What is the risk of having a co-signer on your credit card?

What are the risks for a co-signer

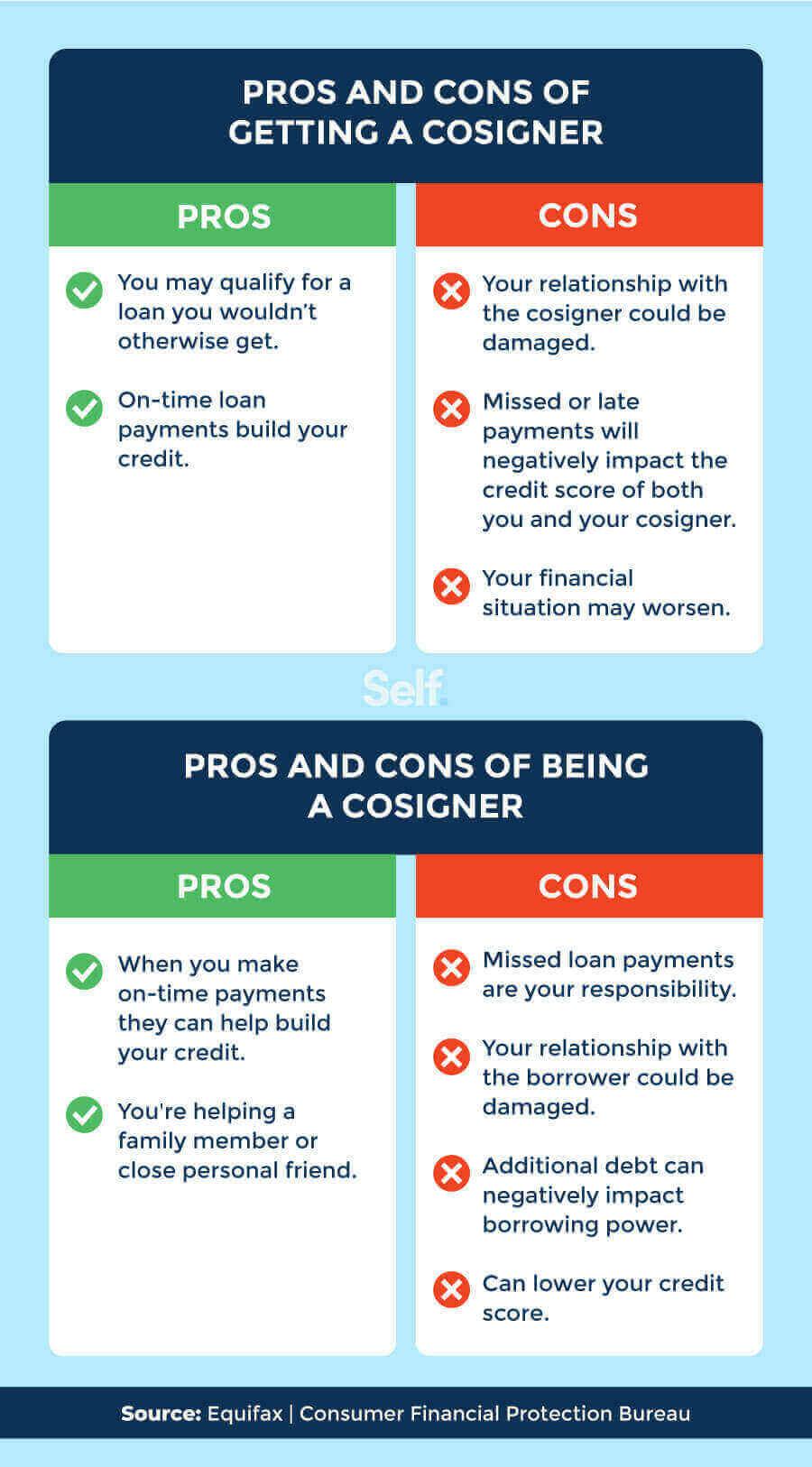

Be sure you can afford to pay the loan. If you are asked to pay and cannot, you could be sued or your credit rating could be damaged. Consider that, even if you are not asked to repay the debt, your liability for this loan may keep you from getting other credit you may want.

