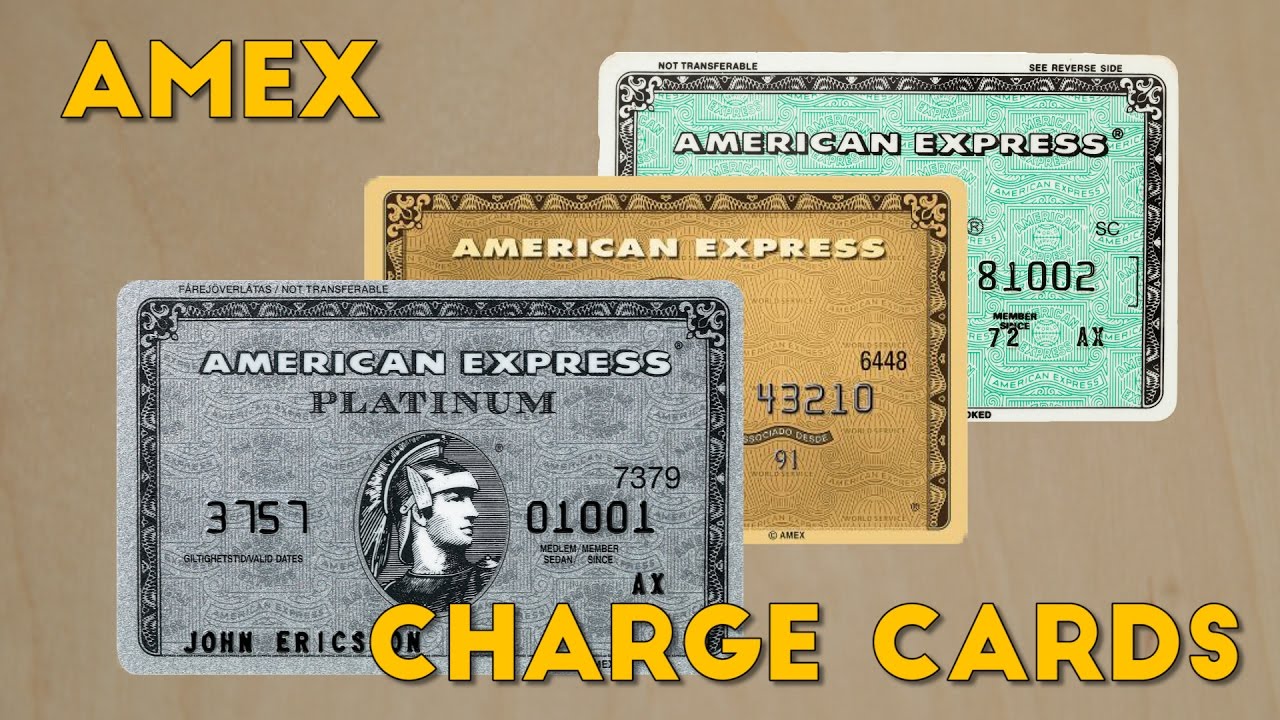

What is the point of an Amex charge card?

Why use an Amex charge card

Charge Cards with no pre-set spending limit

American Express Charge Card comes with no pre-set spending limit4, offering you a higher purchasing power and the flexibility to spend be it a family wedding, or your dream vacation, the flexibility provided by a charge card is unmatched.

Are Amex charge cards worth it

It's a good fit for the occasional traveler looking to rack up travel rewards for the first time. But the rewards rate is pretty mediocre, especially compared to some other rewards credit cards with a similar annual fee. When it comes down to it, pick the card that best aligns with your spending habits.

Cached

What does it mean that Amex is a charge card

With a Charge Card, you'll need to pay off the full balance each month. Charge Cards have no pre-set spending limit1, although that does not mean unlimited spending. Your purchases are approved based on a range of factors.

What is the point of having a charge card

A charge card is a payment card typically used by businesses, or sometimes by high earning individuals. It is similar to a credit card in that you can use them to make purchases without any money being immediately debited from the business bank account.

