these requirements: Your gross income is less than $4,300.

Can I claim my 30 year old boyfriend as a dependent

You can claim a boyfriend or girlfriend as a dependent on your federal income taxes if that person meets certain Internal Revenue Service requirements. To qualify as a dependent, your partner must have lived with you for the entire calendar year and listed your home as their official residence for the full year.

Can I claim my wife as a dependent if she doesn’t work

Under no circumstance can a spouse be claimed as a dependent, even if they have no income. Furthermore, the Tax Cuts and Jobs Act of 2023 eliminated personal exemptions for tax years 2023 through 2025. However, tax credits for dependents were increased along with standard deductions based on filing status.

Can I claim an adult as a dependent

To be a dependent, the adult must be a close relative or living with you, earn less than the exemption amount for the tax year, and receive more than half of their support from you. You can claim the $500 tax credit for other dependents if the adult qualifies and you earn less than $200,000 as an individual.

Can I claim my daughter as a dependent if she made over $10000

Share: You can usually claim your children as dependents even if they are dependents with income and no matter how much dependent income they may have or where it comes from.

Who qualifies for credit for other dependents

Dependents of any age, including those who are age 18 or older. Dependents who have Social Security numbers or individual taxpayer identification numbers. Dependent parents or other qualifying relatives supported by the taxpayer. Dependents living with the taxpayer who aren't related to the taxpayer.

What is the $8000 dependent credit

The expanded tax break lets families claim a credit worth 50% of their child care expenses, which can be up to $16,000 for two or more kids. In other words, families with two kids who spent at least $16,000 on day care in 2023 can get $8,000 back from the IRS through the expanded tax credit.

Who Cannot be claimed as a dependent

Usually, any person who filed a joint return (as a married person) cannot be claimed as a dependent on anyone else's tax return. To be claimed as a dependent, a person must be a U.S. citizen, U.S. resident alien, U.S. national, or a resident of Canada or Mexico.