What is the installment formula?

What is the formula for installment in simple interest

Simple interest is calculated with the following formula: S.I. = (P × R × T)/100, where P = Principal, R = Rate of Interest in % per annum, and T = Time, usually calculated as the number of years. The rate of interest is in percentage R% (and is to be written as R/100, thus 100 in the formula).

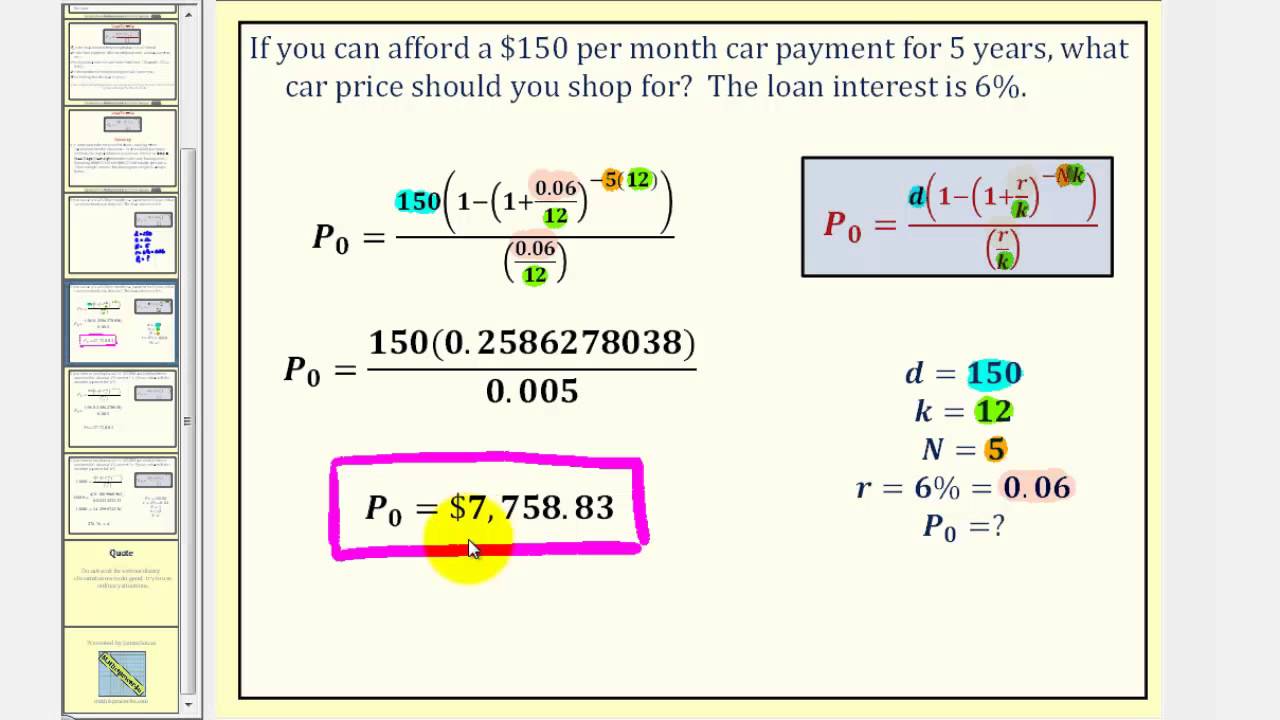

What is the formula for calculating payments

The payment on a loan can also be calculated by dividing the original loan amount (PV) by the present value interest factor of an annuity based on the term and interest rate of the loan. This formula is conceptually the same with only the PVIFA replacing the variables in the formula that PVIFA is comprised of.

Cached

How do you calculate interest installments

Divide your interest rate by the number of payments you'll make that year. If you have a 6 percent interest rate and you make monthly payments, you would divide 0.06 by 12 to get 0.005. Multiply that number by your remaining loan balance to find out how much you'll pay in interest that month.