Cached

Does being a co-signer affect your credit score

Whatever you cosign will show up on your credit report as if the loan is yours, which, depending on your credit history, may impact your credit scores. Cosigning a loan doesn't necessarily mean your finances or relationship with the borrower will be negatively affected, but it's not a decision you should make lightly.

Cached

What does a cosigner do for a credit card

A co-signer is someone with good credit and income who guarantees that they will pay your credit card balance if you default.

Is a co-signer responsible for all debts on a credit card

A cosigner takes on all the rights and responsibilities of a loan along with the borrower. This means that if the borrower can't make a payment on the loan, the cosigner is responsible.

How do I protect myself as a cosigner

5 ways to protect yourself as a co-signerServe as a co-signer only for close friends or relatives. A big risk that comes with acting as a loan co-signer is potential damage to your credit score.Make sure your name is on the vehicle title.Create a contract.Track monthly payments.Ensure you can afford payments.

Can you pull out as a co signer

Some lenders have a release option for co-signers, according to the Consumer Financial Protection Bureau. A release can be obtained after a certain number of on-time payments and a credit check of the original borrower to determine whether they are now creditworthy.

Can a cosigner have worse credit than you

Cosigning a loan can affect the co-signer's credit score—for better or for worse. The loan will be added to the co-signer's credit history and impact their credit score.

Can you remove a cosigner from a credit card

If you want to be removed from the account, you'll have to call the credit card provider and be prepared to negotiate. If the other account holder would qualify for the card on their own, the credit card company may approve your request. If not, your only option is to pay off any outstanding debt and close the account.

What’s the difference between co-signer and authorized user

Adding someone as an authorized user means trusting that person to use the card responsibly. But co-signing a credit card for someone ups the ante. That's because co-signing means you're basically vouching for the other person's purchases.

Can a cosigner be removed from a credit card

Yes, you can remove a cosigner from a loan. To remove a cosigner from a loan, you will need to get a loan release, which is permission from the lender to remove the cosigner's name from the loan agreement, or you can pay off the loan or refinance it with a new loan or credit card.

Can a cosigner remove themselves from a credit card

Contact the Lender to Discuss Your Options

The other person who signed the card almost certainly would have to meet the qualification terms for the account as an individual in order for the credit card issuer to consider removing you as a cosigner.

Can a cosigner take your name off

Fortunately, you can have your name removed, but you will have to take the appropriate steps depending on the cosigned loan type. Basically, you have two options: You can enable the main borrower to assume total control of the debt or you can get rid of the debt entirely.

Can you kick a cosigner out

But if your circumstances change over time or your credit score improves and you would like to remove the co-signer from your loan, there are three primary options. You can refinance, get a co-signer release or pay off the loan.

How do I remove myself as a cosigner on a credit card

If you want to be removed from the account, you'll have to call the credit card provider and be prepared to negotiate. If the other account holder would qualify for the card on their own, the credit card company may approve your request. If not, your only option is to pay off any outstanding debt and close the account.

Whose credit score is used if I have a cosigner

Whose credit score is used when co-signing In a co-signed loan, the co-signer's credit score has more weightage than the primary borrower. This is because the primary borrower will usually have poor credit and will depend on the co-signer's excellent credit to get lower rates.

Can a cosigner have a 600 credit score

If you're planning to ask a friend or family member to co-sign on your loan or credit card application, they must have a good credit score with a positive credit history. Lenders and card issuers typically require your co-signer to have a credit score of 700 or above.

Does removing an authorized user hurt their credit score

For those who use an authorized user account to build up their credit history and don't have much of a track record with cards beyond that, removing yourself from an authorized user account would take a toll on the length of your credit history. This factor accounts for about 15 percent of your credit score.

Does removing a cosigner hurt their credit

Cosigner's Credit Score No Longer Affected

But they won't be affected by your payment habits once you remove them from your loan.

How much will my credit score go up if I become an authorized user

Being added as an authorized user will not have a significant impact on your credit score, because you're not responsible for paying the bills.

Will removing myself as an authorized user hurt my credit

Summary. Removing yourself as an authorized user can lower your credit utilization ratio and the age of your credit history, both of which can have a negative impact on your credit score.