What is the max limit on the PayPal pay in 4?

Why did PayPal deny me Pay in 4

When applying to use PayPal Pay in 4, a soft credit check may be required to assess your credit worthiness, so your application to use PayPal Pay in 4 may be rejected. Your credit score will not be impacted by the soft credit check.

Cached

What is the maximum payment limit on PayPal

What is the Maximum Transfer Limit on PayPal Technically, there is no limit on your maximum transfer amount if you have a verified PayPal account. But generally, the maximum transfer limit for a single transaction is $60,000. If you don't have a PayPal account, you can send a one-time payment of up to $4,000 USD.

Cached

Does PayPal Pay in 4 require approval

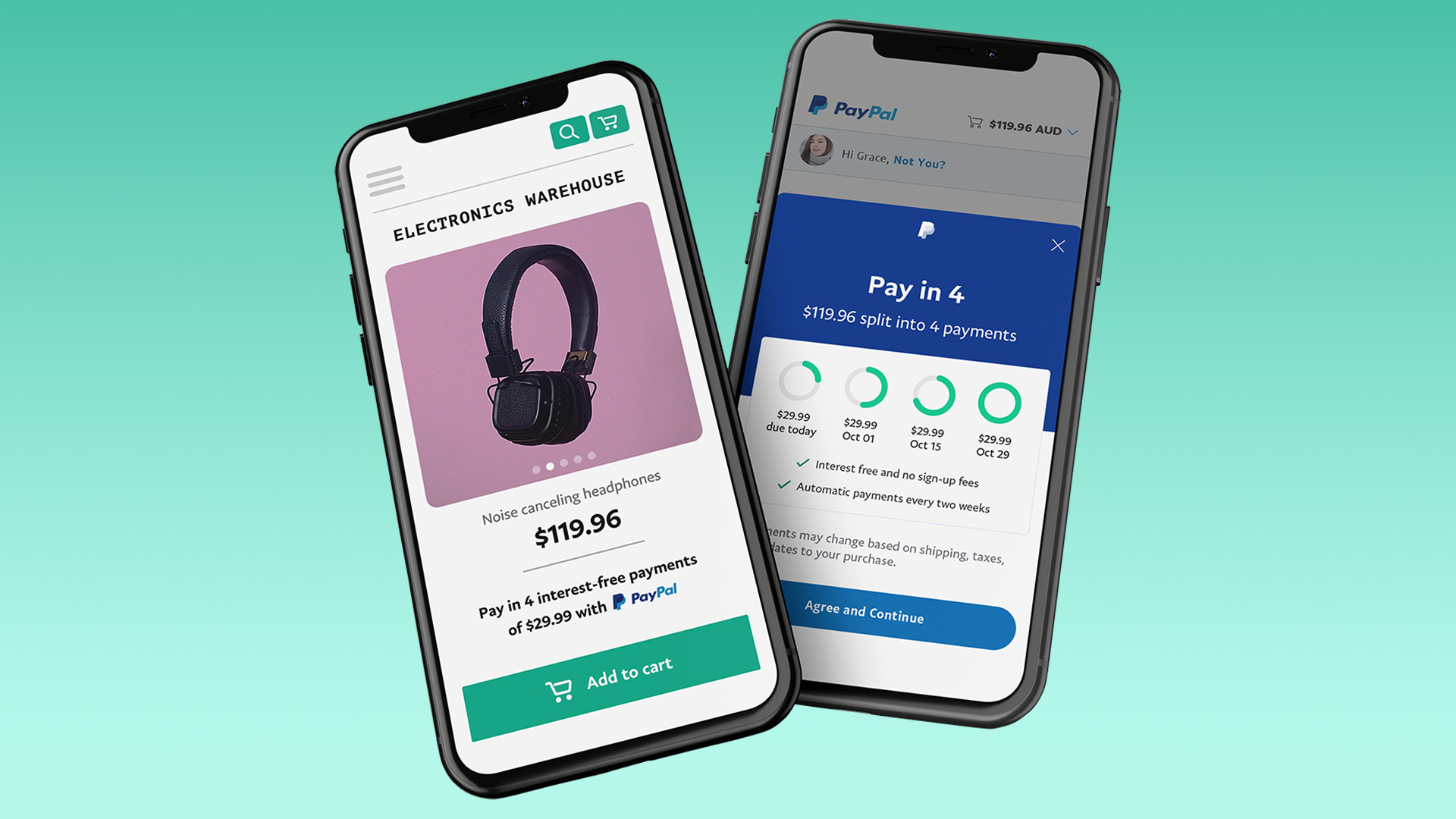

Even if Pay in 4 is listed, it doesn't mean you're automatically approved to use the BNPL service. Pay in 4 is an installment loan, so you must apply to use the service. If you choose Pay in 4 as your payment method, you'll be taken to an application screen.