What is the installment percentage

Installment Percentage means, with respect to Advances outstanding under the Revolver/Term Loan, a percentage of the aggregate Revolver/Term Advances outstanding on the Conversion Date.

Which function is used to calculate of installment

PMT, one of the financial functions, calculates the payment for a loan based on constant payments and a constant interest rate.

How do you calculate yearly installment

Installment = A 1 − ( 100 100 + r ) n × r 100.Installment = A 1 + ( 100 r ) n × r 100.Installment = 100 A r n.Installment = r n A 100.

What is an example of an installment payment

Common examples of installment loans include mortgage loans, home equity loans and car loans. A student loan is also an example of an installment account. Except for student and personal loans, installment loans are often secured with some collateral, such as a house or car, explains credit card issuer, Discover.

What is monthly installment in math

Flat-Rate Method

The EMI amount is calculated by adding the total principal of the loan and the total interest on the principal together, then dividing the sum by the number of EMI payments, which is the number of months during the loan term.

What is the formula to calculate installment in Excel

=PMT(1.5%/12,3*12,0,8500)The rate argument is 1.5% divided by 12, the number of months in a year.The NPER argument is 3*12 for twelve monthly payments over three years.The PV (present value) is 0 because the account is starting from zero.The FV (future value) that you want to save is $8,500.

What is the formula for total installment price

The total installment price is the Sum of all monthly payments plus the down payment: Total Installment Price = Total of all monthly payments + down payment.

What is yearly installment

1) Annual Installments means a series of amounts to be paid annually over a predetermined period of years in substantially equal periodic payments, except to the extent any increase in the amount reflects reasonable earnings through the date the amount is paid.

What is installment payment method

Instalment payments refer to a customer paying a bill in small portions throughout a fixed period of time. Start invoicing for free. Instalment payments are a payment plan arranged between the buyer and the seller. It's usually clearly stated in the payment terms in a contract or on an invoice.

How does installment payment work

When you sign up for an installment plan, the total amount of your purchase is automatically deducted from your available credit. Your monthly installment amount is included in the minimum amount that is due each month. As you pay off the balance, the amount you pay is then added back to your credit limit.

Does installment mean monthly

Key Takeaways. An equated monthly installment (EMI) is a fixed payment made by a borrower to a lender on a specified date of each month. EMIs are applied to both interest and principal each month so that over a specified time period, the loan is paid off in full.

What is an example of installment method

For example, Real Estate Company has just sold a large parcel of land to Case Co. at a price of $1 million. Case signed an installment sales contract that requires payments of $150,000 over the next 6 years and an up-front payment of $100,000. The cost of the land sold for Real Estate is $600,000.

What is an example of installment

Common examples of installment loans include mortgage loans, home equity loans and car loans. A student loan is also an example of an installment account. Except for student and personal loans, installment loans are often secured with some collateral, such as a house or car, explains credit card issuer, Discover.

How do you calculate monthly installment payments

The equation to find the monthly payment for an installment loan is called the Equal Monthly Installment (EMI) formula. It is defined by the equation Monthly Payment = P (r(1+r)^n)/((1+r)^n-1). The other methods listed also use EMI to calculate the monthly payment. r: Interest rate.

What does 1 installment mean

1. any of several parts into which a debt or other sum payable is divided for payment at successive fixed times. to pay for furniture in monthly installments. 2. a single portion of something furnished or issued by parts at successive times.

What are the 2 types of installment

There are two types of installment loans; unsecured or secured. An unsecured loan does not need any form of collateral, only a promise to pay back the debt. Think of medical debt, personal loans, or credit cards. A secured installment loan is backed by an asset equal to the amount being borrowed.

How do you calculate gross income using installment method

Generally, the following should be calculated when determining gross profit from an installment sale:Gross Profit = Sales Price – Adjusted Basis.Gross Profit Percentage = Gross Profit/Sales Price.Amount of Installment Payments = Sales Price/Number of Payments.