What is the IRS look back rule?

Who qualifies for lookback rule

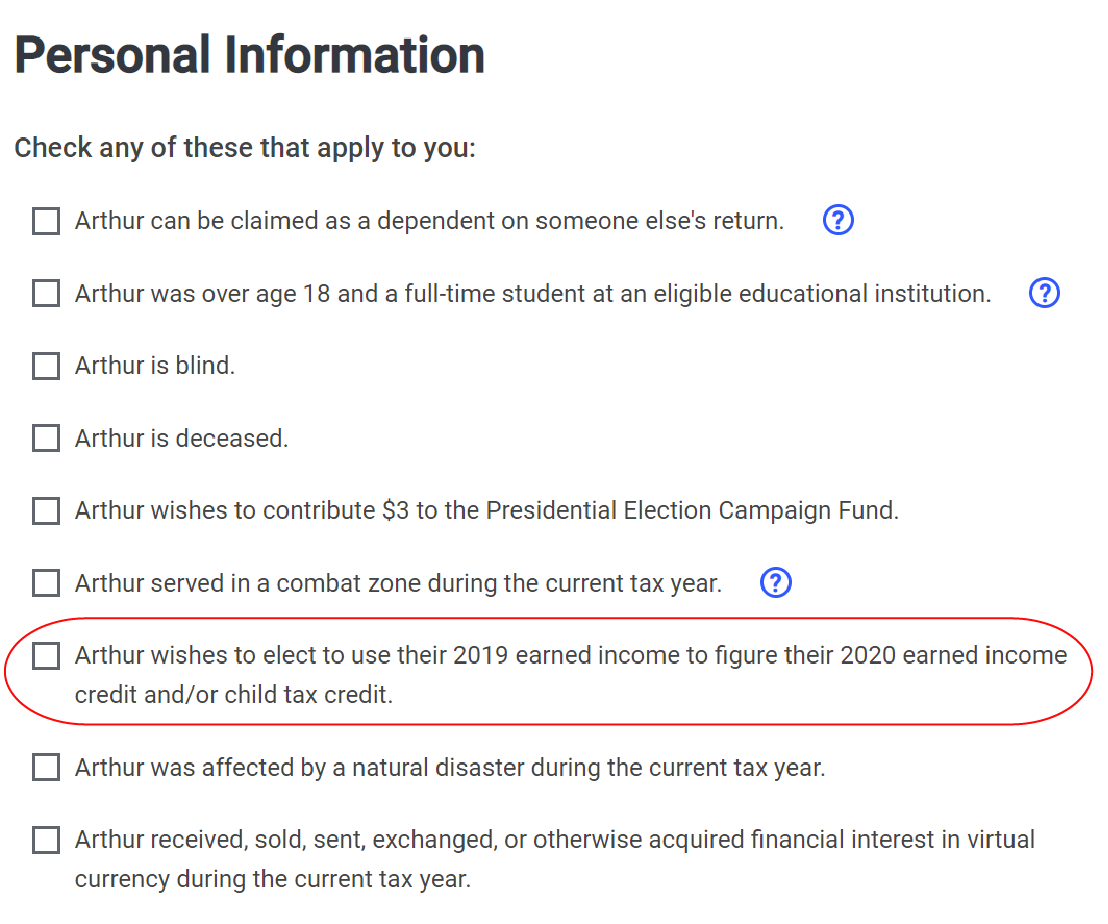

The Earned Income Tax Credit (EITC) lookback rule lets taxpayers with lower earned incomes use either their 2023 or 2023 income to calculate the EITC – whichever one leads to a better refund for the taxpayer. This includes those that received unemployment benefits or took lower-paying jobs in 2023.

What is the IRS 3 year lookback rule

Taxpayers who file claims for credit or refund within three years from the date the original return was filed will have their credits or refunds limited to the amounts paid within the three-year period before the filing of the claim plus the period of any extension of time for filing the original return (the “three- …

How many years can the IRS look back

How far back can the IRS go to audit my return Generally, the IRS can include returns filed within the last three years in an audit. If we identify a substantial error, we may add additional years.

