What is the limit for PayPal transfer?

What is the maximum transfer per day on PayPal

$5,000 maximum transfer amount per day. $5,000 maximum transfer amount per week. $15,000 maximum transfer amount per month.

Cached

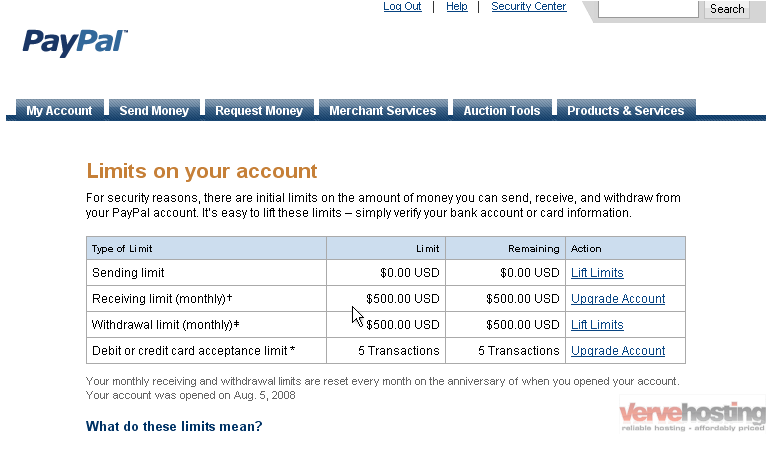

How do I know my PayPal limit

Here's how to check what your limits are for your PayPal Business Debit Mastercard:Hover over your profile and select Account Settings.Click Money, banks, and cards.Click Manage under “PayPal Business Debit Mastercard.”Click Change if you want to update your daily purchase and ATM withdrawal limits.

What is the limit on PayPal friends and family

If your account on PayPal has been verified already, then you only have a limit per transaction, which can go up to $60,000 but may be limited to $10,000.

Why is PayPal denying my transfer

There may be a limitation on your PayPal account that prevents the transfer. Remove the limitation to restore your full account functionality. Your debit card or bank account may not be eligible to process the instant transfer. Select a different bank or card that supports instant transfer from PayPal.

Why would PayPal limit my account

We may limit your account to protect you from potential losses and review any fraudulent activity. This can happen if your: Account was accessed without your authorization. Bank informs us there have been unauthorized transfers between your PayPal account and your bank account.

Does PayPal report to IRS

PayPal tax reporting is required when the sender identifies the product as goods and services to the IRS, even if it was a mistake. This requirement applies once you receive $600 USD or more from this type of payment. Although this transaction is reportable by PayPal, it's possible that the transaction is not taxable.

How do I avoid a limit on PayPal

How to Avoid a PayPal Limitation1 Use unique information.2 Use a payment method that matches your identity.3 Connect to PayPal directly.4 Keep your buyers happy.5 Wait before transferring funds to other users.6 Don't change your account information too much.7 Don't use E-trade as your bank.

What is the minimum amount to transfer from PayPal to bank account

:$1.00

Minimum transfer amount:$1.00. Maximum transfer amount per transaction: $5,000.00. Maximum transfer amount per day: $5,000.00. Maximum transfer amount per week: $5,000.00.

Does PayPal still allow friends and family

As of July 28, 2023, US Business accounts can no longer receive friends and family payments from US senders.

How do I remove a limit on PayPal

Users can contact PayPal customer support by phone, email, or chat to inquire about the reason for the limitation and how to remove it. PayPal customer support may ask users to provide additional information or documentation to verify their account and resolve any issues.

How do I get my PayPal money off hold instantly

How can I access my PayPal money fasterAdd tracking. Use one of PayPal's approved shipping carriers, and PayPal will release the hold on funds one day after the courier confirms delivery.Print a USPS or UPS shipping label via PayPal.Update the order status for services or intangible items.

How do I avoid PayPal limitations

How to Avoid a PayPal Limitation1 Use unique information.2 Use a payment method that matches your identity.3 Connect to PayPal directly.4 Keep your buyers happy.5 Wait before transferring funds to other users.6 Don't change your account information too much.7 Don't use E-trade as your bank.

How do I increase my PayPal transaction limit

And then on business setup. That's taken me to this page here you choose my PayPal. Business account setup and it's on the account setup tab. If you also have a business account you'll be able to

How much can you make on PayPal without paying taxes

PayPal tax reporting is required when the sender identifies the product as goods and services to the IRS, even if it was a mistake. This requirement applies once you receive $600 USD or more from this type of payment.

How much do you have to make for PayPal to send a 1099

$20,000

But the IRS recently changed the rules for 2023 transactions. Now, PayPal is only required to send you a 1099-K if you: Made at least $20,000 in sales on the platform. Had at least 200 business transactions.

Why would PayPal limit an account

We may limit your account to protect you from potential losses and review any fraudulent activity. This can happen if your: Account was accessed without your authorization. Bank informs us there have been unauthorized transfers between your PayPal account and your bank account.

Can I transfer money from PayPal to a bank account

To withdraw money from your PayPal account: Go to Wallet. Click Transfer Money. Click Transfer to your bank.

Why does PayPal take 3 days to transfer money

It usually takes 3-5 business days to transfer money from your linked bank account to your PayPal balance. The money is removed from your bank account and the transaction is verified and processed through the Federal Reserve's ACH (Automated Clearing House) before being released to PayPal.

Does PayPal charge a fee to receive money from a friend

Fees for receiving money are typically a fixed fee plus a percentage of your transaction total. PayPal fees also vary by payment type, currency received, payment method, and whether the transaction is domestic or international.

Does PayPal report to IRS on friends and family

So, if you're using PayPal for personal transactions and are worried about PayPal taxes friends and family, you can rest easy knowing that such transactions are not subject to reporting requirements.