What is the maximum Zelle transfer Navy Federal?

Does Navy Federal have a transfer limit

Transfers from a Navy Federal checking account to a checking account at another financial institution may be requested for a minimum of $5.00 to a maximum of $5,000 per Business Day. However, the total aggregate amount of all checking transfers within any five-Business-Day period cannot exceed $15,000.

Can you send $10000 through Zelle

Through the bank's mobile banking app or Online Banking, you can transfer funds with other Zelle users at no cost if you possess your U.S. account number or email. There is also the option of transferring an amount of $10,000 within seven days and an amount (30 transfers).

What is the maximum amount you can send on Zelle

$2,500 per day

Does Zelle® limit how much I can send or request You can send up to $2,500 per day with Zelle®. There are no limits on how much you can request with Zelle®, but keep in mind that people sending you money may have limits set by their own financial institutions.

Why does Navy Federal Zelle take so long

If the payment is pending for more than 3 days, we recommend confirming that the recipient has activated their Zelle® profile and that you entered his or her email address or U.S. mobile number correctly.

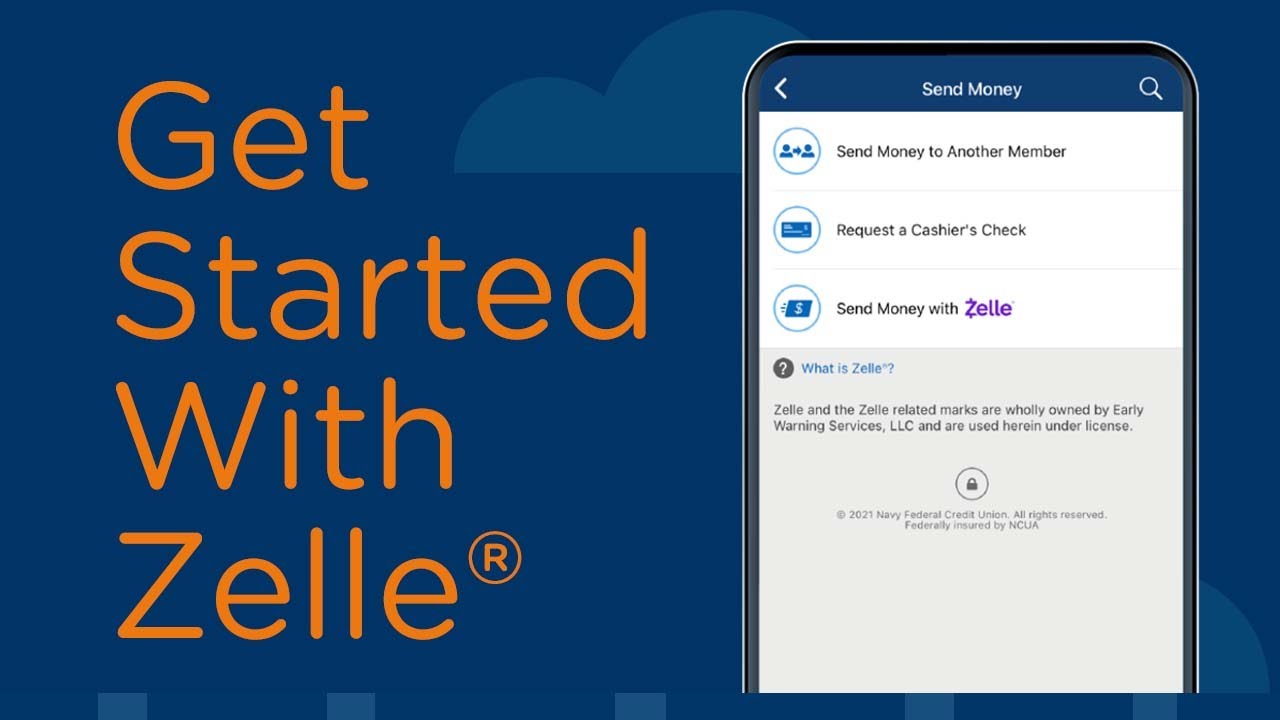

Does Navy Federal work with Zelle

The short answer is yes, Navy Federal Credit Union does offer Zelle. This service allows members to send and receive money from friends and family members quickly and easily. With Zelle, you can send money to anyone with a U.S. bank account using just their email address or mobile phone number.

Can I send $5000 through Zelle

If your bank or credit union offers Zelle®, please contact them directly to learn more about their sending limits through Zelle®. If your bank or credit union does not yet offer Zelle®, your weekly send limit is $500 in the Zelle® app. Please note that you cannot request to increase or decrease your send limit.

Can I receive $5000 through Zelle

Receiving limits: We do not limit how much money you can receive with Zelle® using your email address or U.S. mobile phone number. However, the sender may be subject to limits on how much they can send you, based on the policies of their financial institution or payment network.

Does Zelle report to IRS

Long story short: Zelle's setup, which uses direct bank-to-bank transactions, is not subject to the IRS's 1099-K reporting rules. Other peer-to-peer payment apps are considered “third-party settlement organizations” and are bound by stricter tax rules.

What is the fastest way to send money to a Navy Federal account

Make an Automated Clearing House (ACH) transfer through online banking or by visiting a branch. Our member service reps are also available by phone.

How do I increase my Zelle transfer limit

Please note that you cannot request to increase or decrease your send limit.

Can I send $6000 through Zelle

You may not exceed $6,000 in pending transfers across all transaction types and speeds at any time. You may also respond to requests for payment from other Zelle® Users.

Can I send $4000 through Zelle

If your bank or credit union does not yet offer Zelle®, your weekly send limit is $500 in the Zelle® app. Please note that you cannot request to increase or decrease your send limit.

How much money can you send through Zelle before getting taxed

1, mobile payment apps like Venmo, PayPal and Cash App are required to report commercial transactions totaling more than $600 per year to the Internal Revenue Service.

Is Zelle instant with Navy Federal

Money sent with Zelle® is designed to deliver payments, typically within minutes. All it takes is for your debit card to be activated—which you can do online or via our mobile app.

Can I send 3000 through Zelle

These two institutions tell us that the daily limit to send money through Zelle is $3,500, although if you usually send money monthly, the maximum you can transfer will be $20,000.

Can Zelle send $5,000

If your bank or credit union offers Zelle®, please contact them directly to learn more about their sending limits through Zelle®. If your bank or credit union does not yet offer Zelle®, your weekly send limit is $500 in the Zelle® app. Please note that you cannot request to increase or decrease your send limit.

Can I receive $5000 on Zelle

Receiving limits: We do not limit how much money you can receive with Zelle® using your email address or U.S. mobile phone number. However, the sender may be subject to limits on how much they can send you, based on the policies of their financial institution or payment network.

Can you send $5000 with Zelle

These two institutions tell us that the daily limit to send money through Zelle is $3,500, although if you usually send money monthly, the maximum you can transfer will be $20,000.

Does IRS monitor Zelle

Here is a list of our partners and here's how we make money. If you're a user of online payment apps such as Venmo, you might have heard about new measures the IRS is taking to track income delivered though these services. But there's one widely used app that says its tax-reporting policies won't change: Zelle.

Can I send $20000 through Zelle

These two institutions tell us that the daily limit to send money through Zelle is $3,500, although if you usually send money monthly, the maximum you can transfer will be $20,000.