What is the interest rate on line of credit in Canada?

What is the current interest rate for a line of credit in Canada

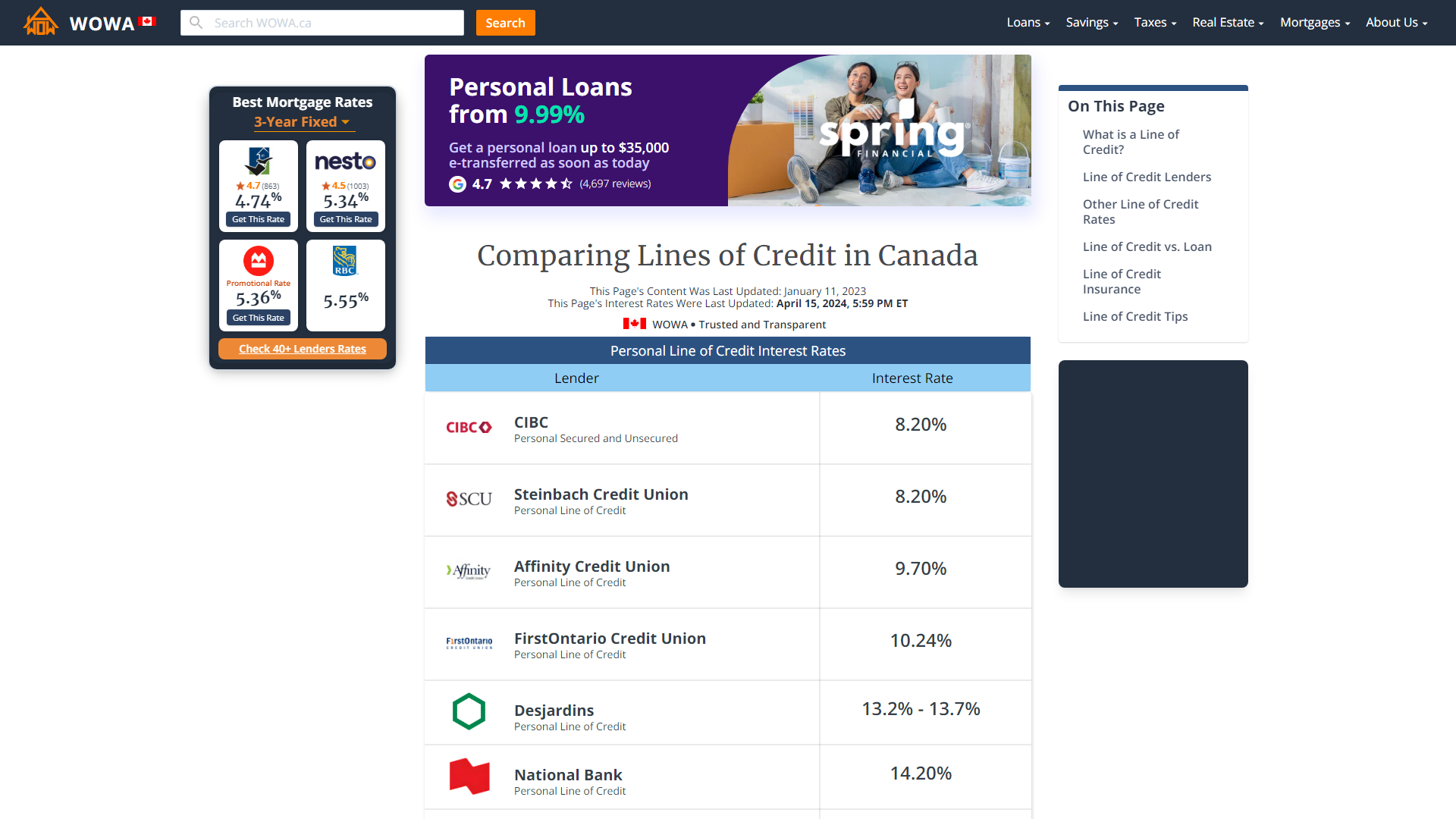

What is the average interest rate for a line of credit in Canada Based on the latest information available from the Bank of Canada, the average interest rate is 6.37% for a secured personal line of credit and 9.83% for an unsecured personal line of credit.

