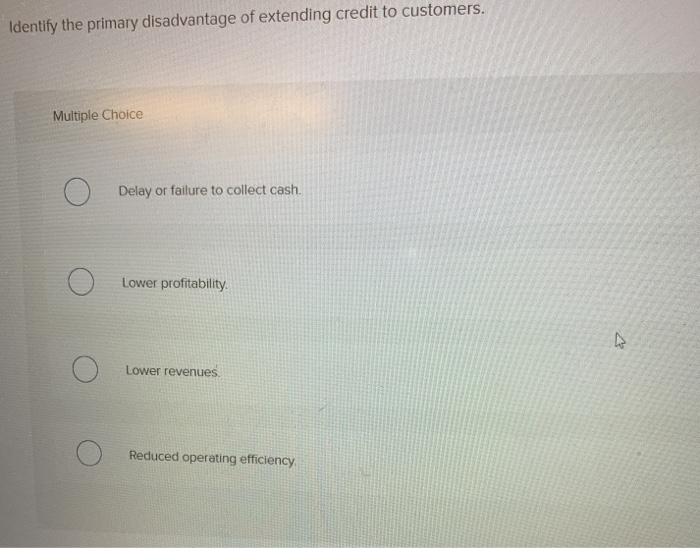

What is the primary disadvantage of extending credit to customers?

What is the disadvantage of extending credit to customers

Cons of extending credit to customers

Your immediate cash flow will be affected based on the amount of credit you offer to customers. If this isn't a top priority for your business, you could limit your business's growth and hinder your own financial obligations. It might lead to unpaid or overdue invoices.

What are the disadvantages to a business for selling on credit to its customers

Disadvantages of Credit Sales

The company will lose revenue. The company will also have to write off the debt as bad debt. Companies usually estimate the creditworthiness or index of a customer before selling to such a customer on credit. The responsibility of collecting debt is on the seller.

What are the advantages and disadvantages of extending credit

Pros & Cons of Extending Credit to Customers

Extending credit to customers can bring you increased sales, a competitive edge, and stronger customer relationships. However, you run the risk of not getting paid. The key is to stay on top of unpaid invoices so they don't become delinquent.

What are 3 disadvantages of credit sales to the business

DisadvantagesThere is always a risk of bad debt. read more.It affects the company's cash flow.The company must incur expenses.The company has to maintain separate books of accounts for accounts receivable.There is a notional loss of interest during the credit period because money is blocked.

What is the danger of extending credit

Consider these downsides to extending credit to customers. The biggest risk to offering credit comes from giving credit to customers who don't pay you. While many customers will make payments on time, some will be late on payments. Or, they might need to make arrangements for late payment options.

What are 4 disadvantages of credit

5 Disadvantages of Credit CardsHigh-Interest Rates. If you carry a balance on your card, the interest rate can be as high as 30% or more.Potential for Overspending. It's easy to get caught up in the moment when using a credit card instead of cash or a debit card.High Annual Fees.Hidden Costs.Credit Card Debt.

What are the disadvantages of giving credit

Despite its many benefits, there are some disadvantages of offering credit.It Puts Your Cash Flow at Risk.It Increases the Occurrence of Delinquent Accounts.It Can Lead To Costly Collection Fees.It Increases Pressure on the Accounts Receivable Department.It Can Cause Your Company To Have Bad Debt.

What is the main disadvantage of credit

Using credit also has some disadvantages. Credit almost always costs money. You have to decide if the item is worth the extra expense of interest paid, the rate of interest and possible fees. It can become a habit and encourages overspending.

What is the danger of extending credit quizlet

What is the danger of extending credit It may lead to delays in payment. Issuing credit to customers will: promote sales. make an investment in a customer.

What does extending credit mean

Also, extend someone credit. Allow a purchase on credit; also, permit someone to owe money. For example, The store is closing your charge account; they won't extend credit to you any more, or The normal procedure is to extend you credit for three months, and after that we charge interest.

What are 3 disadvantages of credit

5 Disadvantages of Credit CardsHigh-Interest Rates. If you carry a balance on your card, the interest rate can be as high as 30% or more.Potential for Overspending. It's easy to get caught up in the moment when using a credit card instead of cash or a debit card.High Annual Fees.Hidden Costs.Credit Card Debt.

What are 3 advantages and 3 disadvantages of using credit

The pros of credit cards range from convenience and credit building to 0% financing, rewards and cheap currency conversion. The cons of credit cards include the potential to overspend easily, which leads to expensive debt if you don't pay in full, as well as credit score damage if you miss payments.

What is a disadvantage of credit quizlet

Two disadvantages of having credit include that the purchases cost more over time and it can lead to overspending.

Which of the following are disadvantages of using credit

5 Disadvantages of Credit CardsHigh-Interest Rates. If you carry a balance on your card, the interest rate can be as high as 30% or more.Potential for Overspending. It's easy to get caught up in the moment when using a credit card instead of cash or a debit card.High Annual Fees.Hidden Costs.Credit Card Debt.

What are the disadvantages of extending credit are costs related to

What are the disadvantages to extending credit to customers The disadvantages of selling on credit include increased wage costs incurred in hiring personnel to monitor and track credit customers, bad debt costs from accounts that are collected late or not at all, and delayed receipt of cash.

What is the advantage of extending credit to customers

Allowing customers extra time to pay their bills can provide a number of advantages to your small business. Extending credit to customers is a way to increases sales and provides payment flexibility for consumers.

Which of the following is a disadvantage of credit *

Through credit usage, the users cannot able to manage all their financial activities and it may lead to slowing down the financial goals.

What are 3 disadvantages of using credit

5 Disadvantages of Credit CardsHigh-Interest Rates. If you carry a balance on your card, the interest rate can be as high as 30% or more.Potential for Overspending. It's easy to get caught up in the moment when using a credit card instead of cash or a debit card.High Annual Fees.Hidden Costs.Credit Card Debt.

What is the main disadvantage to a credit card

Perhaps the most obvious drawback of using a credit card is paying interest. Credit cards tend to charge high interest rates, which can drag you deeper and deeper in debt if you're not careful. The good news: Interest isn't inevitable. If you pay your balance in full every month, you won't pay interest at all.

What is the primary advantage of extending credit to customers

Allowing customers extra time to pay their bills can provide a number of advantages to your small business. Extending credit to customers is a way to increases sales and provides payment flexibility for consumers.