What is the vacation tax credit?

How does the travel tax credit work

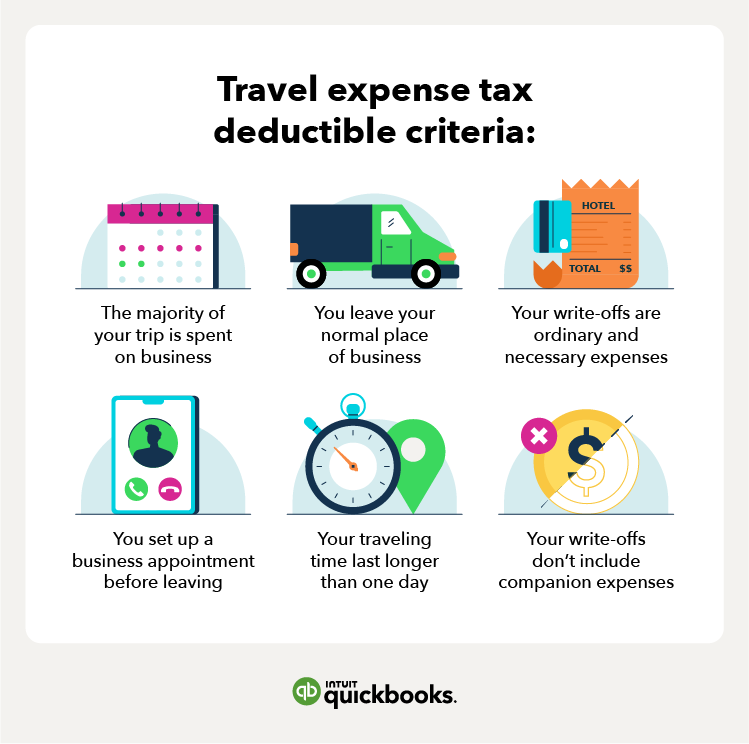

You can deduct business travel expenses when you are away from both your home and the location of your main place of business (tax home). Deductible expenses include transportation, baggage fees, car rentals, taxis and shuttles, lodging, tips, and fees.

Can you write off vacation on your taxes

Travel expenses aren't deductible unless you spend two or more days doing business outside your tax home. Spend the majority of your trip on business. The IRS measures trip length in days. So, if you spend four days of a week-long trip on work and three days on rest, it still qualifies as a business trip.

What is the $4,000 travel tax credit

If approved, the “Explore America” Tax Credit would dangle up to $4,000 in front of Americans for vacation expenses spent in the U.S. at hotels, theme parks, restaurants and other tourism-related businesses through the end of 2023.

Are there tax benefits to owning a vacation home

If your personal use of your vacation home doesn't exceed 14 days a tax year or 10 percent of the total number of days it is rented out at fair market value, whichever is greater, your vacation home qualifies as a rental property.

Cached

How much travel expense can I claim

On a business trip, you can deduct 100% of the cost of travel to your destination, whether that's a plane, train, or bus ticket. If you rent a car to get there, and to get around, that cost is deductible, too.

How does a tax credit save you money

Tax credits directly reduce the amount of tax you owe, giving you a dollar-for-dollar reduction of your tax liability. A tax credit valued at $1,000, for instance, lowers your tax bill by the corresponding $1,000. Tax deductions, on the other hand, reduce how much of your income is subject to taxes.

How much can you write off for travel expenses

How much can you deduct for travel expenses

| Deduction | Amount |

|---|---|

| Travel | 100% of air, train, bus, rideshare, or other transportation fares as well as rental cars |

| Lodging | 100% of the days you spend working |

What kind of travel expenses are tax-deductible

Deductible travel expenses include:

Travel by airplane, train, bus or car between your home and your business destination. Fares for taxis or other types of transportation between an airport or train station and a hotel, or from a hotel to a work location.

Do I qualify for the 7500 tax credit

The idea in theory is quite simple, per the IRS – “You may qualify for a credit up to $7,500 under Internal Revenue Code Section 30D if you buy a new, qualified plug-in EV or fuel cell electric vehicle (FCV). The Inflation Reduction Act of 2023 changed the rules for this credit for vehicles purchased from 2023 to 2032.

What is the $2500 tax credit

The American opportunity tax credit (AOTC) is a credit for qualified education expenses paid for an eligible student for the first four years of higher education. You can get a maximum annual credit of $2,500 per eligible student.

How does IRS define vacation home

The IRS will consider a vacation home either a residence or a rental property based on how many days it is used as a rental vs. personal. Rental income from vacation homes rented less than 15 days during the year doesn't need to be reported on tax forms.

What are the benefits of owning a vacation home

Table of ContentsYou'll Always Have a Place to Stay on Vacay.Proximity to Your Favorite Activities.Vacation Homes Are a Great Place to Host Holidays and Special Occasions.No Need to Pack It All When You Can Leave Some Things Behind.Provides a Change of Scenery.Vacation Feels Less Financially Burdensome.

What kind of travel expenses are tax deductible

Deductible travel expenses include:

Travel by airplane, train, bus or car between your home and your business destination. Fares for taxis or other types of transportation between an airport or train station and a hotel, or from a hotel to a work location.

What are the three requirements for a traveling expense deduction

Expenses must be ordinary, necessary and reasonable.

You can't deduct travel expenses to the extent that they are lavish or extravagant—the expenses must be reasonable considering the facts and circumstances.

Do I have to pay back the tax credit

If you qualify for a “refundable” tax credit, you'll receive the entire amount of the credit. If the credit exceeds the tax you owe, you'll receive the remaining amount as a tax refund. Even if you owe no taxes, you can apply for and receive a refundable tax credit.

Is a tax credit good or bad

Tax credits directly reduce the amount of taxes you owe, providing you with a dollar-for-dollar reduction. For example, if you qualify for a $3,000 tax credit, you'll save $3,000 on your tax bill. In some cases, a tax credit can not only lower your tax bill but can result in a tax refund.

What is included in travel expenses

The IRS defines it as "an expense incurred while away from home on business." This includes things like travel to and from meetings, conferences, and business-related events. It can also include expenses related to lodging, meals, and transportation.

How do you calculate travel expenses for work

5 Steps for Calculating Travel Expenses: Business TipsStep 1: Make a list of possible expenses.Step 2: Find a budget app or template.Step 3: Set a travel budget or check your company budget.Step 4: Plan business travel ahead.Step 5: Find tools to manage and track business trip expenses.

How do I prove travel expenses for taxes

The best way to prove business travel expenses (including hotels, flights, rental cars, meals, and entertainment) is to use a credit card slip (using your business card, of course) with additional notes on the business purpose. Make the note at the time you incur the expense.

What does 7500 federal tax credit mean

1, many Americans will qualify for a tax credit of up to $7,500 for buying an electric vehicle. The credit, part of changes enacted in the Inflation Reduction Act, is designed to spur EV sales and reduce greenhouse emissions. READ MORE: Over a dozen states grapple with adopting California's electric vehicle mandate.