What is the purpose of a deduction?

What is a deduction for dummies

A deduction cuts the income you're taxed on, which can mean a lower bill. A credit cuts your tax bill directly.

Cached

What is the advantage of deduction

Saving tax with deductions

When you claim a tax deduction, it reduces the amount of your income that is subject to tax. The amount of the deduction you are eligible to claim is precisely the amount of the reduction to your taxable income.

What does deduction mean in taxes

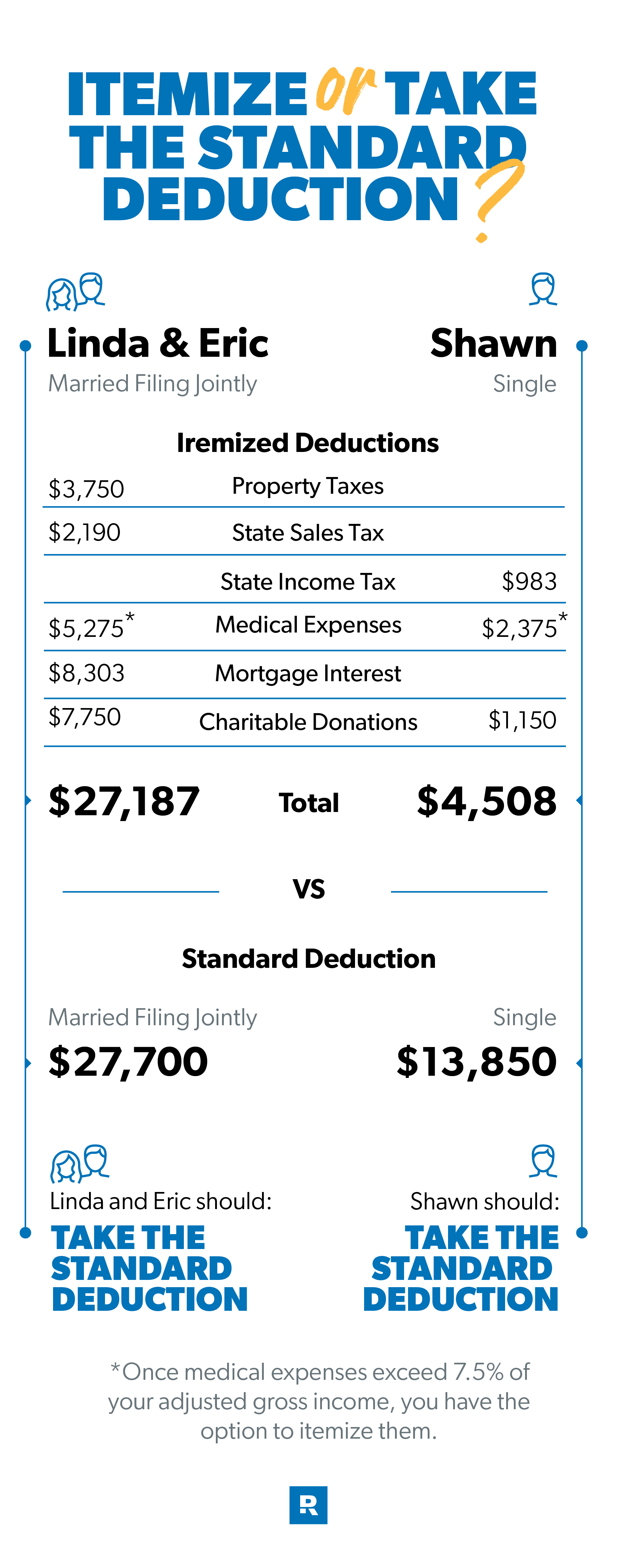

A tax deduction is a provision that reduces taxable income. A standard deduction is a single deduction at a fixed amount. Itemized deductions are popular among higher-income taxpayers who often have significant deductible expenses, such as state/local taxes paid, mortgage interest, and charitable contributions.

Cached

What is a deduction example

Some of the more common deductions include those for mortgage interest, retirement plan contributions, HSA contributions, student loan interest, charitable contributions, medical and dental expenses, gambling losses, and state and local taxes.

Is tax deduction good or bad

Deductions can help you qualify for other tax breaks

Taxpayers generally opt to itemize their deductions — such as those for charitable donations, mortgage interest, state and local taxes, and certain medical and dental expenses — if their total value exceeds the standard deduction amount.

Are deductions good or bad

Deductions can help you qualify for other tax breaks

Taxpayers generally opt to itemize their deductions — such as those for charitable donations, mortgage interest, state and local taxes, and certain medical and dental expenses — if their total value exceeds the standard deduction amount.

How do deductions lower a person’s taxes

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction saves you $220.

Is a tax deduction a good or bad thing

Deductions can help you qualify for other tax breaks

Taxpayers generally opt to itemize their deductions — such as those for charitable donations, mortgage interest, state and local taxes, and certain medical and dental expenses — if their total value exceeds the standard deduction amount.

Is a deduction in taxes good

Tax deductions are a good thing because they lower your taxable income, which also reduces your tax bill in the process. They could help you shave hundreds, maybe even thousands of dollars off your tax bill.

What are 3 examples of deductions

Standard Deduction.IRA contributions deduction.Health savings account (HSA) deduction.State and local taxes deduction.Medical expenses deduction.Home office deduction.Student loan interest deduction.Mortgage interest deduction.

What are 4 types of deductions

Payroll deductions fall into four different categories – pretax, post-tax, voluntary and mandatory – with some overlap in between.

Who benefits most from tax deductions

Lower Income Households Receive More Benefits as a Share of Total Income. Overall, higher-income households enjoy greater benefits, in dollar terms, from the major income and payroll tax expenditures.

How much does a deduction save on taxes

For most non-business deductions, the savings are based upon your tax bracket. For example, if you are in the 12% tax bracket, a $1,000 deduction would save you $120 in taxes. On the other hand, if you are in the 32% tax bracket, the $1,000 deduction will save you $320 in taxes.

What is the difference between a deduction and a withholding

Withholdings are amounts taken out of every employee's paycheck to pay their income taxes for that pay period. Deductions are amounts taken out for benefits and donations the employee has chosen, such as retirement, healthcare, or special funds.

What are examples for deduction

With this type of reasoning, if the premises are true, then the conclusion must be true. Logically Sound Deductive Reasoning Examples: All dogs have ears; golden retrievers are dogs, therefore they have ears. All racing cars must go over 80MPH; the Dodge Charger is a racing car, therefore it can go over 80MPH.

Do tax deductions really help

Tax deductions are a good thing because they lower your taxable income, which also reduces your tax bill in the process. They could help you shave hundreds, maybe even thousands of dollars off your tax bill.

Is it worth it to claim deductions

Tax deductions are a good thing because they lower your taxable income, which also reduces your tax bill in the process.

What are 3 common deductions from a paycheck

Click to jump to any of the common types of payroll withholdings covered in this article:Federal Income Tax.State Income Tax.Social Security (FICA)Medicare Tax (FICA)Insurance Policies.Retirement.

What qualifies for a deduction

Some of the more common deductions include those for mortgage interest, retirement plan contributions, HSA contributions, student loan interest, charitable contributions, medical and dental expenses, gambling losses, and state and local taxes.

Do deductions increase refund

A tax deduction reduces your adjusted gross income or AGI and thus your taxable income on your tax return. As a result, this either increases your tax refund or reduces your taxes owed.