What is the lookback rule for taxes 2023

In plain language, the taxpayer is entitled to receive a refund for the amounts paid through withholding because the claim for refund was filed within three years of the original return and by the last possible date of the lookback period under Notice 2023-21 (i.e., July 15, 2023, plus three years).

Cached

Can you use lookback rule twice

Myths and realities about the lookback rule

Myth: You can use the lookback provision to apply 2023 to your entire return. Reality: You can only use the lookback provision for your eligibility for the Earned Income Credit and the Additional Child Tax Credit.

Is Social Security considered earned income

Earned income does not include amounts such as pensions and annuities, welfare benefits, unemployment compensation, worker's compensation benefits, or social security benefits.

Does the IRS destroy tax records after 7 years

Individual tax returns (the Form 1040 series) are temporary records which are eligible to be destroyed six (6) years after the end of the processing year.

What is the IRS 3 out of 5 year rule

An activity is presumed for profit if it makes a profit in at least three of the last five tax years, including the current year (or at least two of the last seven years for activities that consist primarily of breeding, showing, training or racing horses).

Does IRS forgive debt after 10 years

Yes, after 10 years, the IRS forgives tax debt.

After this time period, the tax debt is considered "uncollectible". However, it is important to note that there are certain circumstances, such as bankruptcy or certain collection activities, which may extend the statute of limitations.

What is the IRS 6 year rule

If you omitted more than 25% of your gross income from a tax return, the time the IRS can assess additional tax increases from three to six years from the date your tax return was filed. If you file a false or fraudulent return with the intent to evade tax, the IRS has an unlimited amount of time to assess tax.

What are the IRS changes for 2023

The standard deduction also increased by nearly 7% for 2023, rising to $27,700 for married couples filing jointly, up from $25,900 in 2023. Single filers may claim $13,850, an increase from $12,950.

Will the lookback rule be extended

New lookback period applies

Notice 2023-21 specifies that the filing dates were postponed, not extended. Therefore, the lookback period was not extended by Notice 2023-23 or 2023-21 and remained at three years unless a taxpayer actually secured an extension to file.

What is a lookback adjustment

Filed on IRS Form 8697, “Interest Computation Under the Look-Back Method for Completed Long-Term Contracts,” the look-back is a hypothetical recalculation of a contractor's taxable income based on the actual performance of its completed jobs.

How do I get the $16728 Social Security bonus

To acquire the full amount, you need to maximize your working life and begin collecting your check until age 70. Another way to maximize your check is by asking for a raise every two or three years. Moving companies throughout your career is another way to prove your worth, and generate more money.

What is the Social Security 5 year rule

The Social Security disability five-year rule allows people to skip a required waiting period for receiving disability benefits if they had previously received disability benefits, stopped collecting those benefits and then became unable to work again within five years.

What is the 10 year rule with IRS

All distributions must be made by the end of the 10th year after death, except for distributions made to certain eligible designated beneficiaries. See 10-year rule, later, for more information.

Does IRS forgive after 10 years

Yes, after 10 years, the IRS forgives tax debt.

After this time period, the tax debt is considered "uncollectible". However, it is important to note that there are certain circumstances, such as bankruptcy or certain collection activities, which may extend the statute of limitations.

What is the IRS 10 year rule

All distributions must be made by the end of the 10th year after death, except for distributions made to certain eligible designated beneficiaries. See 10-year rule, later, for more information.

How much will the IRS usually settle for

How much will the IRS settle for The IRS will typically only settle for what it deems you can feasibly pay. To determine this, it will take into account your assets (home, car, etc.), your income, your monthly expenses (rent, utilities, child care, etc.), your savings, and more.

What happens if you owe the IRS more than $25000

For individuals, balances over $25,000 must be paid by Direct Debit. For businesses, balances over $10,000 must be paid by Direct Debit. Apply online through the Online Payment Agreement tool or apply by phone or by mail by submitting Form 9465, Installment Agreement Request.