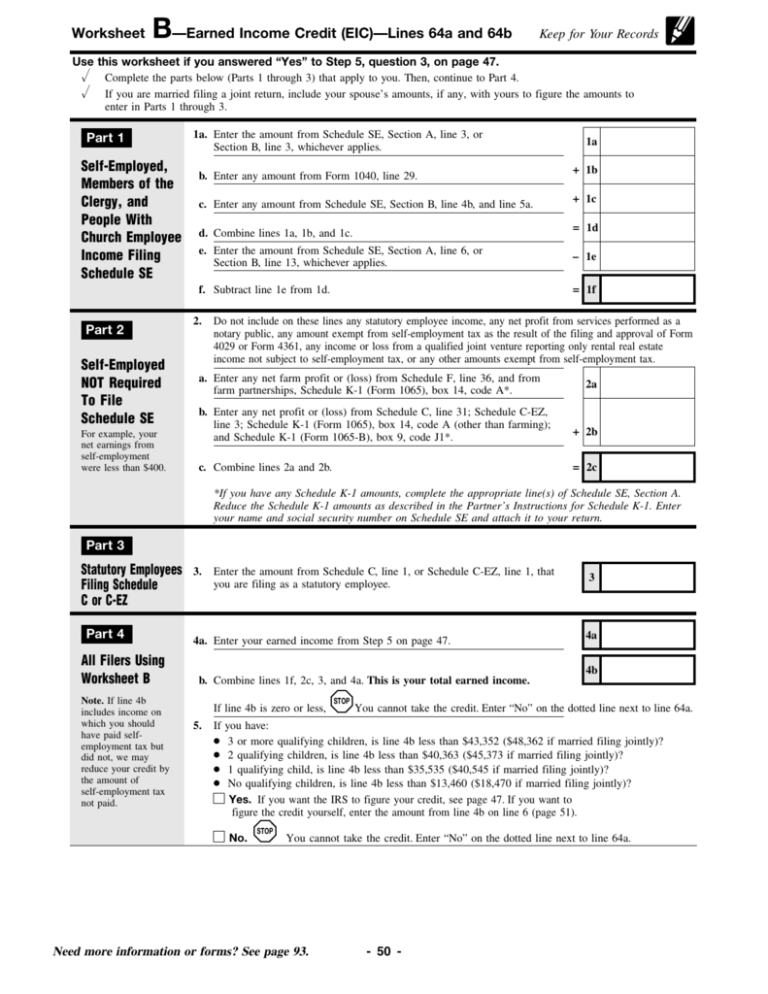

What is worksheet B in taxes?

Who needs to file Schedule B

Use Schedule B (Form 1040) if any of the following applies:You had over $1,500 of taxable interest or ordinary dividends.You received interest from a seller-financed mortgage and the buyer used the property as a personal residence.You have accrued interest from a bond.

What is worksheet C in taxes

Use Schedule C (Form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Your primary purpose for engaging in the activity is for income or profit. You are involved in the activity with continuity and regularity.

What is the Schedule B for taxes

Schedule B is a tax schedule provided by the Internal Revenue Service (IRS) that helps taxpayers compute income tax due on interest paid from a bond and dividends earned. Individuals must complete this form and attach it to their annual tax returns if they received more than $1,500 in qualified interest or dividends.

When must Schedule B be completed

How To Report With Schedule B (Form 941)

| Quarter Includes | Quarter Ends |

|---|---|

| Jan, Feb, Mar | Mar 31 |

| Apr, May, June | Jun 30 |

| July, Aug, Sept | Sep 30 |

| Oct, Nov, Dec | Dec 31 |

Jan 7, 2023

What is the meaning of Schedule B

Schedule B numbers are 10-digit statistical classification codes for all domestic and foreign goods being exported from the United States.

What happens if you don’t file Schedule B

Failure to file Schedule B when required will result in an incomplete tax return, which can lead to big problems. The IRS might reject your tax return and you could be subject to penalties and interest.

What is worksheet C on W 4

Use this step if you (1) have more than one job at the same time, or (2) are married filing jointly and you and your spouse both work. If you (and your spouse) have a total of only two jobs, you may check the box in option (c). The box must also be checked on the Form W-4 for the other job.

What is worksheet A for taxes

Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction.

What does Schedule B stand for

Schedule B numbers are 10-digit statistical classification codes for all domestic and foreign goods being exported from the United States. With over 9,000 codes, the process can seem overwhelming. Here are the steps to find the appropriate number for your goods using the U.S. Census Bureau's Schedule B search engine.

How do I find my Schedule B

How to find your Schedule B code You can find your product classification number by using Schedule B Search Engine. If you are still unsure of the best Schedule B code for your product, phone U.S. Government commodity classification experts at 1-800-549-0595, option 2.

What are Schedule B assets

Instructions Schedule B, Interests in Real Property. Report interests in real property located in your agency's jurisdiction in which you, your spouse or registered domestic partner, or your dependent children had a direct, indirect, or beneficial interest totaling $2,000 or more any time during the reporting period.

Where can I find Schedule B

Go to www.irs.gov/ScheduleB for instructions and the latest information. Attach to Form 1040 or 1040-SR.

How do I find my Schedule B code

How to find your Schedule B code You can find your product classification number by using Schedule B Search Engine. If you are still unsure of the best Schedule B code for your product, phone U.S. Government commodity classification experts at 1-800-549-0595, option 2.

How do I get a $10000 tax refund 2023

How to Get the Biggest Tax Refund in 2023Select the right filing status.Don't overlook dependent care expenses.Itemize deductions when possible.Contribute to a traditional IRA.Max out contributions to a health savings account.Claim a credit for energy-efficient home improvements.Consult with a new accountant.

How do you correct a Schedule B

Write “Amended” at the top of Schedule B. The IRS will refigure the penalty and notify you of any change in the penalty. Monthly schedule depositors. You can file a Schedule B if you have been assessed an FTD penalty for a quarter and you made an error on the monthly tax liability section of Form 941.

Should I check box C on W-4

If you (and your spouse) have a total of only two jobs, you may instead check the box in option (c). The box must also be checked on the Form W-4 for the other job. If the box is checked, the standard deduction and tax brackets will be cut in half for each job to calculate withholding.

Is it better to claim 1 or 0

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

What is a 1099 B worksheet

Form 1099-B is used to report capital gains and losses that a taxpayer incurs after selling certain assets through brokerages and barter exchanges. These firms send separate forms for each transaction to both the IRS and the investor.

What is worksheet C on W-4

Use this step if you (1) have more than one job at the same time, or (2) are married filing jointly and you and your spouse both work. If you (and your spouse) have a total of only two jobs, you may check the box in option (c). The box must also be checked on the Form W-4 for the other job.

Where do I find Schedule B

Go to www.irs.gov/ScheduleB for instructions and the latest information. Attach to Form 1040 or 1040-SR.