Does PayPal Pay in 4 hurt my credit score

While PayPal Pay in 4 doesn't build credit, the Pay Monthly program could potentially help or hurt your credit score. Both programs have the potential to harm your financial standing if you overextend yourself by financing too many purchases. This could even increase your credit card debt if you're not careful.

How do I increase my PayPal payment limit

Raising PayPal Limits: Written InstructionsLog in to your 'PayPal' account.Click on the 'More' tab at the top of the page.Click 'Business Set-up'.Click 'Raise Limits to Move Money More Easily' and follow the instructions.Click on 'Raise Limits'.Follow the required set up steps to raise your PayPal limits.

How do I check my PayPal limit

Here's how to check what your limits are for your PayPal Business Debit Mastercard:Hover over your profile and select Account Settings.Click Money, banks, and cards.Click Manage under “PayPal Business Debit Mastercard.”Click Change if you want to update your daily purchase and ATM withdrawal limits.

What does my credit score have to be to be eligible for PayPal Pay in 4

No, the PayPal Pay in 4 program won't help you build your credit. When you apply to use Pay in 4, PayPal does a soft credit check to determine whether to loan to you, although the company doesn't have a stated minimum credit score to qualify.

Is PayPal Pay in 4 considered a loan

Pay in 4 is an installment loan, so you must apply to use the service. If you choose Pay in 4 as your payment method, you'll be taken to an application screen. PayPal uses information from your application, your financial position and your PayPal account history to determine eligibility for the loan.

Can you pay bills with PayPal Pay in 4

Yes. You can use PayPal to link, pay, and manage your bills from the PayPal app or the PayPal website.

How do I check my PayPal limits

Hover over your profile and select Account Settings. Click Money, banks, and cards. Click Manage under “PayPal Business Debit Mastercard.” Click Change if you want to update your daily purchase and ATM withdrawal limits.

How long does it take to increase PayPal limit

When the required steps have been completed, the review of the account usually takes 3 business days. We'll contact you via email once the review is completed. We may automatically lift some limitations when you complete the steps.

How do I increase my PayPal limit

How do I increase my credit limit We review your credit limit monthly and may invite you to increase your limit once you've been a PayPal Credit customer for at least 6 months. You can always request a credit limit decrease or opt out of receiving offers to increase your credit limit.

Why is PayPal limiting my account

We may limit your account to protect you from potential losses and review any fraudulent activity. This can happen if your: Account was accessed without your authorization. Bank informs us there have been unauthorized transfers between your PayPal account and your bank account.

Is everyone approved for PayPal Pay in 4

PayPal's Pay in 4 is a buy now, pay later installment loan available through select retailers. You must be at least 18 years of age (or your state's age of majority) to use Pay in 4. Availability may depend on where you live. You also need an existing PayPal account that's in good standing.

Can you build credit with PayPal Pay in 4

So, does PayPal Pay in 4 build credit No, the PayPal Pay in 4 program won't help you build your credit. When you apply to use Pay in 4, PayPal does a soft credit check to determine whether to loan to you, although the company doesn't have a stated minimum credit score to qualify.

How do I lift my PayPal payment limit

Once your PayPal business accounts up and running you may need to lift some of the initial limits who put in place the security and with a few simple steps you can change how much you can send to

How do I lift a PayPal receiving limit

We'll lift the limitations once we have verified your account. At times, limitations can be lifted by simply changing your security questions and password.

Can I extend my PayPal Pay in 4

Can I make extra or unscheduled repayments Yes. Log into your PayPal account, go to your Pay Later section, choose the Pay in 4 plan you want to pay and click Make a Payment. Then, you can make an unscheduled or extra repayment that will be applied to that Pay in 4 loan.

How can I lift my PayPal limit

Once your PayPal business accounts up and running you may need to lift some of the initial limits who put in place the security and with a few simple steps you can change how much you can send to

Do you need a credit score to use PayPal Pay in 4

PayPal will conduct a soft credit pull when you apply for a payment plan. This doesn't affect your credit score, and there is no minimum credit score requirement to use PayPal.