What is the minimum credit score to buy a house in Ohio?

What is the lowest credit score to buy a house in Ohio

You meet credit score requirements: Conventional, USDA and VA Loans: 640 or higher. FHA Loans: 650 or higher.

Cached

What is the lowest acceptable credit score to buy a house

620 or higher

It's recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, lenders either won't be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly payments.

What credit score is needed to buy a 300k house

620-660

Additionally, you'll need to maintain an “acceptable” credit history. Some mortgage lenders are happy with a credit score of 580, but many prefer 620-660 or higher.

What is the maximum income for a first time home buyer in Ohio

Maximum Income: $90,840 (1 or 2 person families) and $105, 980 (3 or more person family) Maximum purchase price: $381, 308 (target new and existing homes) and $311,980 (non-target new and existing homes) Credit score minimum 640 (USDA and VA loans) or 650 (FHA loan) Meet debt to income ratio for your loan type.

Cached

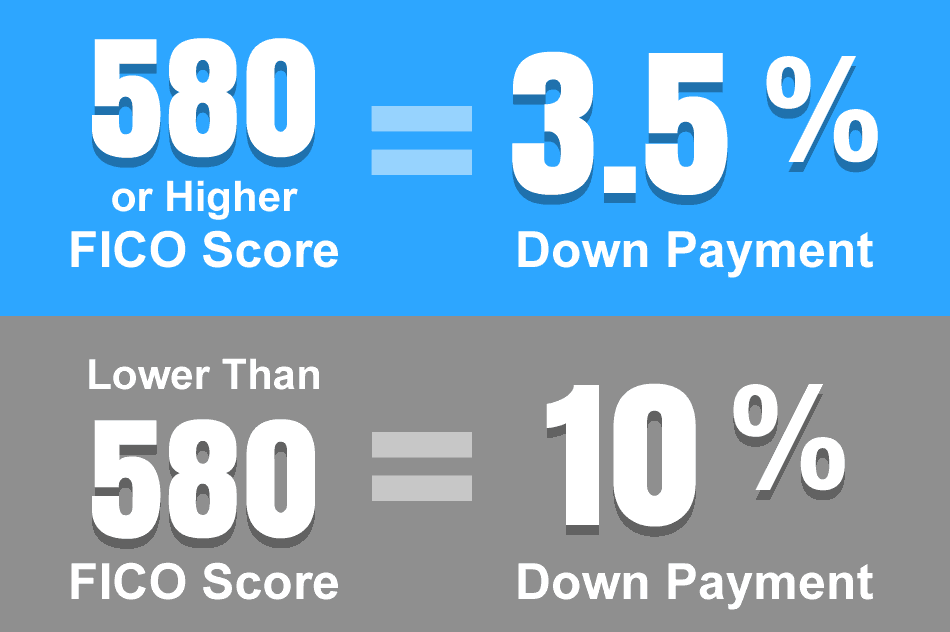

Can I buy a house with 550 credit score

The minimum credit score actually needed to qualify for a mortgage through the FHA is 500, provided you have the capacity to make a 10% down payment. If you can put in a bit of effort on your credit score and increase it up to 580, you can secure an FHA loan for as little as a 3.5% down payment.

What qualifies as a first time home buyer in Ohio

You may qualify for an OHFA first-time homebuyer program if you meet one of the following criteria: You have not had an ownership interest in your primary residence in the last three years. You are an honorably discharged veteran. You are purchasing a home in a target area.

Can I buy a house with a 580 credit score

Most lenders offer FHA loans starting at a 580 credit score. If your score is 580 or higher, you can put only 3.5% down. Those with lower credit scores (500-579) may still qualify for an FHA loan. But they'd need to put at least 10% down and it's more difficult to find a willing lender.

What credit score is needed to buy a $250 000 house

While credit score requirements vary based on loan type, mortgage lenders generally require a 620 credit score to buy a house with a conventional mortgage.

How much does a couple need to make to buy a $200 K house

What income is required for a 200k mortgage To be approved for a $200,000 mortgage with a minimum down payment of 3.5 percent, you will need an approximate income of $62,000 annually.

How much money do you have to put down if you are a first time home buyer in Ontario

5%

What is a minimum down payment

| Purchase price of your home | Minimum amount of down payment |

|---|---|

| $500,000 or less | 5% of the purchase price |

| $500,000 to $999,999 | 5% of the first $500,000 of the purchase price 10% for the portion of the purchase price above $500,000 |

| $1 million or more | 20% of the purchase price |

Aug 5, 2023

Can credit score go up 100 points in a month

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

Can I buy a house with a 571 credit score

Most lenders offer FHA loans starting at a 580 credit score. If your score is 580 or higher, you can put only 3.5% down. Those with lower credit scores (500-579) may still qualify for an FHA loan. But they'd need to put at least 10% down and it's more difficult to find a willing lender.

What is the average down payment on a house in Ohio

Ohio home buyer stats

| Average Home Sale Price in Ohio1 | $240,088 |

|---|---|

| Minimum Down Payment in Ohio (3%) | $7,200 |

| 20% Down Payment in Ohio | $48,025 |

| Average Credit Score in Ohio2 | 715 |

| Maximum Ohio Home Buyer Grant3 | 5% grant from Communities First Ohio |

Mar 10, 2023

What are closing costs in Ohio

Closing costs in Ohio are, on average, $1,992 for a home loan of $145,637, according to a 2023 report by ClosingCorp, which researches residential real estate data. That makes up 1.48 percent of the home price.

How much income is needed to buy a $300 000 house

between $50,000 and $74,500 a year

To purchase a $300K house, you may need to make between $50,000 and $74,500 a year. This is a rule of thumb, and the specific salary will vary depending on your credit score, debt-to-income ratio, type of home loan, loan term, and mortgage rate.

How can I raise my credit score 50 points fast

Here are some strategies to quickly improve your credit:Pay credit card balances strategically.Ask for higher credit limits.Become an authorized user.Pay bills on time.Dispute credit report errors.Deal with collections accounts.Use a secured credit card.Get credit for rent and utility payments.

Can a person with a 500 credit score buy a 45k house

Anyone with a minimum credit score of 500 can apply for an FHA loan. But if you already have a 620 or higher credit score, it makes more sense to go for a conventional mortgage.

How much income do you need to buy a 300 000 house

between $50,000 and $74,500 a year

To purchase a $300K house, you may need to make between $50,000 and $74,500 a year. This is a rule of thumb, and the specific salary will vary depending on your credit score, debt-to-income ratio, type of home loan, loan term, and mortgage rate.

How much house can I afford if I make $36,000 a year

For example, if you make $3,000 a month ($36,000 a year), you can afford a mortgage with a monthly payment no higher than $1,080 ($3,000 x 0.36). Your total household expense should not exceed $1,290 a month ($3,000 x 0.43). How much house can I afford with an FHA loan

How much house can I afford if I make $60000 a year

How much of a home loan can I get on a $60,000 salary The general guideline is that a mortgage should be two to 2.5 times your annual salary. A $60,000 salary equates to a mortgage between $120,000 and $150,000.