What is the lookback rule for taxes?

Will the lookback rule apply in 2023

In plain language, the taxpayer is entitled to receive a refund for the amounts paid through withholding because the claim for refund was filed within three years of the original return and by the last possible date of the lookback period under Notice 2023-21 (i.e., July 15, 2023, plus three years).

How does a lookback work for taxes

The lookback period is the five-year period before the excess benefit transaction occurred. The lookback period is used to determine whether an organization is an applicable tax-exempt organization.

CachedSimilar

What is the IRS three year look back rule

The statute of limitations limits the time allowed to assess additional tax. It is generally three years after a return is due or was filed, whichever is later. There is also a statute of limitations for making refunds.

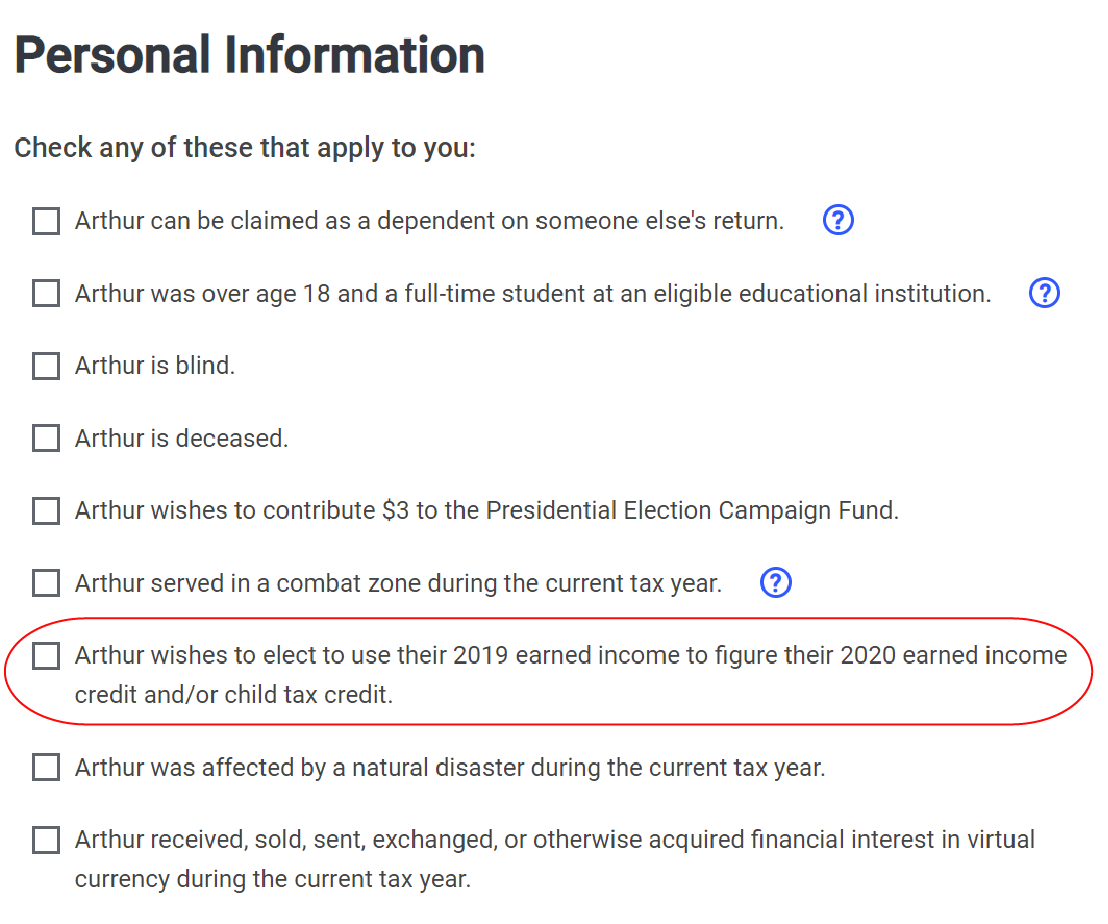

What is the lookback rule for EITC 2023

Additionally, there is a 'lookback' rule for the EITC that allows anyone eligible for the credit to choose to use their earnings from 2023 instead of 2023, if it can help you get a larger credit.