What is a normal interest rate on a line of credit

The average interest rate for a line of credit generally ranges from 7-21%, depending on factors such as your credit score, income level, and other personal financial indicators.

Cached

What is the max HELOC amount in Canada

65%

The credit limit on a HELOC combined with a mortgage can be a maximum of 65% of your home's purchase price or market value. The amount of credit available in the HELOC will go up to that credit limit as you pay down the principal on your mortgage.

Do lines of credit have high interest rates

Also, like credit cards, lines of credit tend to have relatively high interest rates and some annual fees, but interest is not charged unless there is an outstanding balance on the account.

Are line of credit interest rates high

Personal line of credit

Interest rates are usually lower than for credit cards and personal loans.

What is the debt to income ratio for a HELOC Canada

Some lenders require that your monthly debts be less than 36% of your gross monthly income, while others may be willing to go as high as 43% or 50%. Although there is no specific income requirement for home equity products, many will assess your earnings to ensure you can repay your loan.

What is the minimum credit score for HELOC in Canada

In general, a credit score of at least 620 will get you a basic home equity line of credit. However, individuals with higher credit scores will be able to get more from their loans. Most lenders also require a total loan-to-value ratio of 80% or less and a low debt-to-income ratio.

Can you negotiate interest rate on line of credit

From credit cards to credit lines, it never hurts to ask for a lower rate. Start with the math and it's a no brainer: even a slight reduction can save you big bucks. Say you're carrying a $1,000 balance on a credit card. Even a one-per cent reduction will save you $10 a year.

What is the risk of a line of credit

Interest is charged on a line of credit as soon as money is borrowed. Lines of credit can be used to cover unexpected expenses that do not fit your budget. Potential downsides include high interest rates, late payment fees, and the potential to spend more than you can afford to repay.

What are the disadvantages of a line of credit

Cons of a line of creditWith easy access to money from a line of credit, you may get into serious financial trouble if you don't control your spending.If interest rates increase, you may have difficulty paying back your line of credit.

Is it a good idea to get a line of credit

Lines of credit can be used to cover unexpected expenses that do not fit your budget. Potential downsides include high interest rates, late payment fees, and the potential to spend more than you can afford to repay.

What is Bank of Canada prime rate

6.95%

The prime rate has risen from 2.45% in March 2023 to the current prime rate of 6.95%.

How much does TD Bank charge for HELOC

Types of fees charged

TD Bank charges an origination fee of $99 for both its home equity and HELOC products, Depending on the type of loan and property, you might be subject to other upfront fees, as well. Further, its HELOC product has an annual fee of $50, except on loan amounts less than $50,000.

Does Canada have HELOC

A HELOC in Canada can be a maximum of 65% of your home's appraised value if you borrow from a federally regulated financial institution, such as a bank. Or, if your lender combines your home equity line of credit limit with the balance remaining on your mortgage, it can be up to 80% of your home's value.

How can I get a better rate on my line of credit

A higher credit score will generally allow you get a higher approved limit on a line of credit. Generally, lines of credit have a maximum of $50,000. The interest rate for a line of credit is based on banks' prime rates plus a certain percentage. Again, a better credit score means you will get a better interest rate.

Is it good to have a line of credit and not use it

After you're approved and you accept the line of credit, it generally appears on your credit reports as a new account. If you never use your available credit, or only use a small percentage of the total amount available, it may lower your credit utilization rate and improve your credit scores.

Does line of credit ruin your credit score

Since a credit line is treated as revolving debt, both your maximum credit line limit and your balance affect your credit utilization. Your payment history is also reflected on your credit report, which could help or hurt your score depending on how you manage the account.

What credit score is needed for a line of credit

670 or higher

Opening a personal LOC usually requires a credit history of no defaults, a credit score of 670 or higher, and reliable income. Having savings helps, as does collateral in the form of stocks or certificates of deposit (CDs), though collateral is not required for a personal LOC.

What is the 5 year Bank of Canada rate

Canada 5 Year Benchmark Bond Yield is at 3.70%, compared to 3.73% the previous market day and 3.18% last year. This is lower than the long term average of 3.76%.

What will interest rates be in 2023 Canada

Summary (updated June 2023)

On Wednesday, June 7, 2023, The Bank of Canada announced that it will increase the key interest rate by +0.25% to 4.75% while they look closely at the economy to determine future policy.