What is the lookback rule IRS?

What is the lookback rule for tax returns in 2023

In plain language, the taxpayer is entitled to receive a refund for the amounts paid through withholding because the claim for refund was filed within three years of the original return and by the last possible date of the lookback period under Notice 2023-21 (i.e., July 15, 2023, plus three years).

Cached

Who qualifies for lookback rule

The Earned Income Tax Credit (EITC) lookback rule lets taxpayers with lower earned incomes use either their 2023 or 2023 income to calculate the EITC – whichever one leads to a better refund for the taxpayer. This includes those that received unemployment benefits or took lower-paying jobs in 2023.

Cached

How does the lookback rule work

The three-year lookback period is as follows: Taxpayers who file claims for credit or refund within three years from the date the original return was filed will have their credits or refunds limited to the amounts paid within the three-year period before the filing of the claim plus the period of any extension of time …

Cached

What is the lookback period for an IRS audit

three years

How far back can the IRS go to audit my return Generally, the IRS can include returns filed within the last three years in an audit. If we identify a substantial error, we may add additional years.

What is the 2 5 year rule IRS

If you owned the home for at least 24 months (2 years) out of the last 5 years leading up to the date of sale (date of the closing), you meet the ownership requirement. For a married couple filing jointly, only one spouse has to meet the ownership requirement.

What is the three year lookback

Assembly Bill 218: The Lookback Window. In 2023, California passed a new law that opened up a three-year window for child sexual assault survivors to sue their abusers.