What is the new IRS rule 2023

Standard deduction increase: The standard deduction for 2023 (which'll be useful when you file in 2024) increases to $13,850 for single filers and $27,700 for married couples filing jointly. Tax brackets increase: The income tax brackets will also increase in 2023.

What is the Earned income Lookback rule

What is the EITC 'Lookback rule' and why does it matter The Earned Income Tax Credit (EITC) lookback rule lets taxpayers with lower earned incomes use either their 2023 or 2023 income to calculate the EITC – whichever one leads to a better refund for the taxpayer.

What is the new lookback rule

The three-year lookback period is as follows: Taxpayers who file claims for credit or refund within three years from the date the original return was filed will have their credits or refunds limited to the amounts paid within the three-year period before the filing of the claim plus the period of any extension of time …

What is the IRS 7 year rule

Period of limitations for refund claims:

7 years – For filing a claim for an overpayment resulting from a bad debt deduction or a loss from worthless securities, the time to make the claim is 7 years from when the return was due.

Are federal taxes changing as of 2023

What are the tax brackets for 2023 The U.S. taxes income at progressively higher rates as you earn more. Those rates—ranging from 10% to 37%—will remain the same in 2023. What's changing is the amount of income that gets taxed at each rate.

What is the federal exclusion for 2023

Effective January 1, 2023, the federal gift/estate tax exemption and GST tax exemption increased from $12,060,000 to $12,920,000 (an $860,000 increase). [1] The federal annual exclusion amount also increased from $16,000 to $17,000.

Who qualifies for lookback rule

The Earned Income Tax Credit (EITC) lookback rule lets taxpayers with lower earned incomes use either their 2023 or 2023 income to calculate the EITC – whichever one leads to a better refund for the taxpayer. This includes those that received unemployment benefits or took lower-paying jobs in 2023.

How does the lookback rule work

The three-year lookback period is as follows: Taxpayers who file claims for credit or refund within three years from the date the original return was filed will have their credits or refunds limited to the amounts paid within the three-year period before the filing of the claim plus the period of any extension of time …

What form is lookback calculation

Form 8697 is used to determine the interest due or to be refunded under the look-back method of section 460(b)(2) on certain long-term contracts that are accounted for under either the percentage of completion method or the percentage of completion-capitalized cost method.

Does the IRS destroy tax records after 7 years

Individual tax returns (the Form 1040 series) are temporary records which are eligible to be destroyed six (6) years after the end of the processing year.

How much can you inherit from your parents without paying taxes

There is no federal inheritance tax, but there is a federal estate tax. The federal estate tax generally applies to assets over $12.06 million in 2023 and $12.92 million in 2023, and the estate tax rate ranges from 18% to 40%.

How will tax returns change in 2023

When you file your taxes this year, you may have a lower refund amount, since some tax credits that were expanded and increased in 2023 will return to 2023 levels. The 2023 changes include amounts for the Child Tax Credit (CTC), Earned Income Tax Credit (EITC), and Child and Dependent Care Credit.

What will be the federal tax rate 2023

For the 2023 tax year, there are seven tax rates: 10%, 12%, 22%, 24%, 32%, 35% and 37%, the same as in tax year 2023. Tax returns for 2023 are due in April 2024, or October 2024 with an extension.

How does the IRS know if I give a gift

The primary way the IRS becomes aware of gifts is when you report them on form 709. You are required to report gifts to an individual over $17,000 on this form. This is how the IRS will generally become aware of a gift.

What is the look-back calculation

Filed on IRS Form 8697, “Interest Computation Under the Look-Back Method for Completed Long-Term Contracts,” the look-back is a hypothetical recalculation of a contractor's taxable income based on the actual performance of its completed jobs.

How do you use the lookback rule

The three-year lookback period is as follows: Taxpayers who file claims for credit or refund within three years from the date the original return was filed will have their credits or refunds limited to the amounts paid within the three-year period before the filing of the claim plus the period of any extension of time …