What is the difference between Amex charge card and credit card

A Charge Card works like a Credit Card, but without offering the option of making part payment. You are required to pay your charge card bill in full by the due date. Charge Cards offer a 'no pre-set' spending limit.

Why get a charge card instead of a credit card

A charge card is similar to a credit card. But a big difference is that a charge card's balance often has to be paid in full each month. Charge cards typically don't have a preset credit limit like credit cards do. Instead, the card issuer might approve purchases based on financial patterns and habits.

What is the hardest American Express card to get

The hardest Amex card to get is the Centurion® Card from American Express. Also known as the “Black Card,” this Amex card is hard to get because it is available by invitation only, and potential candidates are rumored to need an annual income of at least $1 million.

Is a charge card better than a credit card

Credit cards offer more flexibility when it comes to revolving credit, but that doesn't come without its downsides. Carrying a balance on a credit card can lead to an unpleasant amount of debt without the right discipline. Charge cards, on the other hand, typically need to be paid off in full each month.

What happens if you don’t pay off Amex charge card

With Pay Over Time, you can add eligible charges to a Pay Over Time balance, up to a limit. American Express may also suspend your ability to make charges or cancel your account for failing to pay off the “Pay In Full” balance on your billing statement by the due date.

What is a disadvantage of a charge card

The one major disadvantage of using a charge card instead of using a credit card, is that charge cards tend to come with some fairly sizeable fees that must be paid annually.

Why is a charge card better than a credit card

Charge cards often don't carry a spending limit, whereas credit cards do. Since there is usually no credit limit for charge cards, you can spend without factoring in a credit utilization ratio and how that might affect your credit score.

What are the disadvantages of charge cards

Many charge cards carry high annual fees, while many fee-free credit and debit cards are available. Charge cards are offered by a limited number of issuers, so there are typically far fewer to choose from than credit cards. As with credit cards, late payments can ding your credit history.

Why are charge cards bad

This is because charge cards don't let you carry a balance from one month to the next. Your entire bill must be paid in full each month. You get a lot of flexibility, but you don't have the ability to pile on debt month after month. Credit cards have a specific credit limit that you cannot exceed.

What income do you need for Amex Platinum

Salary Needed for Amex Platinum Credit Card

If you make nearly $100,000 a year and have good credit, you should have no issue getting approved. But, applicants with annual incomes as low as $40,000 have also been approved if they have a low debt-to-income ratio and pay their other credit cards in full every month.

Is Amex the most prestigious

Centurion® Card from American Express

Why It's One of the Most Exclusive Credit Cards: The most exclusive, prestigious credit card is without a doubt the American Express Centurion Card, otherwise known as the Amex Black Card. That's because it's the most famous.

What is the difference between charge card and credit card

A charge card is similar to a credit card. But a big difference is that a charge card's balance often has to be paid in full each month. Charge cards typically don't have a preset credit limit like credit cards do. Instead, the card issuer might approve purchases based on financial patterns and habits.

Do rich people use charge cards

Wealthy Americans generally use credit cards the same way that everyone else does. They opt for cash back and no annual fee cards, and generally trust the big issuers. But they have some bad habits, too — about half had an automatic payment set up, and only a third pay their statement or full balance every month.

Is Amex Platinum for millionaires

Unlike some of the other cards on this list, The Platinum Card® from American Express is an elite card, but it's not invite-only. This accessible card is one of the best credit cards for millionaires.

Is Amex Platinum a status symbol

Yes, the American Express Platinum card is considered a status symbol because of its exclusive benefits, high annual fee, and reputation as a premium metal credit card. The American Express Platinum card caters to high-spenders who travel frequently and want a wide range of luxury travel perks and lifestyle benefits.

What card do billionaires use

What Credit Card Do the Super Rich Use The super rich use a variety of different credit cards, many of which have strict requirements to obtain, such as invitation only or a high minimum net worth. Such cards include the American Express Centurion (Black Card) and the JP Morgan Chase Reserve.