What is the lowest score to buy a house?

Can I buy a house with a 580 credit score

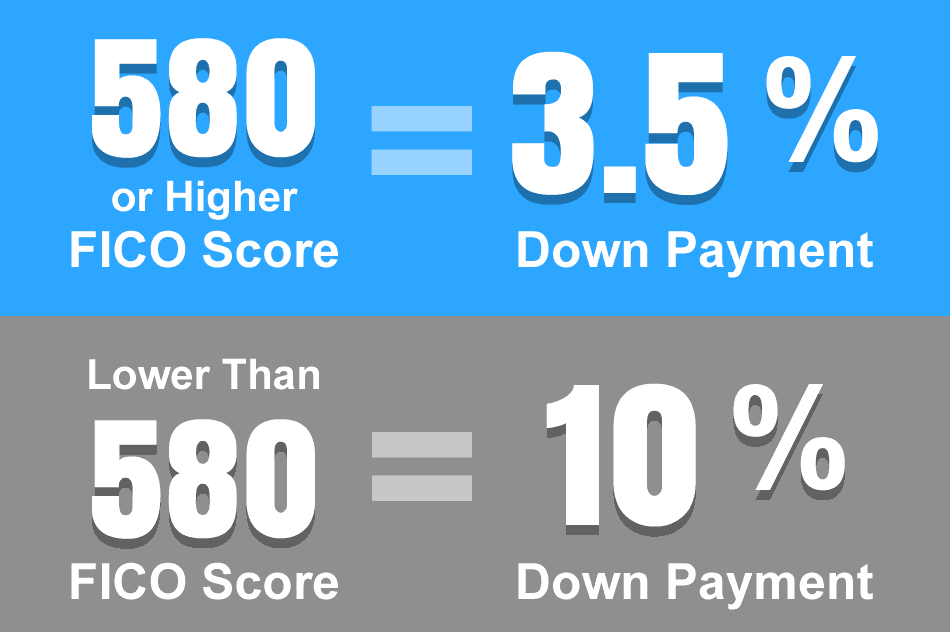

Most lenders offer FHA loans starting at a 580 credit score. If your score is 580 or higher, you can put only 3.5% down. Those with lower credit scores (500-579) may still qualify for an FHA loan. But they'd need to put at least 10% down and it's more difficult to find a willing lender.

Cached

What credit score is needed to buy a 300k house

620-660

Additionally, you'll need to maintain an “acceptable” credit history. Some mortgage lenders are happy with a credit score of 580, but many prefer 620-660 or higher.

Can I get a FHA loan with a 500 credit score

Technically, you can get approved for an FHA loan with a median FICO® Score of as low as 500, but there are some serious drawbacks to an FHA loan with a score that low. The first is that you'll need a down payment of at least 10%. Secondly, when qualifying with a score that low, it's considered a subprime loan.

What FICO score is used for mortgage

FICO Score 5

While most lenders use the FICO Score 8, mortgage lenders use the following scores: Experian: FICO Score 2, or Fair Isaac Risk Model v2. Equifax: FICO Score 5, or Equifax Beacon 5. TransUnion: FICO Score 4, or TransUnion FICO Risk Score 04.

How much income is needed to buy a $300 000 house

between $50,000 and $74,500 a year

To purchase a $300K house, you may need to make between $50,000 and $74,500 a year. This is a rule of thumb, and the specific salary will vary depending on your credit score, debt-to-income ratio, type of home loan, loan term, and mortgage rate.

How can I raise my credit score 50 points fast

Here are some strategies to quickly improve your credit:Pay credit card balances strategically.Ask for higher credit limits.Become an authorized user.Pay bills on time.Dispute credit report errors.Deal with collections accounts.Use a secured credit card.Get credit for rent and utility payments.

What credit score is needed to buy a $250 000 house

While credit score requirements vary based on loan type, mortgage lenders generally require a 620 credit score to buy a house with a conventional mortgage.

Can a person with a 500 credit score buy a 45k house

Anyone with a minimum credit score of 500 can apply for an FHA loan. But if you already have a 620 or higher credit score, it makes more sense to go for a conventional mortgage.

Can I buy a house with a 592 credit score

Can I get a mortgage with an 592 credit score Yes, your 592 credit score can qualify you for a mortgage. And you have a couple of main options. With a credit score of 580 or higher, you can qualify for an FHA loan to buy a home with a down payment of just 3.5%.

Can I buy a house with a 480 credit score

FHA loan. FHA loans are insured by the Federal Housing Administration (FHA) and allow lenders to accept a credit score as low as 580 with a 3.5 percent down payment, or as low as 500 with a 10 percent down payment. These loans have rates comparable to other mortgage types.

Is a FICO score of 8 good or bad

FICO 8 scores range between 300 and 850. A FICO score of at least 700 is considered a good score. There are also industry-specific versions of credit scores that businesses use. For example, the FICO Bankcard Score 8 is the most widely used score when you apply for a new credit card or a credit-limit increase.

What is the average FICO score to buy a house

A conventional loan requires a credit score of at least 620, but it's ideal to have a score of 740 or above, which could allow you to make a lower down payment, get a more attractive interest rate and save on private mortgage insurance.

Can I buy a house if I make 25K a year

Mortgage experts recommend spending no more than 28 percent of your gross monthly income on a housing payment. So if you make $25K per year, you can likely afford around $580 per month for a house payment.

Can I afford a house on 40k a year

How much house can I afford with 40,000 a year With a $40,000 annual salary, you should be able to afford a home that is between $100,000 and $160,000. The final amount that a bank is willing to offer will depend on your financial history and current credit score.

How to raise credit score 100 points in 30 days

Quick checklist: how to raise your credit score in 30 daysMake sure your credit report is accurate.Sign up for Credit Karma.Pay bills on time.Use credit cards responsibly.Pay down a credit card or loan.Increase your credit limit on current cards.Make payments two times a month.Consolidate your debt.

Can I raise my credit score 200 points in 5 months

Improvement in your credit score is directly related to your financial activities. However, if you keep paying your debts on time and in full, you may see a change in your credit score by 200 points within six months to a few years.

How much of a down payment do I need for a $250 K house

FHA Loans. The minimum down payment to buy a home with an FHA loan is just 3.5 percent of the home's purchase price. That means the down payment for, say, a $250,000 home would be $8,750 with this type of loan.

What credit score do you need for a 150 000 house

Conventional Loan Requirements

It's recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, lenders either won't be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly payments.

How long does it take to build credit from 500 to 700

6-18 months

The credit-building journey is different for each person, but prudent money management can get you from a 500 credit score to 700 within 6-18 months. It can take multiple years to go from a 500 credit score to an excellent score, but most loans become available before you reach a 700 credit score.

Can I buy a house with a 430 credit score

A good credit score to buy a house varies depending on the loan type. In any case, however, the minimum credit score required is between 500 and 700. For most conventional loans, for example, you will typically need a minimum credit score of 620, while some lenders will require a credit score of 660 at least.