What is your credit score if you never had credit?

What credit score does an 18 year old start with

The credit history you start with at 18 is a blank slate. Your credit score doesn't exist until you start building credit. To begin your credit-building journey, consider opening a secured credit card or ask a family member to add you as an authorized user on their account.

Will I have a credit score if I never had a credit card

You don't need a credit card to have a credit score. Car loans, student loans, rent payments and even utility payments can help demonstrate your creditworthiness.

How long does it take to get a 700 credit score from 0

Depending on how well you utilize your credit, your credit score may get to anywhere from 500 to 700 within the first six months. Going forward, getting to an excellent credit score of over 800 generally takes years since the average age of credit factors into your score.

How does an 18 year old with no credit build credit

How to start building credit at age 18Understand the basics of credit.Become an authorized user on a parent's credit card.Get a starter credit card.Build credit by making payments on time.Keep your credit utilization ratio low.Take out a student loan.Keep tabs on your credit report and score.

What is your starting credit score

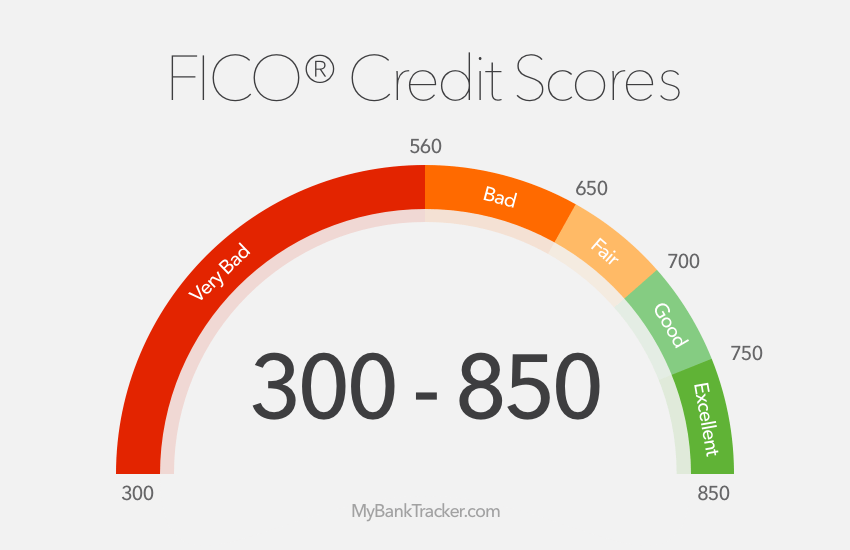

Some people wonder whether the starting credit score is zero, for example, or whether we all start with a credit score of 300 (the lowest possible FICO score). The truth is that there's no such thing as a “starting credit score.” We each build our own unique credit score based on the way we use credit.

How do I start credit with no credit

3 things you should do if you have no credit historyBecome an authorized user. One of the quickest and easiest ways to build credit is by becoming an authorized user on a family member's or friend's credit card.Apply for a secured credit card.Get credit for paying monthly utility and cell phone bills on time.

What is my credit score when I first start

The truth is that there's no such thing as a “starting credit score.” We each build our own unique credit score based on the way we use credit. If you haven't started using credit yet, you won't have a credit score.

How quickly can I go from no credit to good credit

History isn't instant. If you haven't used credit before, it usually takes at least six months to generate a credit score – and longer to earn a good or excellent score.

What credit score do you start with

zero

Some people wonder whether the starting credit score is zero, for example, or whether we all start with a credit score of 300 (the lowest possible FICO score). The truth is that there's no such thing as a “starting credit score.” We each build our own unique credit score based on the way we use credit.

How can I build my credit as soon as I turn 18

Ways you can start building credit:Become an authorized user on a credit card.Consider a job.Get your own credit card.Keep track of your credit score.Make on time payments.Pay more than the minimum payment.

What is a normal first credit score

Instead, depending on how well you manage your credit, your first credit score might be around the 500 mark. The age of your oldest form of credit plays a role in your credit score. However, working on other aspects can even get your initial credit score to be around 700.

How long does it take to get a 700 credit score from 500

6-18 months

The credit-building journey is different for each person, but prudent money management can get you from a 500 credit score to 700 within 6-18 months. It can take multiple years to go from a 500 credit score to an excellent score, but most loans become available before you reach a 700 credit score.

How fast can you build credit with no credit

It usually takes a minimum of six months to generate your first credit score. Establishing good or excellent credit takes longer.

Is no credit better than bad

Generally, having no credit is better than having bad credit, though both can hold you back. People with no credit history may have trouble getting approved for today's best credit cards, for example — while people with bad credit may have trouble applying for credit, renting an apartment and more.

How do I build my first credit score

Here are four ways to get started.Apply for a credit card. Lack of credit history could make it difficult to get a traditional unsecured credit card.Become an authorized user.Set up a joint account or get a loan with a co-signer.Take out a credit-builder loan.

How to get a 700 credit score at 18

How to start building credit at age 18Understand the basics of credit.Become an authorized user on a parent's credit card.Get a starter credit card.Build credit by making payments on time.Keep your credit utilization ratio low.Take out a student loan.Keep tabs on your credit report and score.

Is 700 a good credit score for a 21 year old

So, given the fact that the average credit score for people in their 20s is 630 and a “good” credit score is typically around 700, it's safe to say a good credit score in your 20s is in the high 600s or low 700s.

How long does it take to get credit score to 700

How Long Can It Take to Build a Credit Score Of 800-850

| Initial Score | Avg. time to reach 700* | Avg. time to reach 800* |

|---|---|---|

| 350 – 400 | 2+ years | 3 years |

| 450 – 500 | 18 months – 2 years | 3+ years |

| 550 – 600 | 12-18 months | 2+ years |

| 650 – 700 | – | 1 year |

How long does it take to go from no credit to $700

The time it takes to increase a credit score from 500 to 700 might range from a few months to a few years. Your credit score will increase based on your spending pattern and repayment history. If you do not have a credit card yet, you have a chance to build your credit score.

How to get a 700 credit score from nothing

Here are the best ways to build credit:Get a Store Card.Apply for a Secured Credit Card at a Bank.Apply for a Credit-Builder Loan.Find a Co-Signer.Become an Authorized User on Another Person's Credit Card.Report Rent and Utility Payments to Credit Bureaus.Consider a Student Credit Card.Make On-Time Payments Every Month.