Can you use lookback rule twice

Myths and realities about the lookback rule

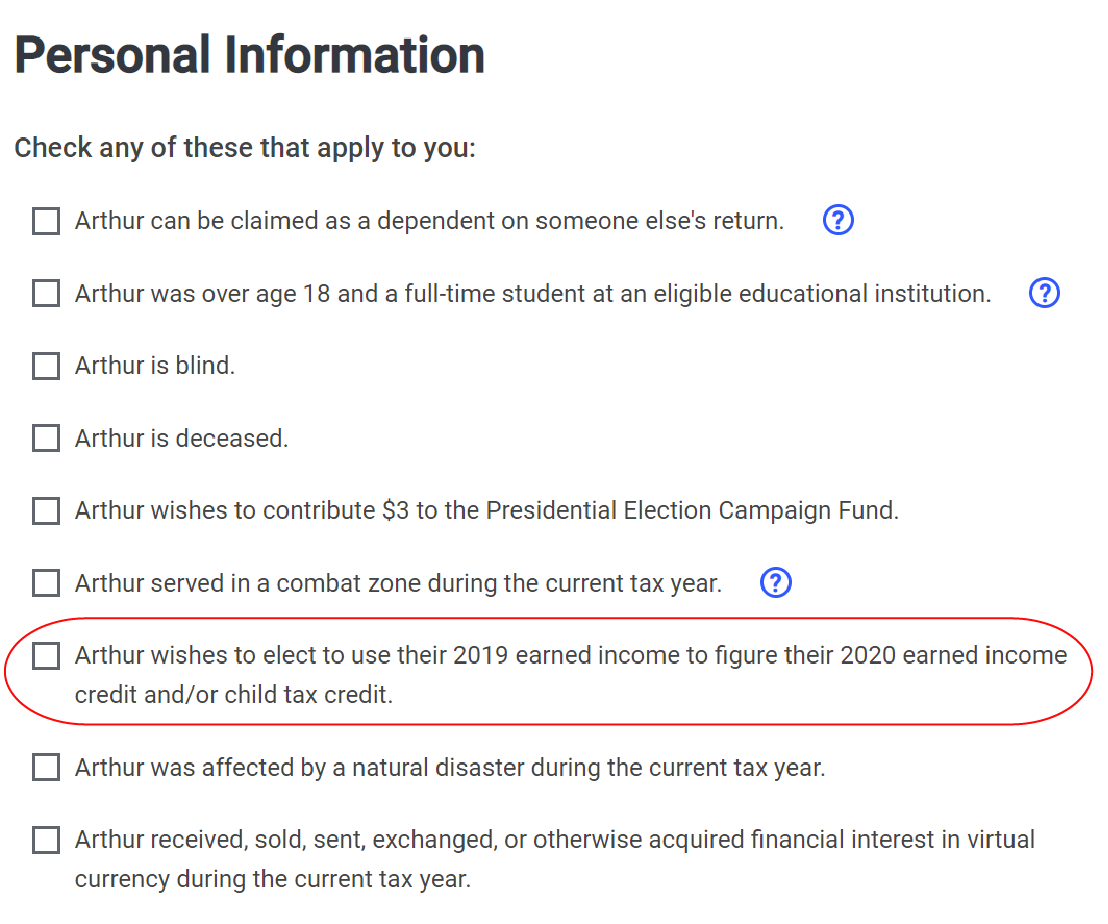

Myth: You can use the lookback provision to apply 2023 to your entire return. Reality: You can only use the lookback provision for your eligibility for the Earned Income Credit and the Additional Child Tax Credit.

What form is lookback calculation

Form 8697 is used to determine the interest due or to be refunded under the look-back method of section 460(b)(2) on certain long-term contracts that are accounted for under either the percentage of completion method or the percentage of completion-capitalized cost method.

What is the look-back calculation

Filed on IRS Form 8697, “Interest Computation Under the Look-Back Method for Completed Long-Term Contracts,” the look-back is a hypothetical recalculation of a contractor's taxable income based on the actual performance of its completed jobs.

What is a lookback clause

A lookback is a provision in certain tax-qualified ESPPs. A lookback provision bases the purchase price not on the stock price at the time of purchase but, rather, on the price either at the beginning of the offering period or at the end of the purchase period, whichever is lower.

What is the IRS 3 year rule

The general rule is that an assessment of tax must be made within three years from the received date of an original tax return or three years from the due date of the original return, whichever is later.

What is the IRS 6 year rule

2. Six Years for Large Understatements of Income. The statute of limitations is six years if your return includes a “substantial understatement of income.” Generally, this means that you have left off more than 25 percent of your gross income.

What is the IRS 7 year rule

Period of limitations for refund claims:

7 years – For filing a claim for an overpayment resulting from a bad debt deduction or a loss from worthless securities, the time to make the claim is 7 years from when the return was due.

How many years back can IRS come after you

10 years

Each tax assessment has a Collection Statute Expiration Date (CSED). Internal Revenue Code section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years.

Will the lookback rule be extended

New lookback period applies

Notice 2023-21 specifies that the filing dates were postponed, not extended. Therefore, the lookback period was not extended by Notice 2023-23 or 2023-21 and remained at three years unless a taxpayer actually secured an extension to file.

What is a lookback adjustment

Filed on IRS Form 8697, “Interest Computation Under the Look-Back Method for Completed Long-Term Contracts,” the look-back is a hypothetical recalculation of a contractor's taxable income based on the actual performance of its completed jobs.

What is earned income lookback

taxpayers who earn less income in the disaster year than the prior year the option of using their prior-year. income to calculate their EITC benefits.3 This provision is referred to as the “EITC lookback rule.”

What is the percentage of completion look back rule

The look-back method does not require allocation of contract income to tax years before the contract was entered into. Costs incurred prior to the year a contract is entered into are first taken into account in the numerator of the percentage of completion ratio in the year the contract is entered into.

What is a look back payroll

A lookback period is the time period used to calculate the total employment taxes paid by an employer. It shows the IRS the employer's full year tax liability and helps the employer determine whether these taxes must be paid on a semi-weekly or monthly basis.

What is an example of a lookback option

Examples of Lookback Options

At a certain point in the options period, it reaches a high price of $120 and a low price of $80. For a fixed strike lookback option, the best price reached is $120 while the strike price is $100. Based on these, the holder's profit can be calculated as follows: $120 – $100 = $20.